Products You May Like

Dollar is trying to recover in Asian session while Aussie tumbles broadly. Sentiments appear to be turning cautious on news that Johnson & Johnson paused coronavirus vaccine study due to an unexplained illness in a participant. UK also started a tiered system of fresh coronavirus restrictions. WTI crude oil is extending this week’s pull back after failing an resistance level while gold is in pull back. But overall movements are relatively limited while there is no turn in recent weak trend in Dollar yet. Coronavirus, US election and Brexit will continue to drive the markets, more so than economic data.

Technically, Dollar is still more likely the head lower as long as these levels hold: 1.1732 support in EUR/USD, 1.2845 support in GBP/USD. 0.7095 support in AUD/USD, 0.9197 resistance in USD/CHF and 1.3242 resistance in USD/CAD. Though, whether Dollar would dive through key near term support, like 1.2011 in EUR/USD, is another question. We’d probably see the greenback staying in familiar range until at least the latter part of October, or even after US election.

In Asia, currently, Nikkei is up 0.11%. 10-year JGB yield is down -0.0014 at 0.031. China Shanghai SSE is down -0.28%. Singapore Strait Times is up 0.09%. Hong Kong is on typhoon holiday. Overnight, DOW rose 0.88%. S&P 500 rose 1.64%. NASDAQ rose 2.56%. 10-year yield rose 0.002 to 0.777.

– advertisement –

BoE Bailey: We haven’t addressed the question of using negative rates

BoE Governor Andrew Bailey said in a webinar yesterday that the central isn’t ready for implementation of negative interest rate yet. “Given the shock we’ve had, there are good reasons to say we shouldn’t rule them out and therefore they’re in the toolbox,” he said. “We haven’t addressed the question of should we use them.”

Earlier, Governor Sam Woods has sent a letter

banks asking for their readiness on negative interest. “We are requesting specific information about your firm’s current readiness to deal with a zero Bank Rate, a negative Bank Rate, or a tiered system of reserves remuneration – and the steps that you would need to take to prepare for the implementation of these,” Woods said in a letter. “We are also seeking to understand whether there may be potential for short-term solutions or workarounds, as well as permanent systems changes.”

UK BRC retail sales reported strongest growth since Dec 09

UK BRC Retail Sales Monitor rose 6.1% yoy in September. That’s the strongest like-for-like retail sales growth since December 2009.

Paul Martin, Partner, UK Head of Retail, KPMG: “The resilience of British retailers has been nothing shy of remarkable in recent months, with 6.1% like-for-like growth in September serving to reinforce that. That said, this month’s uptick is against the woeful performance recorded in September 2019 and so caution remains vital. Last year, the prospect of a no-deal Brexit loomed over purchasing decisions dampening demand, but now that same prospect is accompanied by the recent resurgence of COVID-19 numbers. Combined, these factors could have a significant impact on retail growth over the next months.

China’s imports and exports surged in Sep, trade surplus shrank

In September, in USD terms, China’s total trade rose 11.4% yoy to USD 442.5B. exports rose 9.9% yoy to USD 239.8B. Imports rose 13.2% yoy to USD 202.8B Trade surplus came in at USD 37.0B, down from August’s USD 58.9B and missed expectation of USD 59.3B.

Year-to-date, total trade dropped -1.8% yoy to USD 3298B. Imports dropped -0.8% yoy to USD 1811B. Exports dropped -3.1% yoy to USD 1485B. Trade surplus was at USD 326B.

With the EU, year-to-date, total trade rose 0.4% yoy to USD 461.2B. Exports rose 3.1% yoy to USD 279.5B. Imports dropped -3.6% yoy to USD 181.7B. Trade surplus was at USD 97.9B

With the US, year-to-date, total trade dropped -0.6% to USD 401.5B. Exports dropped -0.8% yoy to USD 310.0B. Imports rose 0.2% yoy to USD 91.4B. Trade surplus was at USD USD 218.6B.

Looking ahead

UK employment data and German ZEW economic sentiment will be the major focus in European session. Later in the day, US CPI will take center stage.

AUD/USD Daily Report

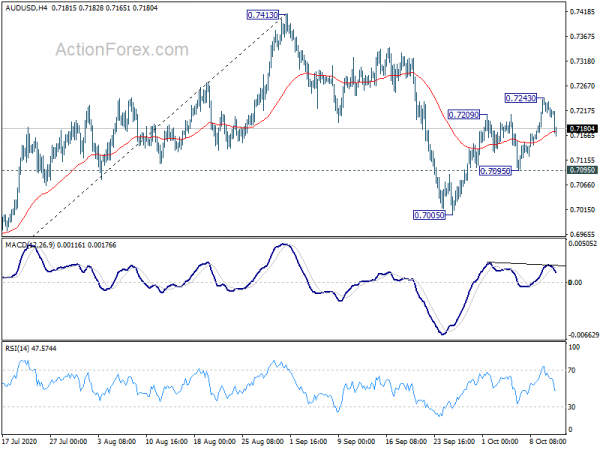

Daily Pivots: (S1) 0.7198; (P) 0.7217; (R1) 0.7230; More…

Intraday bias in AUD/USD is turned neutral with today’s retreat. But further rise is in favor as long as 0.7095 support holds. On the upside, above 0.7243 will extend the rebound form 0.7005 to retest 0.7413 high. Decisive break there will resume larger rise form 0.5506 to 0.7635 fibonacci level. However, firm break of 0.7095 will argue that corrective fall from 0.7413 is resuming through 0.7005.

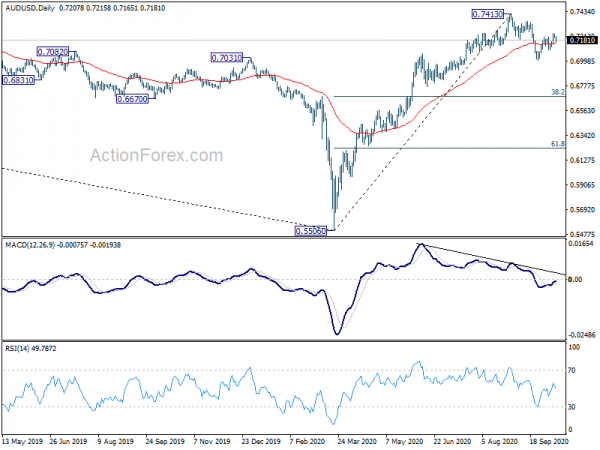

In the bigger picture, while rebound from 0.5506 was strong, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a corrective inside the long term up trend. Sustained trading back below 55 week EMA (now at 0.6898) will favor the bearish case and argue that the rebound has completed. Focus will be turned back to 0.5506 low. On the upside, break of 0.7413 will extend the rise from 0.5506 to 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Sep | 6.10% | 4.70% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 9.00% | 9.10% | 8.60% | |

| 3:06 | CNY | Trade Balance (USD) Sep | 37.0B | 59.3B | 58.9B | |

| 3:06 | CNY | Exports (USD) Y/Y Sep | 9.90% | 9.50% | ||

| 3:06 | CNY | Imports (USD) Y/Y Sep | 13.20% | -2.10% | ||

| 3:06 | CNY | Trade Balance (CNY) Sep | 258B | 420B | 417B | |

| 3:06 | CNY | Exports (CNY) Y/Y Sep | 8.70% | 11.60% | ||

| 3:06 | CNY | Imports (CNY) Y/Y Sep | 11.60% | -0.50% | ||

| 6:00 | GBP | Claimant Count Change Sep | 73.7K | |||

| 6:00 | GBP | Claimant Count Rate Sep | 7.60% | |||

| 6:00 | GBP | ILO Unemployment Rate 3M Aug | 4.30% | 4.10% | ||

| 6:00 | GBP | Average Earnings Including Bonus 3M/Y Aug | -0.50% | -1.00% | ||

| 6:00 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 0.60% | 0.20% | ||

| 6:00 | EUR | Germany CPI M/M Sep F | -0.20% | -0.20% | ||

| 6:00 | EUR | Germany CPI Y/Y Sep F | -0.20% | -0.20% | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Oct | 74 | 77.4 | ||

| 9:00 | EUR | Germany ZEW Current Situation Oct | -60 | -66.2 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Oct | 70.5 | 73.9 | ||

| 10:00 | USD | NFIB Business Optimism Index Sep | 100.9 | 100.2 | ||

| 12:30 | USD | CPI M/M Sep | 0.20% | 0.40% | ||

| 12:30 | USD | CPI Y/Y Sep | 1.40% | 1.30% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 1.70% |