Products You May Like

The EURGBP’s tail is wagging the dog (the EURUSD and the GBPUSD) in trading today as it falls sharply.

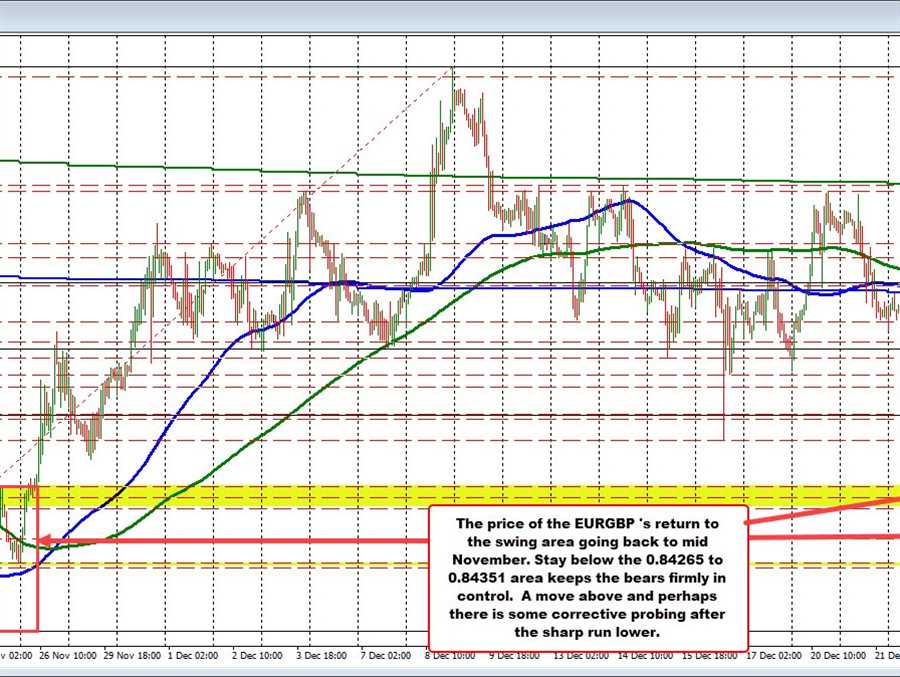

The selling started in the Asian session after a run to the upside stalled, and the price started to crack below swing levels going back to last week’s trading at 0.8485, and 0.84765. The price also cracked below the 61.8% retracement of the move up from the November 19 low at 0.84626 and the swing low from the Bank of England rate rising day last week at 0.84529. All of which contributed to a worsening technical picture. The price moved further and further to the downside.

The low price has reached into a low swing area between 0.83786 and 0.84351 that can find the pair between November 17 and November 26. The current price at 0.8423 is between those extremes. As always the price can remain below the 0.8435 level, the sellers remain in firm control. A move above and there could be some upside corrective probing with the 0.84529 swing low from the Bank of England rate day as the upside target.

What do the two dogs that make up the EURGBP look like from a technical perspective?

Taking a look at 4-hour chart of the GBPUSD, it has been pushed higher on the EURGBP weakness. Technically, the price based against its 200 bar moving average on the four hour chart. That moving average was broken during yesterday’s trade. Staying above the 200 bar moving average was a technical reason for the pair to move higher. The high price did extend above the 38.2% retracement of the move down from the October 20 high at 1.34166. The high price reached 1.3435 before rotating back below the retracement level. Getting back above the 1.34166 would be more bullish for the pair. Conversely, a move back below the 1.3370 area (swing highs from November 30 and December 16) would week in the bullish bias.

Looking at the other dog, i.e. the EURUSD, it as seen movement back to the downside today. On the hourly chart, the price just moved down to test the converged 100 and 200 hour moving averages once again at 1.1288. Move below those moving averages and the bias shifts more to the downside.