Products You May Like

Forex news for North American trading on December 18, 2020

The day (and week for that matter) started with hopes for deals. One was for a Brexit deal out of the EU/UK. The second was a deal out of US lawmakers for a Covid stimulus deal. Both did not happen with negotiations continuing into the weekend.

Meanwhile, Covid cases and deaths increase in the UK and the US with the UK looking to increase Covid restrictions and the same happening in the US. Food lines are miles long in some areas. Many are still without a job.

In an incongruent twist to those that are suffering, VP Pence, Speaker of the House Pelosi and Senate Majority leader McConnell all protected themselves with the Covid vaccine. Sure it is to show the American people it is safe to take the vaccine, but something is just wrong with that picture as the debate about stimulus continues to go on and on and on and those in need suffer. It is just not right.

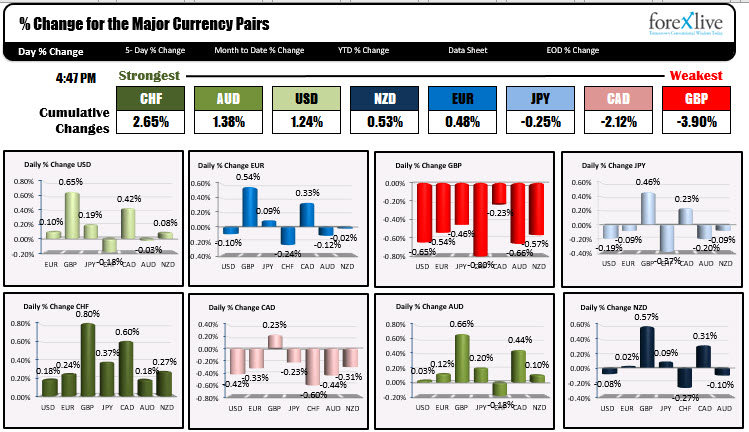

In the forex market, the CHF is ending the day as the strongest of the major. The GBP is the weakest. The USD closed mostly/moderately higher today after the dollar fell to the lowest levels in over 2 years this week.

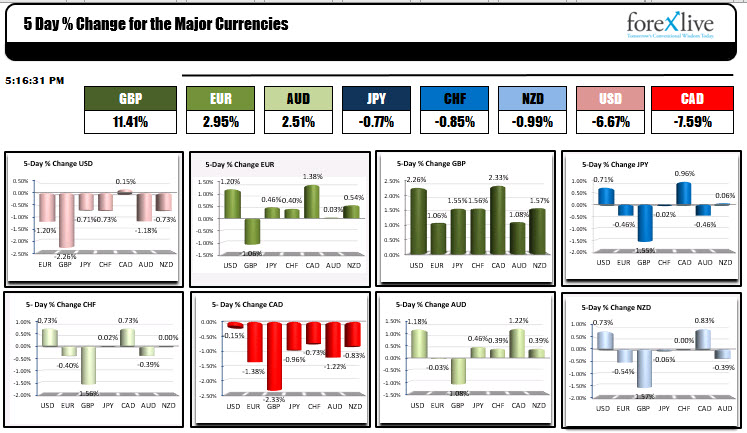

For the week, despite the USD weakness this week, the CAD was the weakest of the majors (followed by the USD), while the GBP – on hopes for a Brexit deal – was the strongest (see rankings of the major currencies this week below).

Spot gold is trading down around -$4.00 or -0.22% at $1881.35. For the week, the price closed a week ago at $1839.85. The gain of about $41 or 2.2%. Spot silver is up up from $23.95 last Friday to $25.81 today or 7.76%.

Those gains, however, were dwarfed by the rise in bitcoin which a week ago closed at at $18100 and is currently trading at $22850. That is a dollar gain of +$4750. The % gain for the week is 26.2%. Winner. Winner. Chicken dinner for the digital currency.

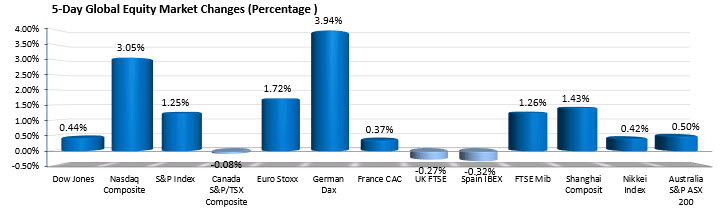

In the US stock market, the major indices closed down today with the Dow down -0.41%, the S&P down -0.35% and the Nasdaq down -0.07%, but for the week, each ended up higher vs last Friday.

The biggest gainer for the major indices was the German Dax which rose nearly 4% and because of the gains this week, are now up around 3% for the year. In the US, the Nasdaq tacked on 3.05% to the gains for the year that stand at 42% for the year (yes 42%). The S&P index is up 14.81% YTD.

Next week, is Christmas week (Friday). In addition to they continued stimulus talks and price negotiations, the following economic events and releases are scheduled:

Next week, is Christmas week (Friday). In addition to they continued stimulus talks and price negotiations, the following economic events and releases are scheduled:

- Tuesday: Australian retail sales, UK final GDP, US final GDP, US consumer confidence and existing home sales

- Wednesday: BOJ monitor policy meeting minutes and CPI, Canada GDP, US durable goods orders, US personal income and personal spending, weekly initial jobless claims, new home sales and University of Michigan consumer sentiment

- Thursday: Canada building permits

- Friday, Japan retail sales

Wishing all a good weekend. Be safe.