Products You May Like

GBP/USD Analysis: Profit-taking kicks in as Brexit deal optimism fades

The GBP/USD pair witnessed a dramatic intraday turnaround on the first day of a new trading week and tumbled around 150 pips from daily swing highs, near the 1.3575 region. The euphoria over a post-Brexit trade deal faded rather quickly as investors flagged concerns about the exclusion of the crucial services sector from the accord. This, coupled with a goodish US dollar rebound, exerted some additional pressure and contributed to the steep intraday fall.

Relief over the long-awaited US stimulus triggered a fresh wave of the global risk-on trade and pushed the US Treasury bond yields higher across the board. This, in turn, was seen as a key factor that helped revive the USD demand. It is worth reporting that the US President Donald Trump signed a $2.3 trillion pandemic aid and spending package on Sunday, restoring unemployment benefits to millions of Americans and averting a partial federal government shutdown that would have started on Tuesday. Read more…

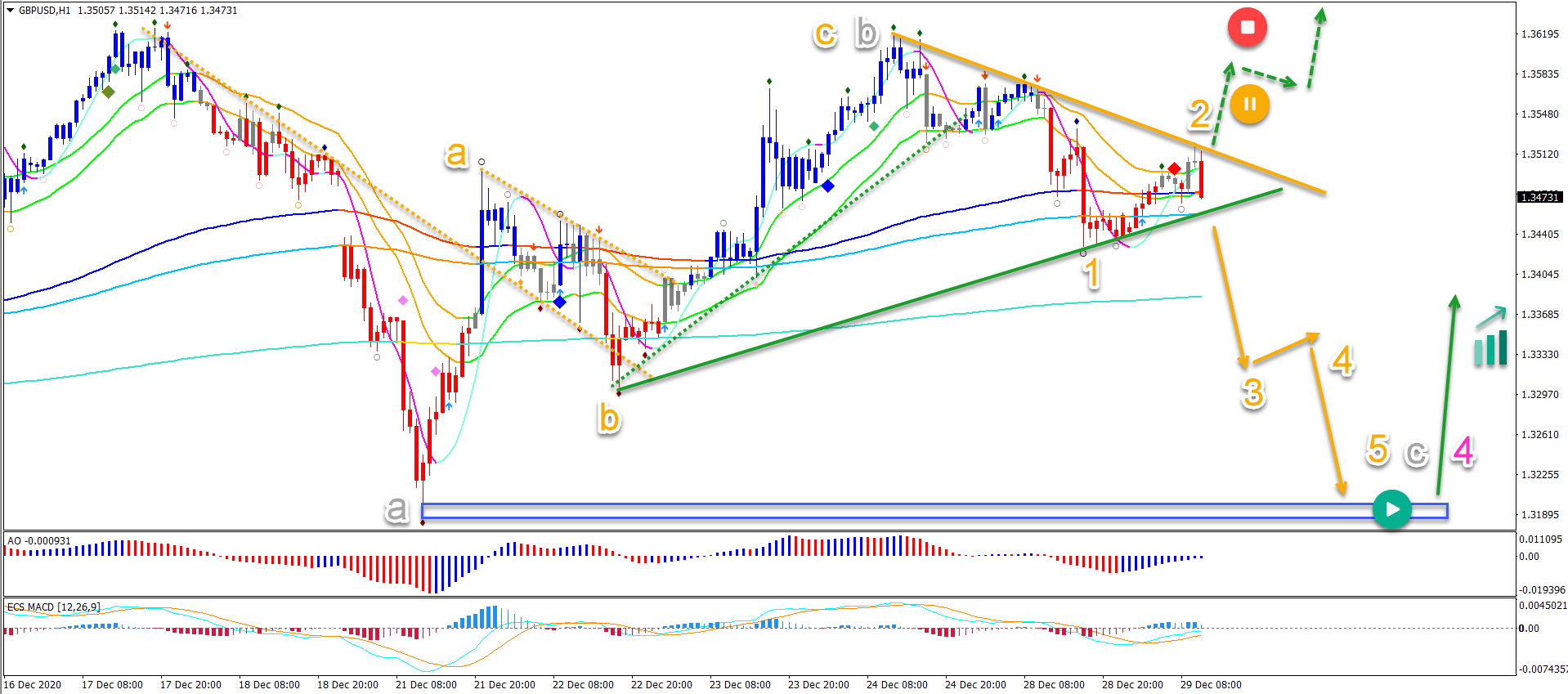

GBP/USD roller coaster part of wave 4 pullback in uptrend

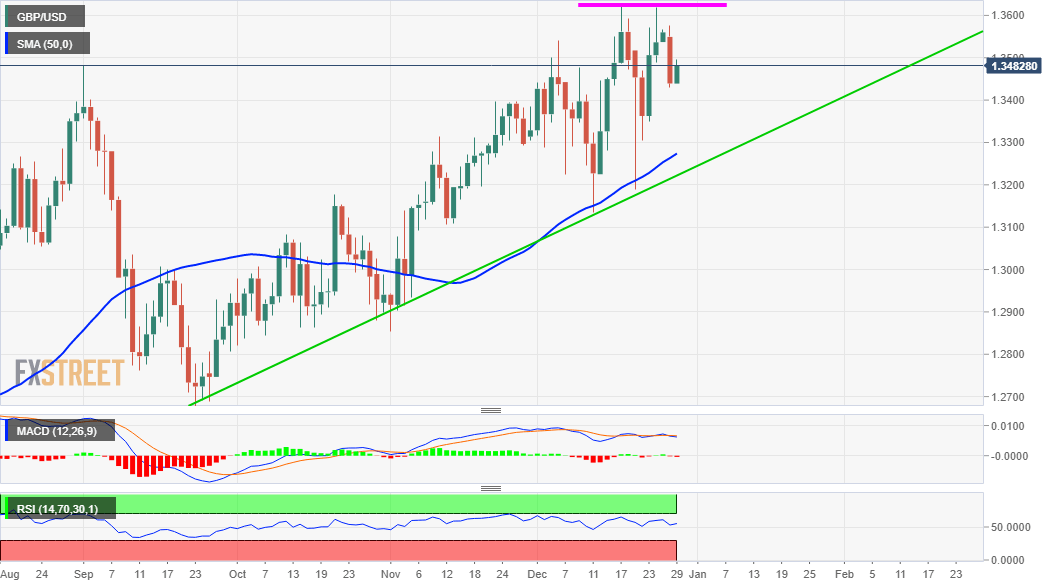

The GBP/USD is creating an increased price volatility between 1.3205 support and 1.35 resistance zones. That said, price action remains in a solid uptrend when comparing the moving averages (21 ema above 144 ema above 610).

The GBP/USD is building a bullish 5 wave pattern (purple) after a long-term downtrend. The wave 5 could complete a larger wave A (blue) of an ABC (blue). Read more…

GBP/USD climbs further beyond 1.3500 mark, fresh session tops

The GBP/USD pair added to its intraday gains and climbed further beyond the key 1.3500 psychological mark during the early part of the European session.

Following the previous session’s sharp intraday pullback of around 150 pips, the pair caught some fresh bids on Tuesday and was being supported by the emergence of some fresh US dollar selling. The already upbeat market mood got an additional boost after the lawmakers pushed forward with an enhanced COVID-19 relief package. Read more…