Products You May Like

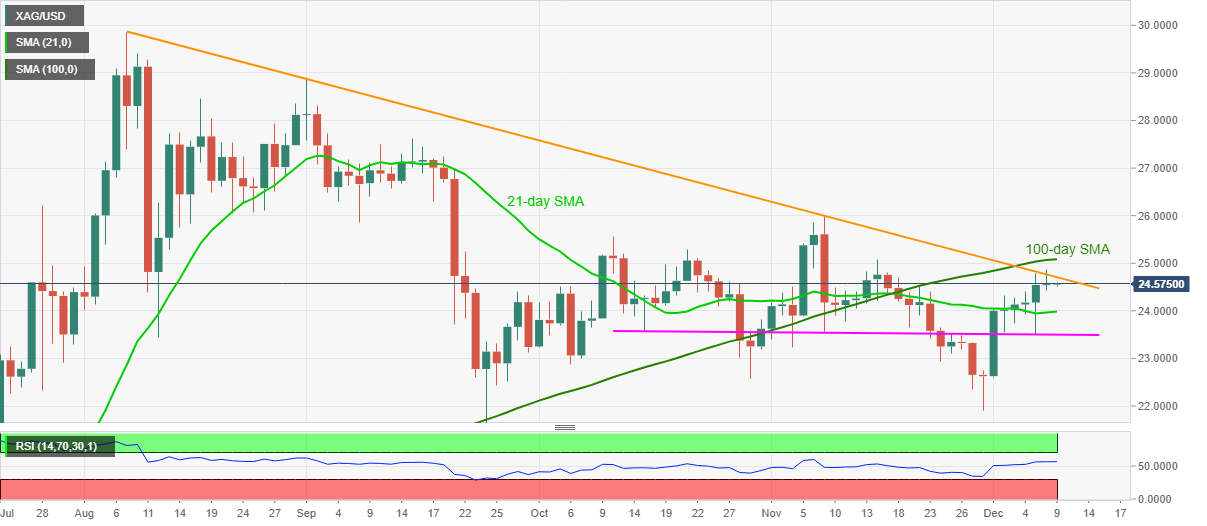

- Silver refreshes intraday low after stepping back from three-week top.

- Key resistance line, 100-day SMA challenge bulls amid normal RSI conditions.

- Bears will look for entries below 21-day SMA.

Silver prices bounce off an intraday low of $24.51, currently down 0.05% to $24.55, during Wednesday’s Asian session. In doing so, the white metal marks another pullback from the key resistance line stretched from August 07 despite rising to the highest since November 16 before a few hours.

Considering the strength of the resistance line, coupled with the normal RSI curve, the commodity is likely to ease further towards revisiting the 21-day SMA support near $24.00.

However, eight-week-old horizontal support around $23.55/50 can challenge the metal’s downside past-$24.00, failing to do so will highlight the November 30 low of $21.89 for silver sellers.

On the contrary, an upside clearance of the stated trend line resistance, at $24.70 isn’t enough to convince the bulls as the 100-day SMA level of $25.08 and November’s high near $26.00 offer additional filters to the north.

Overall, the bullion prices are likely to witness fresh pullback but the downside can be limited.

Silver daily chart

Trend: Pullback expected