Products You May Like

More or a correlation than causation

I don’t see anything in Brainard’s comments that would argue for buying the dollar here. She said risks are tilted to the downside and it will take some time for inflation to get closer to target.

If anything she’s saying that more accommodation is coming.

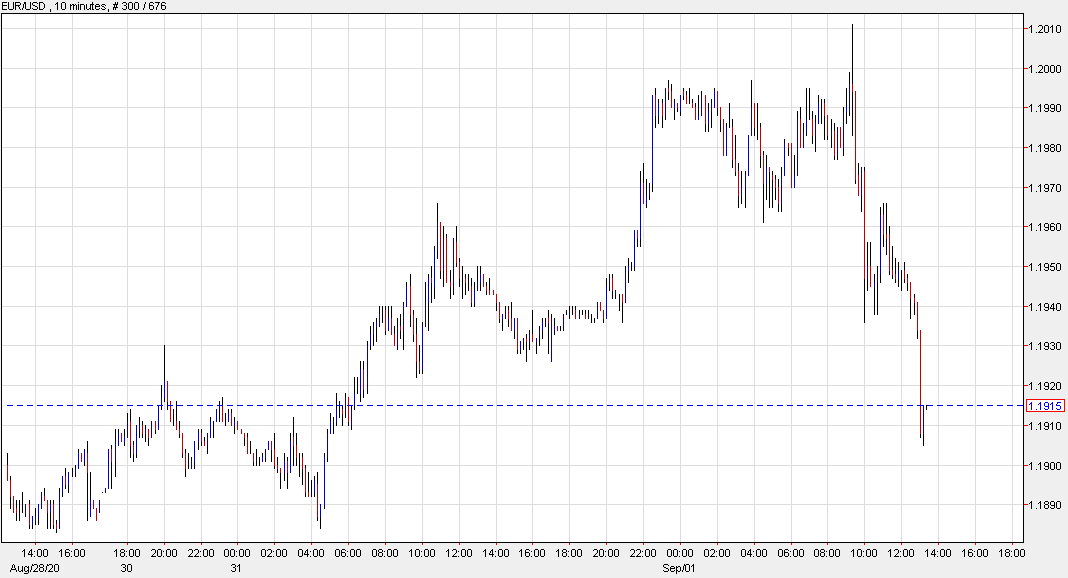

But the dollar is on the comeback trail today and that continued after her comments. EUR/USD has fallen to 1.1906, which is more than a full cent from the spike above 1.20 at the start of US trading.

The other moves are less dramatic and that suggests EUR/USD repositioning is a factor here. Speculative longs in the pair are extremely stretched and you have to imagine there were some big positions waiting for 1.20 to take profits. That’s a solid return from 1.08 in late May.

Given that and the commentary, I really don’t see this as a trend changer for the dollar. The larger risk is a correction in stocks.

This article was originally published by Forexlive.com. Read the original article here.