Products You May Like

Swiss Franc is generally firm as weekend approaches. Even though there was no follow through buying in Euro after ECB overnight, the common currency is somewhat support mildly by the strength in the Franc. Meanwhile, Yen’s selloff faded quickly, together with the rebound attempt in treasury yields. Dollar, Canadian Dollar and New Zealand Dollar are the relatively weaker ones, together with Aussie.

Technically, Sterling could be a focus today with UK GDP data featured. GBP/USD’s rebound from yesterday’s low was rather impressive and focus is now slightly back on 1.4248 resistance. Sustained break there will confirm up trend resumption, following USD/CHF’s down trend resumption path. GBP/JPY also maintains most of yesterday’s gains and could be heading back towards 156.05 top.

In Asia, at the time of writing, Nikkei is up 0.06%. Hong Kong HSI is up 0.41%. China Shanghai SSE is down -0.18%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.0103 at 0.038. Overnight, DOW rose 0.06%. S&P 500 rose 0.47%. NASDAQ rose 0.78%. 10-year yield dropped -0.030 to 1.459.

BoC Lane hinted at more tapering in July

BoC Deputy Governor Timothy Lane said in a speech that, “the bottom line is that the Canadian economy has been largely on track with our story.”Vaccinations are also rolling out “at, or faster than, the pace we assumed in April”. Other economies are also picking up “smartly as they have reopened”. The developments are “encouraging” and suggest that “we are on track for a strong consumer-led recovery as containment measures ease here in Canada.”

Some decisions on further adjustment on asset purchases could be made in July. Lane reiterated that “if the recovery evolves in line with or stronger than in our latest projection, then the economy won’t need as much QE stimulus over time”. BoC would have the “coming weeks” to assess the reopening in Canada, and there will be an updated outlook in July too.

New Zealand BusinessNZ manufacturing rose to 0.3, upward pressure on input prices

New Zealand BusinessNZ manufacturing PMI rose 0.3 to 58.6 in May. Looking at some details, production rose from 64. to 65.3. Employment dropped from 52.2 to 51.5. New orders rose from 61.0 to 63.7. Finished stocks dropped from 54.7 to 52.4. Deliveries rose from 52.6 to 53.5.

BusinessNZ’s executive director for manufacturing Catherine Beard said: “Globally, manufacturing activity continues to expand at a robust pace, culminating in an 11-year high for May. However, this has led to upwards pressure on input prices across most countries, including New Zealand, given comments from respondents outlining increased costs of raw materials.”

Looking ahead

UK GDP will be a major focus in European session while productions and trade balance will be featured. Later in the day, Canada will release capacity utilization. US will release U of Michigan consumer sentiment.

USD/CHF Daily Outlook

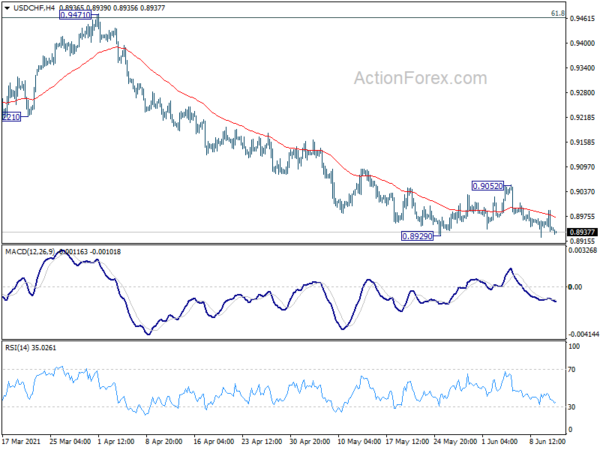

Daily Pivots: (S1) 0.8928; (P) 0.8959; (R1) 0.8978; More….

Intraday bias in USD/CHF stays mildly on the downside for the moment. Current decline from 0.9471 should target a test on 0.8756 low. On the upside, break of 0.9052 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, prior rejection by 61.8% retracement of 0.9901 to 0.8756 at 0.9464 argues that rebound from 0.8756 was probably just a corrective move. That is, larger down trend from 1.0237 might be still in progress. Medium term bearish is also affirmed as the pair is now far below falling 55 week EMA. Firm break of 0.8756 low will target 61.8% projection of 1.0237 to 0.8756 from 0.9471 at 0.8556 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index May | 58.6 | 58.4 | 58.3 | |

| 23:50 | JPY | BSI Large Manufacturing Index Q2 | -1.4 | 1.6 | ||

| 6:00 | GBP | GDP M/M Apr | 2.40% | 2.10% | ||

| 6:00 | GBP | Industrial Production M/M Apr | 1.20% | 1.80% | ||

| 6:00 | GBP | Industrial Production Y/Y Apr | 30.20% | 3.60% | ||

| 6:00 | GBP | Manufacturing Production M/M Apr | 1.50% | 2.10% | ||

| 6:00 | GBP | Manufacturing Production Y/Y Apr | 42.00% | 4.80% | ||

| 6:00 | GBP | Index of Services 3M/3M Apr | -2% | |||

| 6:00 | GBP | Goods Trade Balance (GBP) Apr | -11.8B | -11.7B | ||

| 12:30 | CAD | Capacity Utilization Q1 | 79.20% | |||

| 13:00 | GBP | NIESR GDP Estimate May | 1.30% | |||

| 14:00 | USD | Michigan Consumer Sentiment Index Jun P | 84 | 82.9 |