Products You May Like

Recover much of the earlier losses

- German DAX -0.4%. The low reached -1.5%

- France’s CAC -0.2%. The low reached -1.39%

- UK’s FTSE 100 +0.2%. The low reached -1.19%

- Spain’s Ibex +0.1%. The low reached -1.22%

- Italy’s FTSE MIB -0.1%. The low reached -1.29%

For the week, provisional closes are showing gains for the major indices across the board:

- German DAX, +1.76%

- France’s CAC, +1.8%

- UK’s FTSE 100, +0.75%

- Spain’s Ibex, +1.8%

- Italy’s FTSE MIB, +1.8%

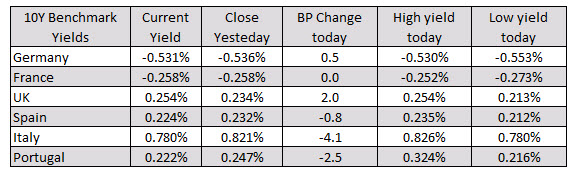

In the European debt market, the benchmark 10 year yields are ending the session mixed. German and UK yields are higher. Spain, Italy, and Portugal yields are lower.

- Spot gold is trading up $0.72 or 0.04% at $1906.70. The high price reached $1917.16. The low extended to $1889.93

- Spot silver is trading up $0.28 or 1.2% at $24.06. The high price reached $24.20. The low extended to $23.48

- WTI crude oil futures are trading down $1.24 or -3.20% at $37.47. That is rebounding off of the New York session low at $36.63. But still below the high for the day at $38.65.

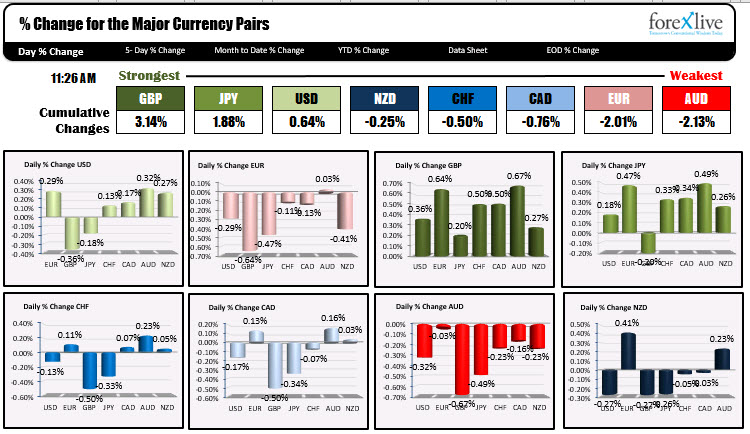

The USDCAD extended the trading range for the day in the NY morning session from 51 pips to 54 pips. The NZDUSD extended its trading range from 40 pips to 41 pips. The other pairs have remained within the trading ranges set before the New York open. So despite all the news including the employment statistics, and more headlines on Covid and stimulus potential, the forex market remains mired within ranges.

Having said that, The USDJPY has rebounded with the rebounds and stock indices from premarket levels.

A snapshot of the US stock indices shows:

- S&P index, -26 points or -0.78% the 3354.28. It’s low was at 3323.69. It’s high reached 3364.24

- NASDAQ index -167 points or -1.48% 11158.2. It’s low reached 11082.52. It’s high extended to 11244.87

- Dow industrial average -172 points or -0.62% at 27643. It’s a low reached 27382.94. It’s high price extended to 27716.24