Products You May Like

Forex news for New York trade on August 28, 2020:

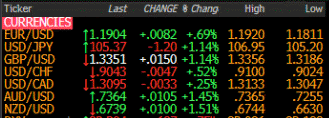

Markets:

- Gold up $35 to $1964

- WTI crude flat at $42.97

- US 10-year yields down 3 bps to 0.72%

- S&P 500 up 23 points to record 3508

- NZD leads, USD lags

The resignation of Abe in Japan resonated throughout the world and led to a round of yen strength as political uncertainty returns. USD/JPY dropped 25 pips initially on the news and continued another 100 pips down through the remainder of the day.

A big part of that was general USD selling in the fallout from the FOMC. The dollar is getting hit on risk-positive trades as well as worry about a dovish Fed. It completed its breakout on most fronts on Friday.

Cable was particularly strong as it broke above the August highs. Some fixing flows added to GBP demand ahead of a long UK weekend.

The euro wasn’t as enthusiastic but made some headway towards the top of the range in a solid 80 pips rally to 1.1900.

The Canadian dollar initially tried to breakout alongside the Australian and New Zealand dollars but couldn’t quite complete the move. An initial drop to 1.3050 was bid up steadily all the way to 1.3125 before some late selling.

The aforementioned AUD and NZD both finished at the highs of the day which are also post-pandemic highs in what looks like a major breakout.

Have a great weekend.