Products You May Like

- Gold lost 4.5% on the week, the worst week since end-September.

- Stops got triggered after gold breached the $1800 critical threshold.

- Coronavirus vaccine progress-led economic optimism hammered gold.

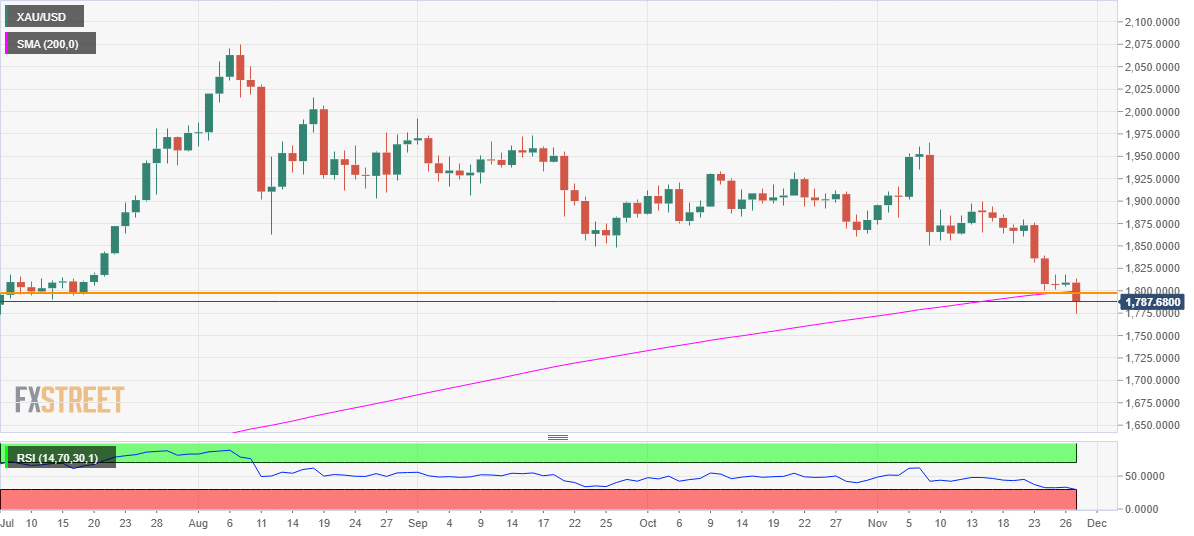

Gold (XAU/USD) finally breached the critical $1800 support on Friday, closing the week below that level for the first time since July 16.

The spot eroded 4.5% of its value over the week, recording the biggest weekly decline since end-September while extending the correction from record highs of $2075 reached in August.

The bearish sentiment undermining gold can be attributed to hopes for a swifter global economic recovery, thanks to the promising coronavirus vaccine results, which could likely bring life to normalcy in 2021.

The Wall Street stocks rallied to record highs on potential quicker economic turnaround and weighed heavily on the non-yielding gold. The market optimism diminishes the odds of additional monetary and fiscal support.

Gold Price Chart: Daily

Gold: Technical levels

Friday’s sell-off to fresh four-month lows of $1775 was ensured after the metal breached the $1800 support line, the confluence of the psychological level and 200-day simple moving average (DMA). Stops got triggered below the latter, fuelling a sharp $25 drop.

The next downside target for the bears awaits at May 18 highs of $1765 while the recovery could gain traction only on a sustained break above the $1800 level.