Products You May Like

Eurozone Preliminary CPIs and GDP overview

Eurostat will publish the first estimate of Eurozone inflation figures for November at 1000 GMT on Tuesday.

The headline CPI is anticipated to drop 0.2% YoY vs. -0.3% previous while the core inflation is seen steady at 0.2% YoY in the reported month.

Deviation impact on EUR/USD

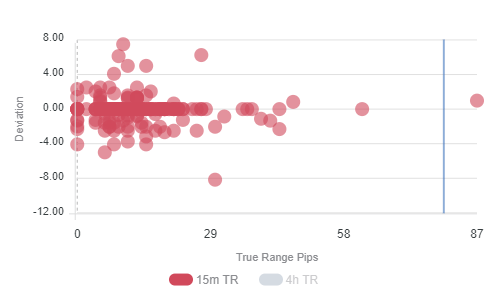

Readers can find FX Street’s proprietary deviation impact map of the CPI below. As observed the reaction is likely to remain confined between 10 and 20 pips in deviations up to 3 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 30-45 pips.

How could affect EUR/USD?

Omkar Godbole, FXStreet’s Analyst, is off the view, “despite the quick recovery to levels above the 100-hour SMA, the immediate bias remains neutral. That’s because the pair is yet to clear the psychological hurdle of 1.20. The EUR bulls failed to establish a foothold above that hurdle on Monday, having faced similar rejection on Sept. 1.”

“More importantly, the pair ended up carving a red candle with a long upper shadow. The bias will turn bearish if Monday’s low of 1.1922 is breached. That would shift risk in favor of a drop to 1.18 (Nov. 23 low),” Omkar adds.

Key notes

Forex Today: New month, fresh market gains, PMIs, Powell’s testimony and Brexit eyed

EUR/USD adds over 30 pips as risk assets gain ground

ECB flags more stimulus ahead as financial conditions tighten

About Eurozone Preliminary CPIs and GDP estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).