Products You May Like

6 PM curfew and Virginia National Guard called in

The US dollar has dipped modestly as chaos continues in Washington and specifically and and around the US Capitol. There will be a 6 PM curfew and the US National Guard of Virginia have been mobilized.

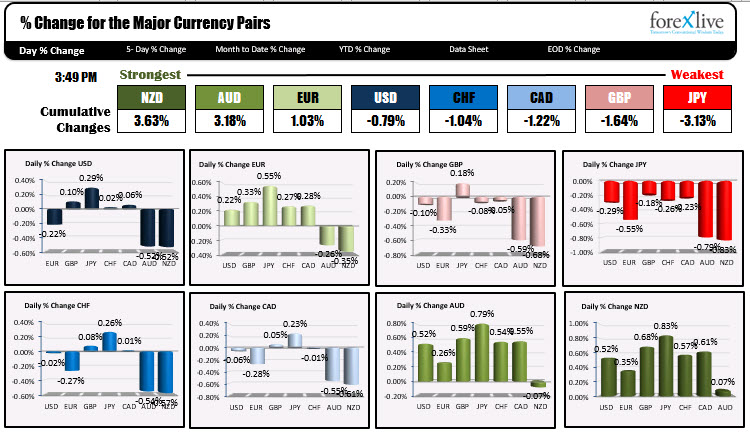

Looking at the strongest to weakest rankings of the major currencies is showing the NZD is the strongest and the JPY is the weakest. The USD has mixed on the day (off the highs) with modest gains vs. the JPY, GBP, CAD and CHF, and declines vs the NZD, AUD, and EUR.

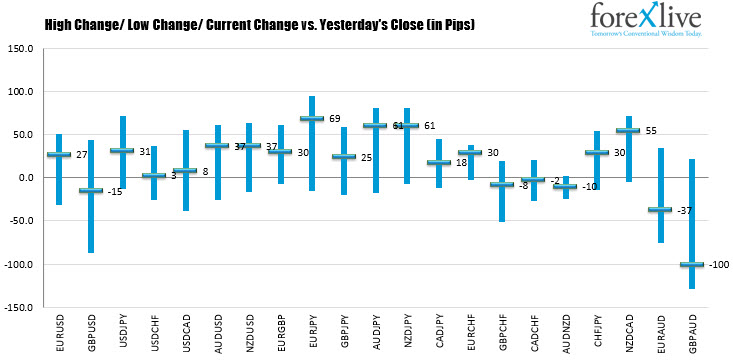

Looking at the changes, the biggest moves from a pip standpoint is 37 pips higher in the AUDUSD and the NZDUSD. The USDJPY is also higher by 31 pips, but off the high for the day.

In other markets,

- The price of gold has moved off session lows of $1900.88, and is trading at $1919.21.

- Silver is trading at $27.27. That is off its low price of $26.60 earlier today

- WTI crude oil futures trading up $0.45 or 0.90% $50.39

in the US stock market, the major indices remain mixed with funds flowing into the Dow 30 stocks.

- Dow is trading up 446 points or 1.46% at 30833

- S&P index is up 21.39 points or 0.57% at 3748

- NASDAQ index is down about -80 points or -0.62% and 12739

US yields are off there highest levels but still sharply up on the day:

- 2 year 0.138%, +1.7 basis points

- 5 year 0.424%, +4.7 basis points

- 10 year 1.030%, +7.5 basis points

- 30 year 1.805%, +9.7 basis points

looking at some individual currency pairs:

- EURUSD: The EURUSD has extended back above the ceiling level from last week and earlier this week at 1.23093. That ceiling was broken in the Asian session and again in the London session. The recent fall in the US dollar taken the price back above the old ceiling as the ups and downs continuing the pair. The high price from earlier today reached 1.23488. That is the next upside target. Above that is a topside trend line on the daily chart which cuts across near 1.2371.

- USDJPY: The USDJPY fell back below its 100 hour moving average at 103.00 on its way to a New York session low of 102.937. The price has since bounced back to just above the 100 hour moving average at 103.023. The 100 hour moving average will be the barometer for both the buyers and sellers as we head toward the new trading day. On the topside, the 50% retracement of the range since December 28 comes in at 103.239 and the 200 hour moving average comes in at 103.275.

- GBPUSD: The GBPUSD still sits between its 100 hour moving average above at 1.36239 and its 200 hour moving average below 1.35746. The current price trades at 1.3611. Traders will be using those levels as parameters for bulls and bears. Move above the 100 hour moving average is more bullish. Move below the 200 hour moving average is more bearish. Stay between and the buyers and sellers continue the battle.