Products You May Like

Markets continue to tread water today with little movements. European indices are fluctuating in tight range between gain and loss. US futures point to mildly higher open. In the currency markets, most major pairs and crosses are stuck in side Friday’s range. Swiss franc is currently weakest, followed by Euro and Aussie. Canadian is the strongest one, followed by Dollar and Pound.

Technically, EUR/CHF might be a cross to watch for the rest of the day. It’s bounded in range below 1.0838 for a while. Break of this resistance will resume the rebound form 1.0602 to 1.0915. GBP/CHF drew support from 4 hour 55 EMA again and recovered. Break of 1.2034 will resume the choppy rise from 1.1630 for 1.2259 high.

– advertisement –

In Europe, currently, FTSE is up 0.28%. DAX is up 0.09%. CAC is up 0.32%. German 10-year yield is down -0.0222. Earlier in Asia, Hong Kong HSI dropped -0.63%. China Shanghai SSE rose 0.75%. Japan and Singapore were on holidays.

Eurozone Sentix investor confidence rose to -13.4

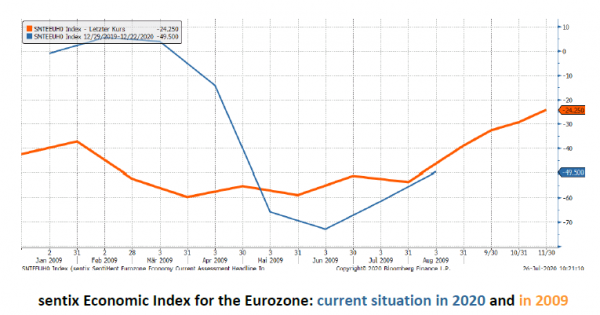

Eurozone Sentix Investor Confidence rose to -13.4 in August, up from -18.3, beat expectation of -15.2. It’s also the fourth increase in a row, and highest since February. Current Situation index rose to -41.3, up from -49.5, highest since March. Expectations, however, dropped slightly to 19.3, down from 19.5.

Sentix said: “If one compares the development of the current situation following the financial crisis in 2009 with the recovery movement of the sentix economic indices this year, it is noticeable that the recovery of the current situation is very similar in terms of both level and timing. At that time, the expectations were also the first to rise. For a long time, the current situation values bobbed in the deep red range. It was not until summer 2009 that the economic indicators began to recover. The path in 2020 is now very similar, giving rise to the fantasy that the low point has definitely been passed and that the initiated recovery can continue.”

Bank of France: July economic activity -7% below normal levels

Bank of France said in the monthly report that economic activity is running -7% below normal levels in July. That follows -13.8% contraction in the economy in Q2.

It also noted, in July, “industrial activity continued to recover, albeit at a more subdued pace compared to June”. “Services sector activity continued to expand, but at a slower rate than previous month”. “Construction sector activity continued to grow but decelerated.”

For August, business leaders expect industry to “grow moderately”, services to “remain almost stable”, construction to “tick upwards”.

New Zealand ANZ business confidence dropped to -42.2, post-lockdown rebound run its course

August’ preliminary reading of New Zealand ANZ Business Confidence dropped back to -42.4, down form -31.8. It’s still above lockdown low of -55, though. Own Activity Outlook also dropped to -17.0, down from -8.9.

ANZ said the reading “adds to the evidence that the post-lockdown rebound may have run its course.” “There are three prongs to this economic crisis: lockdown, closed borders, and an incredibly synchronised global slowdown that will hit exports.”

USD/JPY Mid-Day Outlook

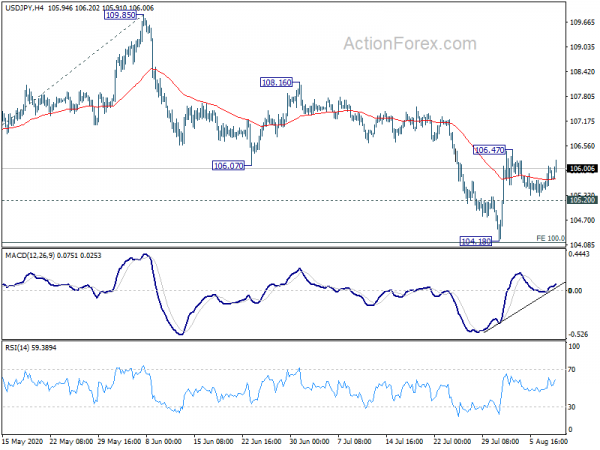

Daily Pivots: (S1) 105.58; (P) 105.82; (R1) 106.16; More...

USD/JPY is staying in consolidation from 106.47 and intraday bias remains neutral. The bullish case is still in favor for now. That is, corrective fall from 111.71 has completed with three waves down to 104.18, after missing 100% projection of 111.71 to 105.98 from 109.85 at 104.12. On the upside, above 106.47 will target 108.16 resistance next. Nevertheless, break of 104.18 will extend the whole decline from 111.71 instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | NZD | ANZ Business Confidence Aug P | -42.4 | -31.8 | ||

| 1:30 | CNY | CPI Y/Y Jul | 2.70% | 2.60% | 2.50% | |

| 1:30 | CNY | PPI Y/Y Jul | -2.40% | -2.50% | -3.00% | |

| 5:45 | CHF | Unemployment Rate Jul | 3.30% | 3.40% | 3.30% | |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Aug | -13.4 | -15.2 | -18.2 |