Products You May Like

Volatility divergence was a tell

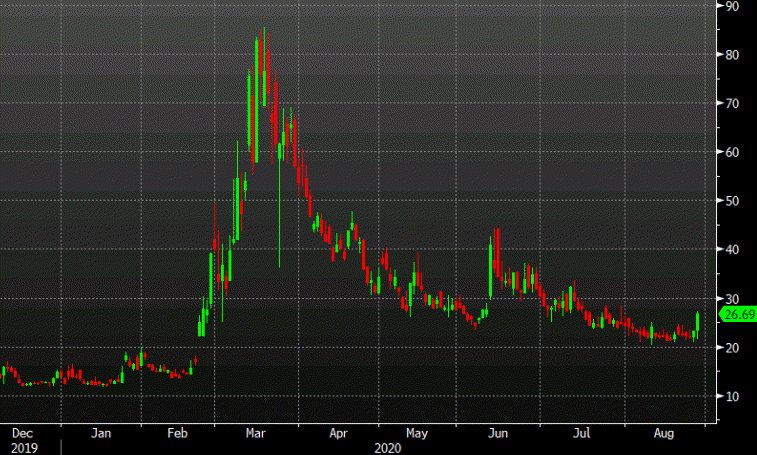

In the past week, US equities have continued to rally but there were some signs that it was running on fumes. In the FX market, the US dollar stopped going down. A bigger tell may have been that volatility wouldn’t fall.

Now, stocks are turning as volatility has shot higher. The VIX is up 14% in a sign that someone wants puts. When you scale out, it doesn’t look like a big move but if stocks start to roll over, there is some serious upside.

What’s most notable for me is that it could be a leading indicator. These potential false breakouts in the dollar today could also be instructive. Long bond yields have climbed to the highest since June.

This article was originally published by Forexlive.com. Read the original article here.