Products You May Like

Daily thread to exchange ideas and to share your thoughts

December looks to be starting in the same fashion that November traded, as equities are running higher as the new month begins.

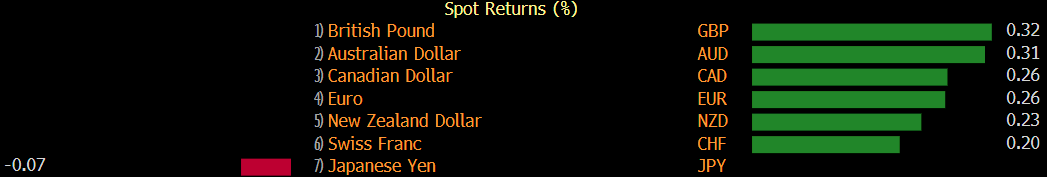

The dollar and yen are slightly on the back foot as such, but key technical levels held up for the most part in trading yesterday with the notable one being the rejection of EUR/USD at 1.2000 and that kept the dollar steadier towards the end of the day.

December promises to be more of a test of buyers’ resolve in breaking above the key figure level and that would open up the range between 1.2000-1.2500 to roam.

GBP/USD had some testing times around its 200-hour moving average (now @ 1.3325) yesterday but buyers kept a defense of that level and are maintaining more near-term control now, although price action is still confined between 1.3300-1.3400.

But the 100-hour moving average is @ $1,798 and that is the key near-term level that buyers need to get back above to wrestle back some control first and foremost.

Looking at the month ahead, the next few weeks will see more of a battle between risk once again but the transitional narrative is one to be mindful about in the coming months.

The virus/health crisis is one that will eventually peak and the vaccine narrative will only grow greater and the transition of the risk balance there will also eventually (if not already) be reflected in the market even more so over time.

What are your views on the market right now? Share your thoughts/ideas with the ForexLive community here.