Products You May Like

The forex markets still generally range bound for the moment. Dollar weakened mildly overnight, but stays above near term lows against other major currencies. Similarly, Yen is also bounded in very tight range. US stocks’ rebound overnight was as positive development for sentiments. Yet, there is no follow through actions in Asia. Though, volatility might come back later today, depending on Eurozone PMIs.

Technically, now attention is back on some Dollar support levels, including 1.2244 temporary top in EUR/USD, 1.4240 resistance in GBP/USD and 0.8959 in USD/CHF. Additionally, eyes are also on 133.42 temporary top in EUR/JPY and 154.80 in GBP/JPY. Break of these levels will indicate the markets back in prior trend of Dollar and Yen selloff.

In Asia, at the time of writing, Nikkei is up 0.53%. Hong Kong HSI is down -0.21%. China Shanghai SSE is down -0.45%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is down -0.0050 at 0.079. Overnight, DOW rose 0.55%. S&P 500 rose 1.06%. NASDAQ rose 1.77%. 10-year yield dropped -0.049 to 1.634.

Japan CPI core unchanged at -0.1% yoy, CPI core-core turned negative to -0.2% yoy

Japan CPI core (all item less fresh food), was unchanged at -0.1% yoy in April, better than expectation of -0.2% yoy. Headline all item CPI dropped to -0.4% yoy, down from -0.2% yoy. CPI core-core (all item ex fresh food and energy), turned negative to -0.2% yoy, down form 0.3% yoy.

Nevertheless, analysts saw the drop in inflation as being almost entirely due to the -26.5% plunge in mobile phone charges. That already lowed -0.5% off core CPI.

Japan PMI composite back in contraction, but firms not discouraged by virus resurgence

Japan PMI manufacturing dropped to 52.5 in May, down from 53.6, below expectation of 53.8. PMI Services dropped notably to 45.7, down from 49.5. PMI Composite dropped to 48.1, down from 51.0, back in contraction again.

Usamah Bhatti, Economist at IHS Markit, said: “Flash PMI data indicated that activity at Japanese private sector businesses saw a renewed reduction in May. Output fell at the quickest pace for four months, while the contraction in new business inflows was the fastest since February. Survey members widely attributed the deterioration in business conditions to a resurgence in COVID-19 cases and the reimposition of state of emergency measures.

“Positively, private sector firms were not discouraged from further increasing capacity, as employment levels rose for the fourth consecutive month. This was despite another sharp rise in input costs across the Japanese private sector.

“Disruption to short-term activity is likely to remain until the latest wave of COVID-19 infections passes and restrictions enacted under state of emergency laws are lifted. However, Japanese private sector companies were optimistic that business conditions would improve in the year ahead, albeit to a lesser extent than that seen in April. Positive sentiment stemmed from the expectation that the currently sluggish vaccine rollout would gather pace and aid in the submission of the pandemic, in turn triggering a recovery in demand in both domestic and external markets.”

Australia PMI manufacturing hit another record, services edged down

Australia PMI Manufacturing rose to 59.9 in May, up from 59.7, hitting another record high since May 2016. PMI Services dropped to 58.2, down from 58.8. PMI Composite also dropped slightly to 58.1, down from 58.9.

Jingyi Pan, Economics Associate Director at IHS Markit, said: “Australia’s private sector growth eased from April’s survey record. That said, growth remained sharp to affirm the continued improvement in economic conditions following the easing of COVID-19 restrictions.

“Export orders notably continued to improve, reflecting the robust external demand despite concerns of rising COVID-19 cases in the region. In turn, this filtered through to the labour market with employment improving at the fastest pace in the survey’s five-year history.

“The outlook for activity over the coming year remained optimistic, particularly in the service sector in May. Ongoing supply-chain disruptions, however, continued to impact private sector firms, pushing up input cost inflation and thereby output prices.”

Australia retail sales rose 1.1% in April, led by food retailing

Australia retail sales rose 1.1%, or AUD 350.2m, in April, above expectation of 0.5% mom. Annually, sales rose 25.1% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “Food retailing led the rises in April, following falls in both February and March 2021. All industries except department stores rose, with similar rises for cafes, restaurants, and takeaway food services, household goods retailing, and other retailing.

New South Wales and Victoria led the state rises, with sales continuing to return in Sydney and Melbourne. A lockdown in Western Australia in April saw a 1.5% fall in that state”.

Looking ahead

Eurozone PMIs, UK retail sales PMIs will be the main focuses in European session. Canada will release retail sales. US will release PMIs, and existing home sales.

USD/CHF Daily Outlook

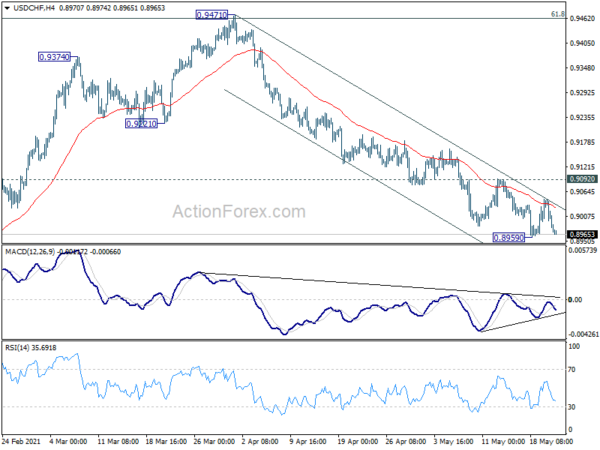

Daily Pivots: (S1) 0.8952; (P) 0.8999; (R1) 0.9024; More….

Intraday bias in USD/CHF remains neutral first. Outlook stays bearish with 0.9092 resistance intact. On the downside, break of 0.8959 will resume the fall from 0.9471 to retest 0.8756 low. However, break of 0.9092 will indicate short term bottoming and turn bias to the upside for stronger rebound.

In the bigger picture, rejection by 61.8% retracement of 0.9901 to 0.8756 at 0.9464 argues that rebound from 0.8756 was probably just a corrective move. That is, larger down trend from 1.0237 might be still in progress. Medium term bearish is also affirmed as the pair is now far below falling 55 week EMA. Firm break of 0.8756 low will target 61.8% projection of 1.0237 to 0.8756 from 0.9471 at 0.8556 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI May P | 59.9 | 59.7 | ||

| 23:00 | AUD | Services PMI May P | 58.2 | 58.8 | ||

| 23:01 | GBP | GfK Consumer Confidence May | -9 | -13 | -15 | |

| 23:30 | JPY | National CPI Core Y/Y Apr | -0.10% | -0.20% | -0.10% | |

| 00:30 | JPY | Manufacturing PMI May P | 52.5 | 53.8 | 53.6 | |

| 01:30 | AUD | Retail Sales M/M Apr P | 1.10% | 0.50% | 1.30% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Apr | 4.00% | 4.90% | ||

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Apr | 31.40% | 7.90% | ||

| 06:00 | GBP | Retail Sales M/M Apr | 4.00% | 5.40% | ||

| 06:00 | GBP | Retail Sales Y/Y Apr | 36.50% | 7.20% | ||

| 07:15 | EUR | France Manufacturing PMI May P | 58.1 | 58.9 | ||

| 07:15 | EUR | France Services PMI May P | 53.0 | 50.3 | ||

| 07:30 | EUR | Germany Manufacturing PMI May P | 65.8 | 66.2 | ||

| 07:30 | EUR | Germany Services PMI May P | 52.0 | 49.9 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 62.4 | 62.9 | ||

| 08:00 | EUR | Eurozone Services PMI May P | 52.0 | 50.5 | ||

| 08:30 | GBP | Manufacturing PMI May P | 60.0 | 60.9 | ||

| 08:30 | GBP | Services PMI May P | 62.0 | 61.0 | ||

| 12:30 | CAD | Retail Sales M/M Mar | 2.30% | 4.80% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | 4.00% | 4.80% | ||

| 13:45 | USD | Manufacturing PMI May P | 60.4 | 60.5 | ||

| 13:45 | USD | Services PMI May P | 64.6 | 64.7 | ||

| 14:00 | USD | Existing Home Sales M/M Apr | 6.08M | 6.01M | ||

| 14:00 | EUR | Eurozone Consumer Confidence May P | -6.8 | -8.1 |