Products You May Like

Continuation of the trend

One of the major divergences in markets in the past two months has been the lack of enthusiasm in emerging market currencies. Most — if not all — are way below pre-pandemic levels.

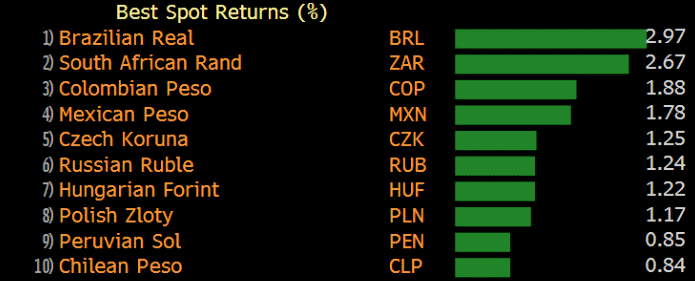

Among the laggards are the LatAm currencies, including BRL, MXN and COP. All three are near the top of the chart today and up strongly. That’s a very good sign for those beaten-down currencies, and also for risk assets in general.

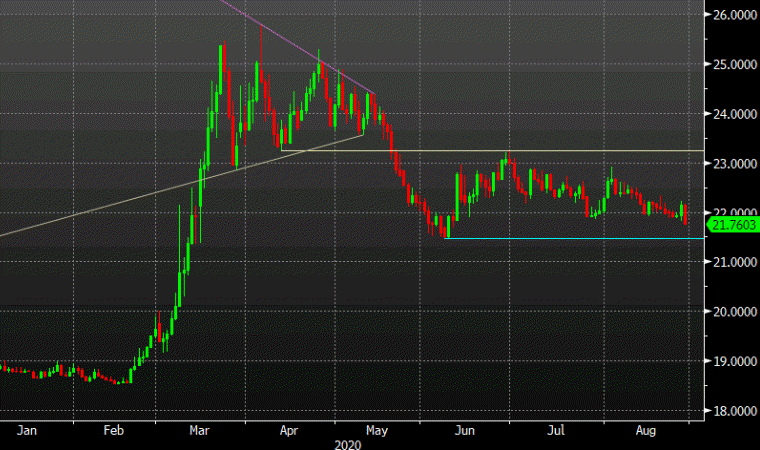

One I’m paying particularly close attention to — because I think it’s a long-term positive secular story — is the Mexican peso.

USD/MXN has hung out in a range since since breaking lower from a triangle formation in May. Now, it’s headed back to the lower end of the range.

I think there is a great case for shorts here, particularly if 21.47 breaks.