Products You May Like

Euro is under heavy selling pressure today on renewed worries over cut off of Russia gas supply. It’s additionally pressured and Germany 10-year yield breaks below 1% handle again. For now, Sterling appears to be a distant second. On the other hand, Dollar and Yen are gaining most, followed by Swiss Franc. Commodity currencies are now taking a back seat, with Aussie, Kiwi and Loonie trading mixed.

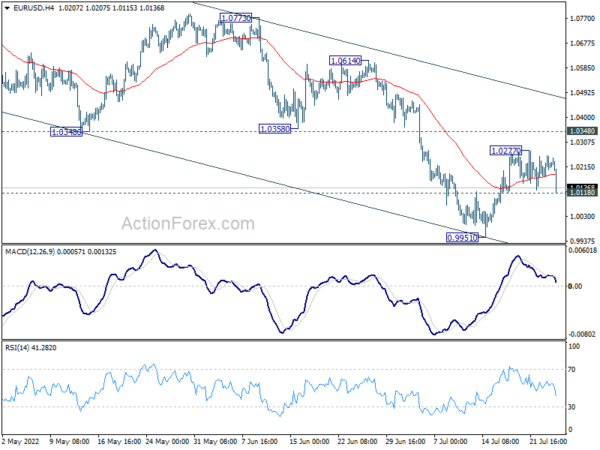

Technically, EUR/GBP’s break of 0.8456 minor support now suggests that rebound form 0.8401 is finished, and fall from 0.8720 is resume to resume. A major focus in on whether EUR/USD will also break through 1.0118 minor support, and reach larger down trend through 0.9951 low. This time, if it happens, it might take a relatively much longer term for EUR/USD to regain parity.

In Europe, at the time of writing, FTSE is up 0.61%. DAX is down -0.54%. CAC is down -0.11%. Germany 10-yaer yield is down -0.0085 at 0.933. Earlier in Asia, Nikkei dropped -0.16%. Hong Kong HSI rose 1.67%. China Shanghai SSE rose 0.83%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield rose 0.0035 to 0.210.

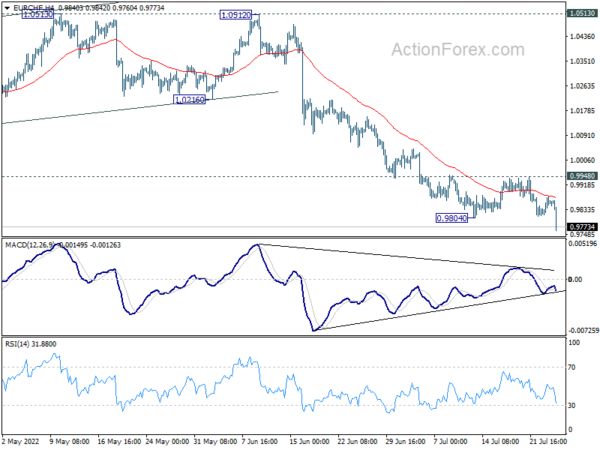

EUR/CHF downside breakout on gas crunch worries

Euro is knocked down by renewed concerns over Russia gas supply cut to EU countries. That came after Russia said yesterday that it would cut gas flows through the Nord Stream 1 to Germany, to just 20% of normal capacity, down from current 40%.

EUR/CHF finally resumes recent down trend through 0.9804 low. Outlook will now stay bearish as long as 0.9948 resistance holds. Next target is 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650.

Japan government: Economy is picking up moderately

In the latest monthly report, Japan’s Cabinet office upgraded its assessment slightly, and noted that “the Japanese economy is picking up moderately.” That compared to showing signs of picking up in previous report.

But the report also warned of the downside risks from “fluctuations in the financial and capital markets amid global monetary tightening.”

BoJ minutes: Board members spoke of importance of wage increases

In the minutes of June meeting, BoJ board said price rises have been broadening. But massive support is still needed for the economy while uncertainty surrounding the outlook was “extremely high”.

“Many members spoke about the importance of wage increases from the perspective of achieving the BoJ’s price target in a sustained and stable fashion.”

“Japan must create a resilient economy at which consumption continues to rise even when companies raise prices,” one board member said.

“The BOJ must maintain monetary easing until wage hikes become a trend, and help Japan achieve the bank’s price target sustainably and stably,” another member said.

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 138.92; (P) 139.49; (R1) 140.27; More….

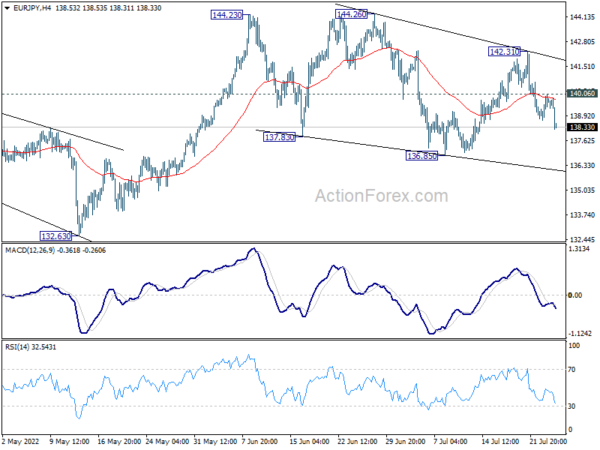

EUR/JPY’s fall resumes after brief recovery and intraday bias stays on the downside. Fall from 142.31 is seen as a falling leg inside the corrective pattern from 144.23. Deeper decline would be seen to 136.85 support. On the upside, above 140.06 minor resistance will turn bias back to the upside for 142.31 resistance instead.

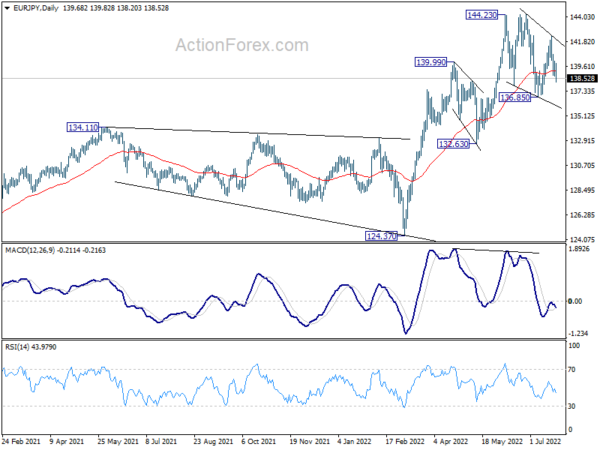

In the bigger picture, up trend from 114.42 (2020 low) is seen as the third leg of the pattern from 109.30 (2016 low). Further rally is in favor as long as 134.11 resistance turned support holds, even in case of deep pull back. Next target is 149.76 (2015 high). However, sustained break of 134.11 will be a sign of medium term bearish reversal and turn focus to 124.37 support for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 2.00% | 2.00% | 1.80% | 1.90% |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y May | 20.50% | 20.50% | 21.20% | |

| 13:00 | USD | Housing Price Index M/M May | 1.40% | 1.00% | 1.60% | |

| 14:00 | USD | Consumer Confidence Jul | 96.3 | 98.7 | ||

| 14:00 | USD | New Home Sales Jun | 670K | 696K |