Products You May Like

USD/JPY extends its good form this week to touch 104.00

Higher yields continue to fuel gains in the pair (and yen crosses in general) this week, with price now hitting 104.00 for the first time since 15 December.

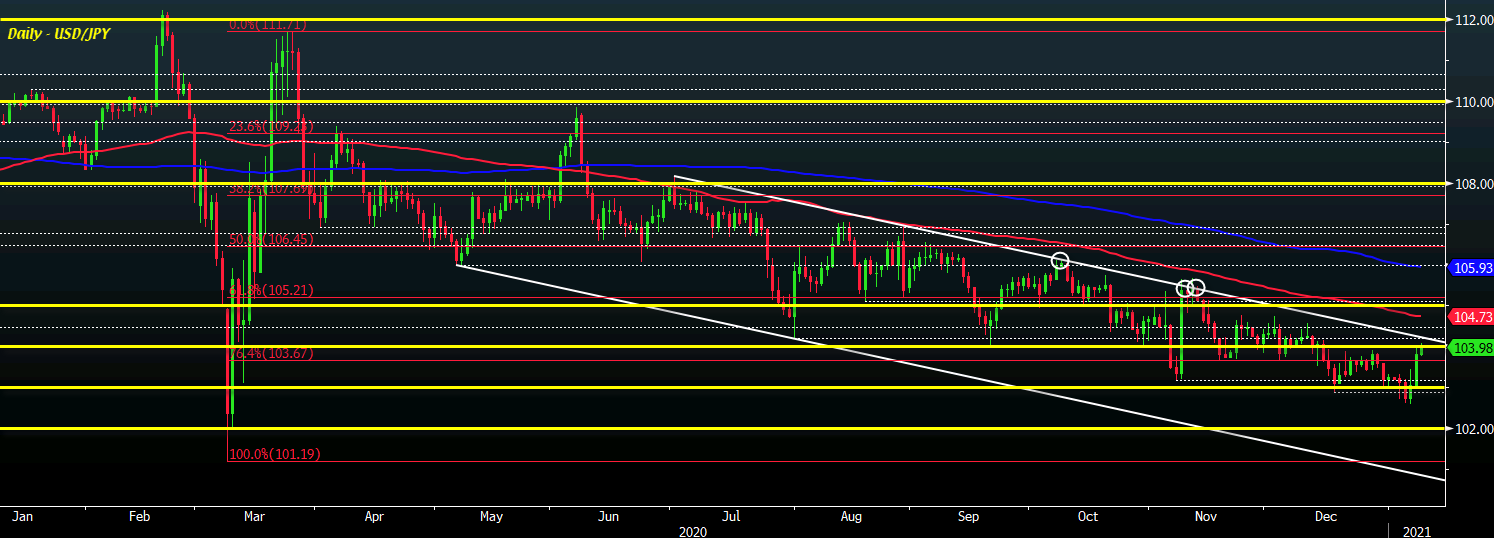

While the push higher this week has been encouraging for buyers, this is where the hard part truly begins. On the one hand, price is moving closer towards the key trendline resistance from the middle of last year @ 104.21.

Adding to that is despite the breakout in 10-year Treasury yields above 1%, there is a lack of interest in short-term yields i.e. 2-year to follow that up.

In turn, that may very well serve to limit any real upside momentum in USD/JPY – at least for a prolonged period – unless the Fed switches up its narrative and short-term yields also follow with a significant move higher some time this year.

For now, resistance around 104.00-21 will be key to watch before getting to the 100-day moving average (red line) @ 104.73. The latter is a level that USD/JPY buyers has struggled to breach since June last year, so that adds to the challenge ahead.