Products You May Like

The test of buyers’ appetite is just beginning for USD/JPY

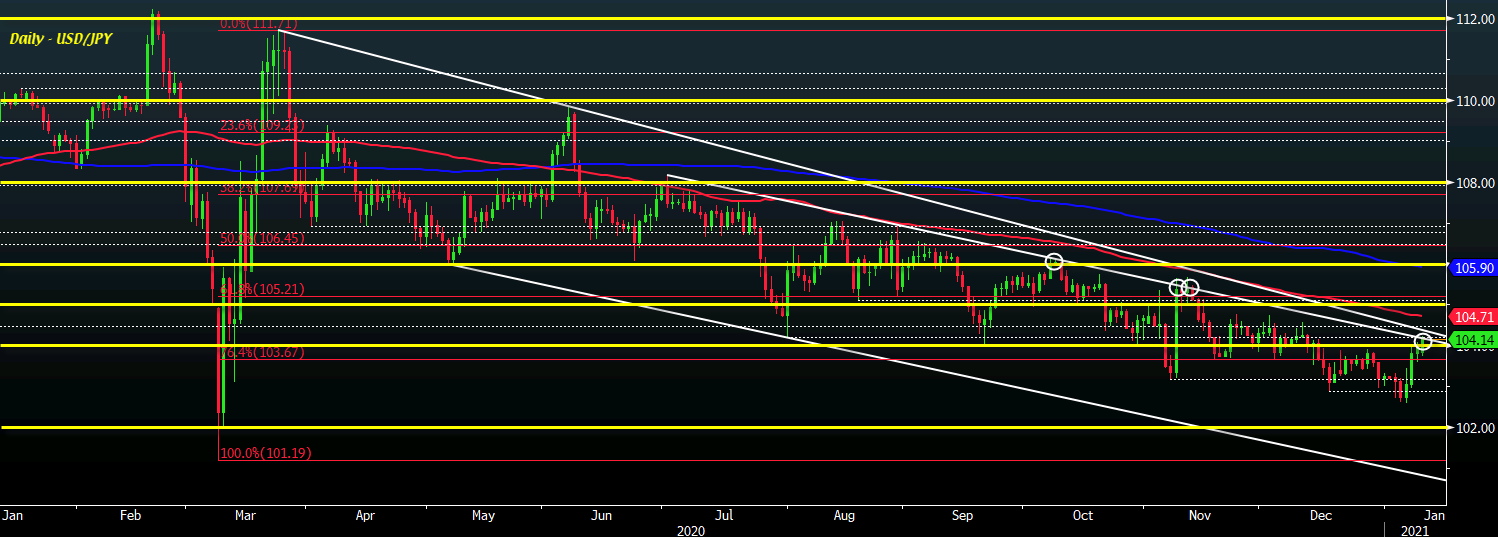

The pair is up to its highest levels in nearly a month above 104.00 as the dollar keeps more bid ahead of European trading today. Of note, price is running into a key resistance trendline since the middle of last year – now seen @ 104.18.

That has helped to limit gains in the pair throughout the second-half of last year and will be a key level to watch in case buyers try to establish further upside momentum.

Just above that, there is also another key trendline resistance stretching back to the March highs last year and that is seen @ 104.38 at the moment.

As such, the region between 104.18-38 will be the key spot that buyers need to break above now in order to chase further upside in the pair amid the breakout in yields.

Adding to the resistance layer nearby is the 100-day moving average (red line) @ 104.71.

The level has helped to limit buyers’ momentum since June last year and I would argue that it is the key technical level to watch if there is to be a stronger upside break in the pair towards 105.00 and perhaps the 200-day moving average (blue line) next.

However, I’m still not all too convinced about how sustainable this move can be. In the case of USD/JPY, the rise in long-end yields is surely an impetus to move higher. However, if short-end yields don’t follow through, gravity may weigh on the pair eventually.