Products You May Like

Forex news for North American trading on December 4, 2020

In most years, if a US jobs report can in worse than expectations by 215K jobs, you might expects stocks to move lower, yields to move lower. the USD to move lower.

Today, NFP came in at 245K vs 460K estimate and stocks rallied and closed at all time record highs, yields moved to the highest levels of the year and the USD moved higher.

Of course the dynamics THIS year and in THESE markets are a bit different. The way the sun, moon and stars are aligned with the Covid, AND the fact that a large swatch of people will lose benefits at the end of the year, means a weaker number makes for a better chance for more fiscal COVID stimulus. Add the positive, from a vaccine that will get going in earnest in 2021 (although it will be a long process), and an accomodative Fed who isn’t “even thinking about, thinking about tightening”, and you get higher stocks, higher yields and a USD that pushed to 2018 lows this week as investors jumped into the riskier/more beaten down currencies. Today, the dollar did bounce into the close after moving to new multi-year lows vs the EUR, GBP, CHF, CAD earlier in the day today. So there was some limits to the USDs decline for now at least.

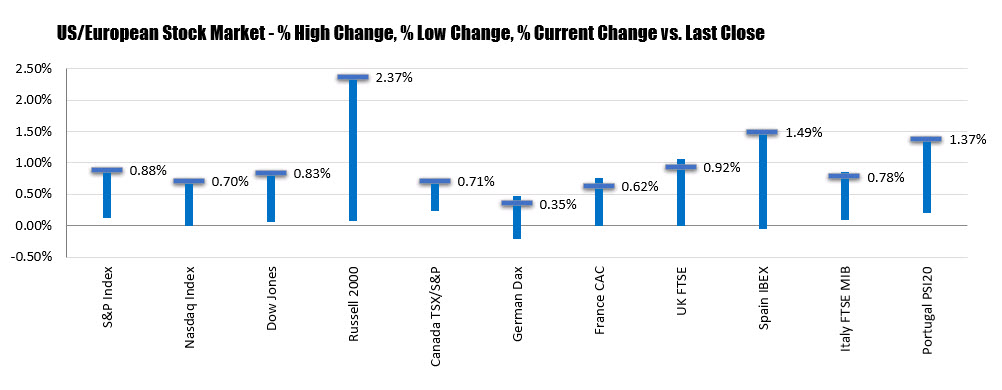

A look at the US stock changes shows solid gains of 0.70% to 0.88% for the 3 major indices. The Russell 2000 index of small caps really caught fire with a gain of 2.37%. European shares also benefitted today with gains from 0.35% (for the German Dax) to 1.49% (for the Spainish Ibex). Below is a snap shot of the ranges and closing % changes of the major US and European indices.

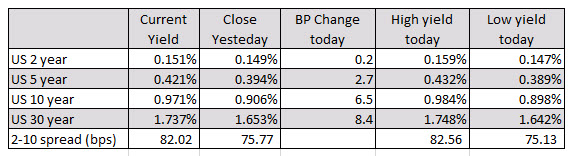

The US 10 year yield traded to it’s highest level since March to 0.9842% or nearly 1%. The 2-10 yield curve also steepened to the highest since 2018 at 82 basis points (from 75.77 at the close yesterday).

That sounds scary, but yields were up as high as 1.27% in March after the plunge to 0.3137%, and the high for the year was up at 1.9440%. Putting yields into that perspective, the 1% is not all that scary. However, it is still above the 50, 100 and 200 day MAs (see white blue and green lines in the chart below), which is a positive bias. We will see what next week brings as the levels test resistance.

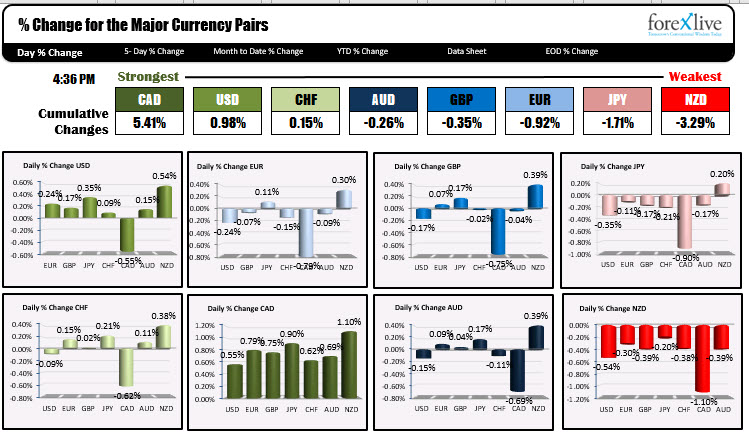

In the forex market, the USD reversed from being down marginally at the start of the day to being marginally positive. Nevertheless for the week, the dollar index reached the lowest levels since April 2018.

Below is a snapshot of the strongest to weakest currencies. The CAD was far away the strongest as the loonie benefited from a stronger employment report and pairs technicals for the USDCAD. The NZD was the weakest of the majors.

In other markets:

- Spot gold trading down $2.20 to $1838.86 today. The high price reached $1848.21. The low price extended to $1829.28

- WTI crude oil futures rose $0.45 to $46.09. The high price reached $46.68. The low price extended to $45.61

- Bitcoin on Coinbase is trading close at $18,821. That was down around $600 on the day and off the $19,915.14 reached on Monday. The problem with the new high was that it only took out the previous record high at $19,891.99 by about $24.

Wishing all a happy and safe weekend….