Products You May Like

The forex markets are generally staying in tight range in Asian session today. Dollar is mildly higher even though Fed chair Jerome Powell further talked down stimulus removal. Yen is also strengthening while commodity currencies turn slightly softer. For the week, Sterling remains the strongest one, followed by Canadian. Euro is the worst performing. Selloff in Euro could extend further before weekly close.

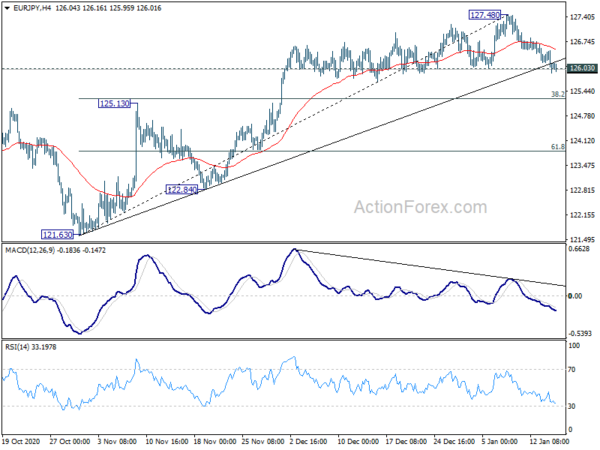

Technically, EUR/JPY’s breach of 126.03 support and trend line support should confirm near term topping. Deeper fall would be seen to 125.13 resistance turned support. EUR/GBP is eyeing 0.8861 support. Decisive break there will extend the pattern from 0.9499 high through 0.8670 support.

In Asia, currently, Nikkei is down -0.53%. Hong Kong HSI is down -0.41%. China Shanghai SSE is down -0.68%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is down -0.0011 at 0.032. Overnight, DOW dropped -0.22%. S&P 500 dropped -0.38%. NASDAQ dropped -0.12%. 10-year yield rose 0.041 to 1.129.

Fed Powell: Not is not the time to talk about stimulus exit

Fed chair Jerome Powell said yesterday that “now is not the time to be talking about exit” from the asset purchase program. He added, “another lesson of the global financial crisis, is be careful not to exit too early.”

“We’ll let the world know. We’ll communicate very clearly to the public and we’ll do so, by the way, well in advance of active consideration of beginning a gradual taper of asset purchases,” he added. “That wouldn’t be a reason to raise interest rates unless we see troubling inflation or other imbalances that could threaten achievement of our mandate.”

On the outlook, Powell said, “we’ve got to get through this very difficult period this winter with the spread of COVID, but as the vaccines go out and we get COVID under control, there’s a lot of reason to be optimistic.”

Biden outlined USD 1.9T package, DOW shrugged and ended slightly lower

US President-Elect Joe Biden outlined his USD 1.9T fiscal package a the remarks from Delaware overnight. The package include USD 1T in direct relief to households, with stimulus checks for USD 1400 on top of the USD 600 checks in last congressional stimulus. USD 440B will be used for small business and communities. USD 415B will be used on virus responses and vaccine rollouts.

Stock markets had very little reactions. DOW traded in very tight range and closed down -0.22%, or -68.95 pts, at 30991.52. There is no change in the near term bullish outlook with 29881.82 support intact. We’re expecting another rise, sooner or later, to 61.8% projection of 18213.65 to 29199..35 from 26143.77 at 32932.93.

On the data front

Japan tertiary industry index dropped -0.7% mom in November, versus expectation of 0.3% mom. In European session, UK GDP, production and trade balance will be featured. Eurozone will release trade balance too. Later in the day, US will release retail sales, PPI, industrial production, business inventories and U of Michigan consumer sentiment.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 125.88; (P) 126.20; (R1) 126.48; More….

EUR/JPY’s breach of 126.03, and break of trend line support, indicates short term topping at 127.48. Intraday bias is back not the downside. Deeper fall would be seen to 38.2% retracement of 121.63 to 127.48 at 125.24. On the upside, break of 127.48 high is now needed to confirm rise resumption. Otherwise, rise will stay on the downside in case of recovery.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 121.63 support holds. Decisive break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67. Sustained trading above there will target 137.49 next. However, firm break of 121.63 will argue that the rise from 114.42 has completed and turn focus back to this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 4:30 | JPY | Tertiary Industry Index M/M Nov | -0.70% | 0.30% | 1.00% | |

| 7:00 | GBP | GDP M/M Nov | -4.00% | 0.40% | ||

| 7:00 | GBP | Index of Services (3M/3M) Nov | 2.50% | 9.70% | ||

| 7:00 | GBP | Manufacturing Production M/M Nov | 0.70% | 1.70% | ||

| 7:00 | GBP | Manufacturing Production Y/Y Nov | -5.20% | -7.10% | ||

| 7:00 | GBP | Industrial Production M/M Nov | 0.40% | 1.30% | ||

| 7:00 | GBP | Industrial Production Y/Y Nov | -4.30% | -5.50% | ||

| 7:00 | GBP | Goods Trade Balance (GBP) Nov | -11.1B | -12.0B | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | 22.3B | 25.9B | ||

| 13:30 | GBP | NIESR GDP Estimate Dec | 1.50% | |||

| 13:30 | USD | Empire State Manufacturing Index Jan | 5.7 | 4.9 | ||

| 13:30 | USD | Retail Sales M/M Dec | 0.00% | -1.10% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Dec | -0.10% | -0.90% | ||

| 13:30 | USD | PPI M/M Dec | 0.30% | 0.10% | ||

| 13:30 | USD | PPI Y/Y Dec | 0.80% | 0.80% | ||

| 13:30 | USD | PPI Core M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | PPI Core Y/Y Dec | 1.30% | 1.40% | ||

| 14:15 | USD | Industrial Production M/M Dec | 0.40% | 0.40% | ||

| 14:15 | USD | Capacity Utilization Dec | 73.50% | 73.30% | ||

| 15:00 | USD | Michigan Consumer Sentiment Jan P | 79.2 | 80.7 | ||

| 15:00 | USD | Business Inventories Nov | 0.40% | 0.70% |