Products You May Like

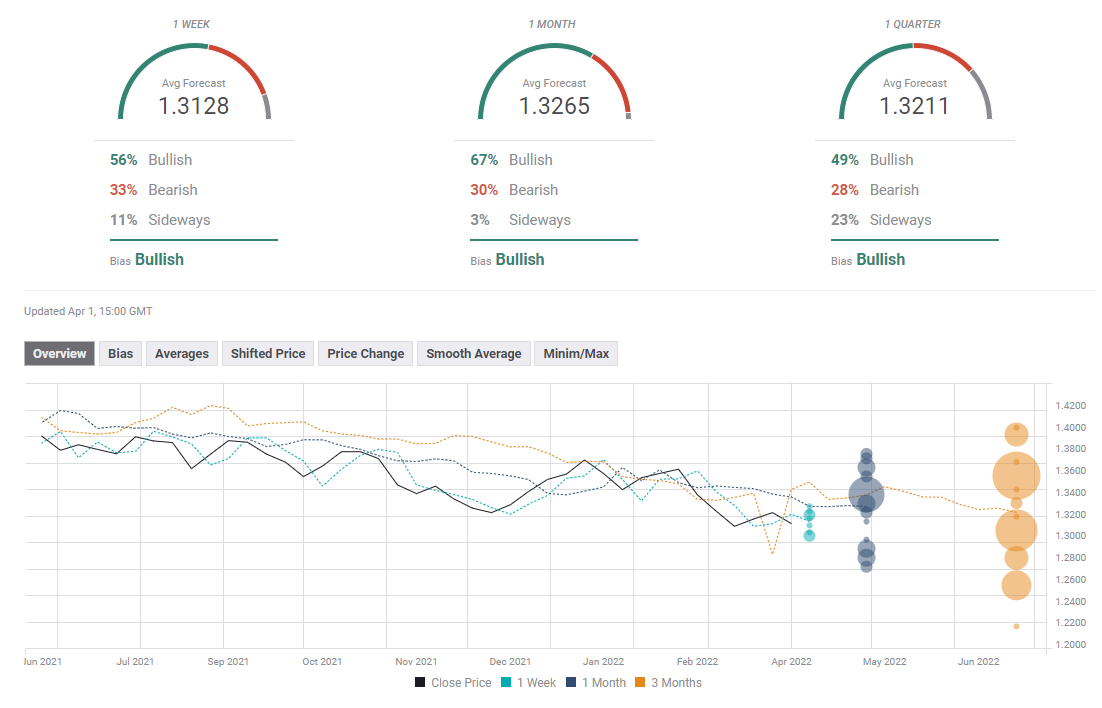

GBP/USD Weekly Forecast: Little hope for bulls, as focus shifts to Fed minutes

After charting a Doji candlestick in the previous week, sellers returned this week and left GBP/USD in close proximity to two-week lows of 1.3050. The divergent monetary policy outlooks between the US Fed and Bank of England (BOE) weighed heavily on the pair alongside a pause in the bond rout. Meanwhile, markets remained in a cautious mood amid a lack of progress in the Russia-Ukraine crisis and global growth concerns. Looking ahead, a quiet week on the economic data front will put the focus back on the Ukraine saga and the central banks’ expectations. Read more…

GBP/USD falls to near 1.3100, again unable to hold above 21DMA as strong US data supports Fed tightening bets

GBP/USD fell during US trade on Friday, as the US dollar strengthened versus the majority of its G10 counterparts following a strong official March labour market report and robust but also highly inflationary March ISM Manufacturing PMI survey release. To recap briefly, the US economy added 432K jobs, the unemployment rate dropped to 3.6% and wages grew at a pace of 5.6% YoY in March, while the headline ISM Manufacturing PMI index remained well in expansion territory, but the Price Paid subindex spiked to its highest levels since last July. The US dollar benefitted from a surge in US yields, particularly at the short-end of the curve. The bond market moves reflected a market interpreting Friday’s data strengthening the likelihood that the Fed opts to lift interest rates in 50 bps intervals in the coming quarters, and as more Fed policymakers indicated their openness to these larger rate moves. Read more…

GBP/USD Forecast: Further losses likely with a drop below 1.3100

GBP/USD has struggled to make a decisive move in either direction on Thursday and has started to edge lower in the early European session on Friday. The pair is closing in on 1.3100 support and the bearish pressure could increase in case that level fails. Escalating geopolitical tensions on Russia’s decision to force buyers to pay for Russian gas in roubles forced investors to seek refuge late Thursday. Moreover, Russian forces are reportedly relocating and reorganising rather than pulling back, reviving concerns over a prolonged military conflict. Read more…