Products You May Like

NZDUSD is the biggest gainer today

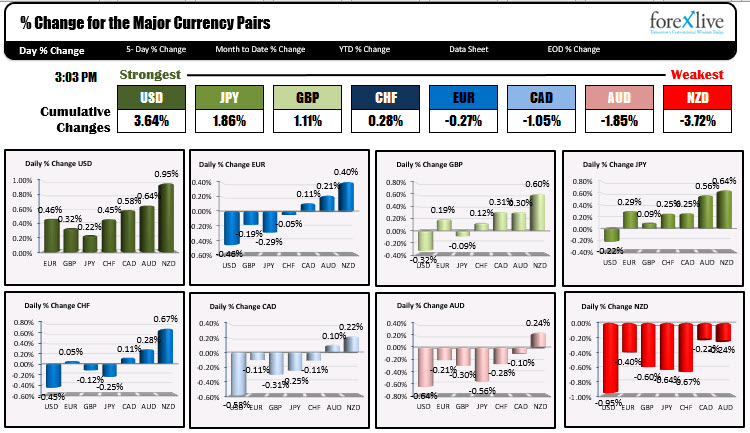

The USD is higher today, but is trading off it’s highest levels of the day. The greenback is the highest vs the NZD (+0.95%), the AUD (+0.64%) and the CAD (+0.58%). It is up the least vs the JPY today at 0.22%.

At the high today, the dollar index traded at the highest level since December 21 – just above the high from December 22.

Looking at the hourly chart of the US dollar index, the index based on Friday right at the 100 hour MA (blue line). That helped to push the index higher. Today, that momentum higher continued.

Having said that, the rise off the January 6 low at 89.209 is still modest. The index reached the lowest level since April 2018 at the lows. The 100 day MA is up at 92.319 (blue line in the chart above). The 38.2% of the move down from the March 2020 high is up at 94.469. In other words, the rebound is still very modest for the greenback.

Drilling to the hourly chart below, the good news for the bulls/dip buyers is that the index price based at the 100 hour MA (blue line on the chart below) on Friday, and broke higher and away from that MA and the 200 hour MA as well (both are at 89.83 currently).

If the price can stay above each of those MAs going forward (they are starting to move higher too), the upside has more room to roam. The high from December 21 at 91.08 and the 38.2% of the move down from the November 4 high comes in at 91.155. Those are the next targets (and minimum targets to get to and through) if the buyers are to take more control.