Products You May Like

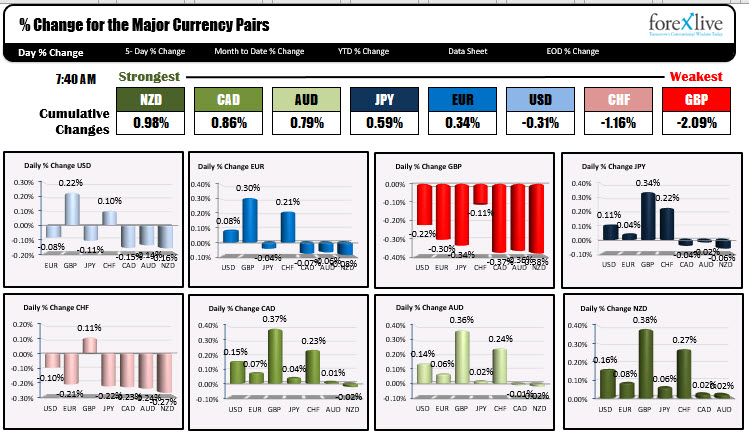

The USD is mixed in semi-holiday post Turkey Day Hangover day

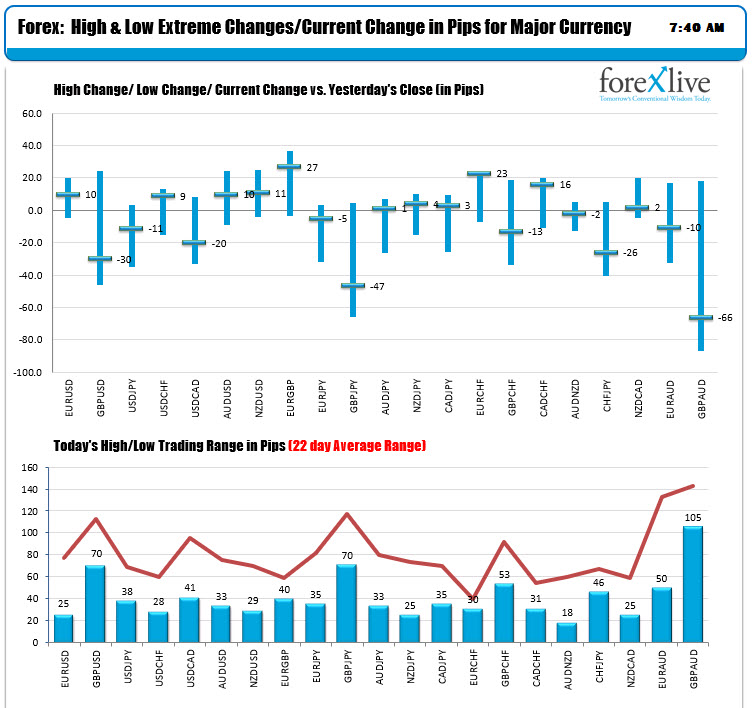

The day after Turkey Day will see the Bond and Stock markets close early, but they are open and the USD is trading mixed with gains vs the GBP, and CHF and declines vs the EUR, CAD, AUD and NZD. Overall, the NZD is the strongest of the majors, while the GBP is the weakest.. The changes are relatively modest, although the GBP took a dive to the downside after an EU diplomat said, gaps on level playing field, governance, fisheries remain large. The GBPUSD tumbled below its 100 hour MA at 1.33523 and fell toward the 200 hour MA at 1.3308 before finding a buyer (the low reached 1.3310 and the pair currently trades at 1.3333 in early NA trading). The technical level worked nicely to stall the fall at least (and for now).

The ranges and changes are showing modest price action. Apart from the GBPUSD range at 70 pips, the next highs range is 41 pips for a currency verse the US dollar (USDCAD). The Lois trading range is only 25 pips for the EURUSD. All the ranges for the major pairs vs the USD and major crosses are all well below the 22 day averages (about a month of trading).

In other markets, the snapshot of the current prices shows:

- Spot Gold, $-9.40 -0.52% at $1806.35.

- Spot silver $-0.24 or -1.05% at $23.17

- Bitcoin on Coinbase exchange is trading down $31 and $17,018.93. The high price earlier this week reached $19,469. That was still short of the all-time high price from December 2017 at $19,891.99

- WTI crude oil futures are trading down $0.42 or -0.92% at $45.29

In the premarket for US stocks, the major indices are trading higher:

- Dow industrial average up 68 points

- S&P index up 9 points

- NASDAQ index up 51 points

In the European equity markets, the major indices are mostly higher. The exception is the UK FTSE reacting well to the Brexit negotiations:

- German DAX, +0.23%

- France’s CAC, +0.5%

- UK’s FTSE 100, -0.5%

- Spain’s Ibex, +0.5%

- Italy’s FTSE MIB, +0.44%

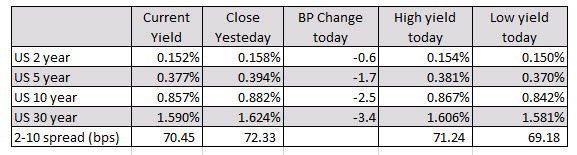

In the US debt market, the yields are trading lower across the board with a flatter yield curve

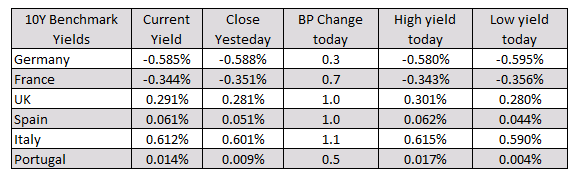

In the European debt market, the benchmark 10 year yields are trading up, but only by 1 basis point across the spectrum of major countries: