Products You May Like

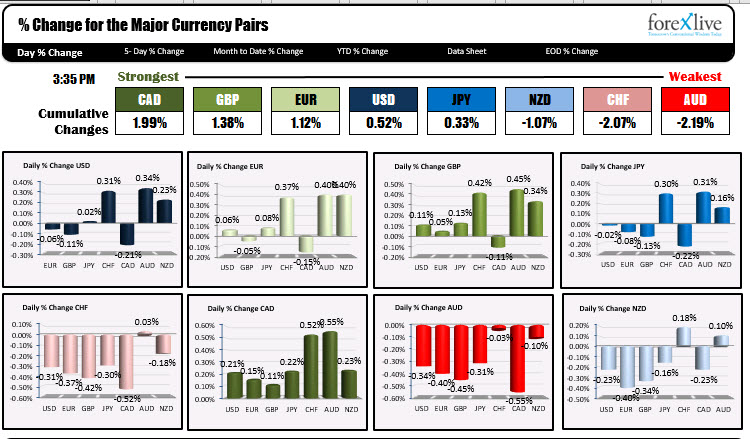

A up and down day in most major pairs today

The forex market had some ups and downs in the USD today. The day started with the greenback higher. It remained near high levels as London traders headed to the exit. However, some selling in the NY afternoon session has erased a lot of the earlier gains. The dollar is now lower vs the EUR, GBP, CAD. Higher vs the CHF, AUD and NZD and unchanged vs the JPY.

Maybe the price action was not as up and down volatile like the US stocks but you can’t help but think that the dollar buyers had their victory snatched from them today.

Technially, a few thoughts on some of the major pairs going into the new trading day:

- EURUSD: The EURUSD moved to a 2 month low (July 24 ) to 1.16258. That stalled around 7 pips from a lower trendline on the hourly chart. The price rebounded and when it moved above the low from yesterday at 1.1651 and then the close from yesterday at 1.1658, it push the pair up further with the high reaching 1.1686. The price is currently trading around 1.1670 as we head toward the close. Traders in the new day will be watching the 1.1650 swing low from yesterday (an early low from the Asian session today) as close support a move below should solicit more selling. While staying above keeps the door open for a test of the swing low from Tuesday at 1.16917. Above that and traders will be focused on the 38.2% retracement at 1.17196. The falling 100 hour moving average should also start to creep into focus. It is currently at 1.17289 but moving lower by about 3 pips per hour.

- GBPUSD.: The GBPUSD for the 3rd day in a row trade above and below its 100 and 200 day moving averages. The 100 day moving averages at 1.27265. The 200 day moving average is 1.27179. Over the last 2 and half trading days the price has traded between 1.2782 and 1.26737. The range today was in between those levels with a low at 1.26899 and a high at 1.27803. The price is trading mid range at 1.2749 currently. If the price is to go higher staying above the 100/200 day MAs is the most bullish technical clue (between 1.27179 and 1.27265). If it can hold, the high over the last few days at 1.27823 and the falling 100 hour MA at 1.27872 (and moving lower) will be upside hurdles Fall back below the MAs and recent intraday swing lows on the hourly at 1.27064, 1.26892 and 1.26737 are the steps to a more open bearish road.

- USDJPY: The USDJPY like many pairs, traded up and down and up and down today. The pair did hold an upward sloping trendline on the hourly chart (connecting lows from Monday and Tuesday). Today, the low for the got within a few pips of the level and is currently testing the upward sloping line (at a higher level). If the pair can hold support (at around 105.39), a swing area between 105.537 and 105.60 would be needed to be broken to open the door for further upside momentum toward 105.78 to 105.82 as targets. Although up and down today, the pair is holding on to a modest gain for the day. A close higher would be the 4th day in a row higher.

- USDCAD: The USDCAD moved to it’s highest level since August 3 at 1.34174. Intraday, the pair tested a trend line on the hourly chart connecting lows from Monday and Wednesday. However, that trendline was broken in the late morning at 1.3386 turning buyers and sellers. The price bottomed at 1.3328. The pair is currently trading around 1.3362. In the new trading day, a close barometer for buyers and sellers will come in at the 1.3345 level. That was the swing hi from Tuesday’s trade and also a swing high from trading on Wednesday. If the price can stay above that level, the tilt still remains in the buyers direction. If it is broken traders will look toward the rising 100 hour moving average 1.33118 as the next key hurdle. Below that comes the 38.2% retracement of the move up from the September 16 low. That level comes in at 1.3306

This article was originally published by Forexlive.com. Read the original article here.