Products You May Like

Canadian Dollar is a main focus today with BoC rate decision featured. Recent strong risk-on markets haven’t given the Loonie much lift. It’s upside is somewhat capped as oil price turned into consolidation after last week’s spike. Also, traders turned cautious before BoC’s indication on the chance of a micro rate cut. Elsewhere, Dollar and Yen remain pressured even though Asian markets have turned mixed. Euro is taking a breather after yesterday’s rally.

Technically, firstly, we’re still awaiting a a breakout in USD/JPY from the tight range of 103.51/104.39, to guide the next move in Dollar and Yen pairs. Secondly, 53.92 temporary top in WTI oil is now back in focus after WTI drew support from 4 hour 55 EMA and recovered. Break will resume recent up trend to 100% projection of 40.32 to 49.42 from 47.31 at 56.41, give USD/CAD the needed downside momentum through 1.2623 temporary low.

In Asia, currently, Nikkei is down -0.67%. Hong Kong HSI is up 0.26%. China Shanghai SSE is up 0.01%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is down -0.008 at 0.039. Overnight, DOW rose 0.38%. S&P 500 rose 0.81%. NASDAQ rose 1.53%. 10-year yield dropped -0.005 to 1.092.

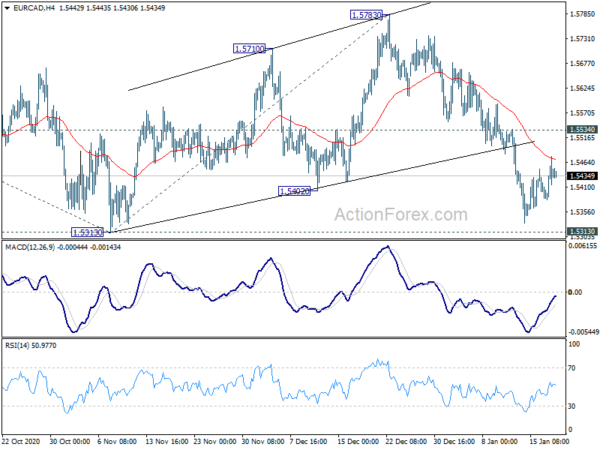

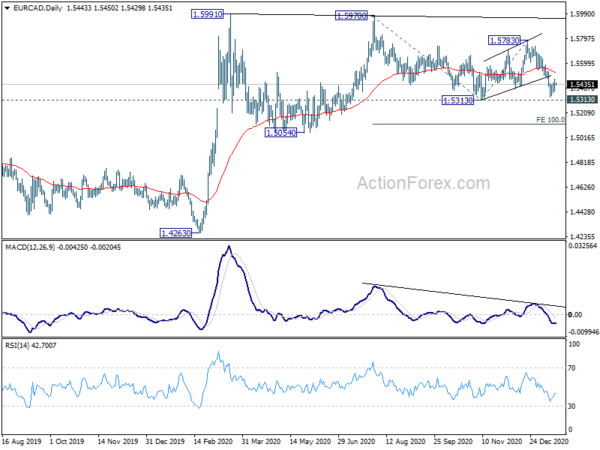

EUR/CAD in recovery ahead of BoC, downside breakout still expected

BoC rate decision is a major focus today. It’s widely expected to keep overnight rate unchanged at 0.25%. The size of the asset purchase program will also be held at CAD 4B per week. Focuses will be on Governor Tiff Macklem’s guidance on the chance of a “micro rate cut” ahead. That is, lowering interest rate to a new effective lower bound, while keeping it positive. Also, BoC will release new economic projections.

Here some some previews:

Canadian Dollar is outperformed by European majors this week so far. EUR/CAD’s decline halted ahead of 1.5313 support and recovered. Though, the structure suggests that it’s merely a corrective rise, which is in line with our bearish view. We’d expect the recovery to be limited by 1.5534 resistance to bring decline resumption sooner or later. Firm break of 1.5313 will resume whole fall from 1.5978 to 100% projection of 1.5978 to 1.5313 from 1.5783 at 1.5118.

Yellen: The world has changed, defeating the pandemic is the most important thing

US stocks closed higher overnight after Treasury secretary nominee Janet Yellen’s Senate confirmation hearing. “The world has changed,” she said. “In a very low interest-rate environment like we’re in, what we’re seeing is that even though the amount of debt relative to the economy has gone up, the interest burden hasn’t.”

She gave a strong node to President-elect Joe Biden’s fiscal package, to be unveiled next month. “The most important thing we can do is to defeat the pandemic, to provide relief to American people and to make long-term investments that make the economy grow and benefit future generations,” said Yellen.

Yellen described China as the most important strategic competitor with its “abusive, unfair and illegal practices.” She also said China is “guilty of horrendous human rights abuses” in response to a question on whether China had committed “genocide” in treating of Uyghurs.

In a last-minute proclamation, outgoing Secretary of State Mike Pompeo determined China “has committed genocide against the predominantly Muslim Uyghurs and other ethnic and religious minority groups in Xinjiang”, and “this genocide is ongoing”. Biden’s nominee for Secretary of State Antony Blinken also said in his confirmation hearing, “The forcing of men, women and children into concentration camps; trying to, in effect, re-educate them to be adherents to the ideology of the Chinese Communist Party, all of that speaks to an effort to commit genocide.”

BoE Haldane: Recovery probably at rate of knots from Q2

BoE Chief Economist Andy Haldane said current tougher lockdown restrictions are threatening to bring the UK economy into a double-dip recession. That next slump could be “shorter, sharper shock” than the last one in 2007. Though, unemployment could be capped as long as Chancellor of the Exchequer Rishi Sunak maintains the furlough wage subsidies until the economy has recovered to with 5-10% of pre-pandemic level. Current tighter

Also, “if we get that recovery that I expect to start coming on stream, probably at the rate of knots from the second quarter, that will hopefully then eat away and improve the prospects of reemploying those million people who have lost their jobs”, Haldane added. “Ultimately there’s a timing question — timing the end of the furlough scheme in such a way that the economy is recovered sufficiently to prevent any losses of jobs.”

Australia Westpac consumer sentiment dropped -4.5%, still healthy

Australia Westpac Consumer Sentiment dropped -4.5% to 107 in January, down from 112.0. The fall came in where there was domestic border closures, emergence of coronavirus clusters in some states and the sharp upswing in infections globally. Overall, “it still points to healthy consumer sentiment”.

Regarding RBA’s next meeting on February 2, Westpac said the board “seems almost certain to maintain its current policy stance”. The central bank decided in November the intention to purchase AUD 100B in government and semi-government bonds. Markets would be interested in any guidance in respect to the program, which is set to end at the end of April. Westpac expects a second program of AUD 100B afterwards.

Looking ahead

Germany will release PPI in European session while Eurozone will release CPI final. UK will also release inflation data including CPI, RPI and PPI. Later in the day, in addition to BoC rate decision, Canada will release CPI. US will release NAHB housing index.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7672; (P) 0.7699; (R1) 0.7724; More…

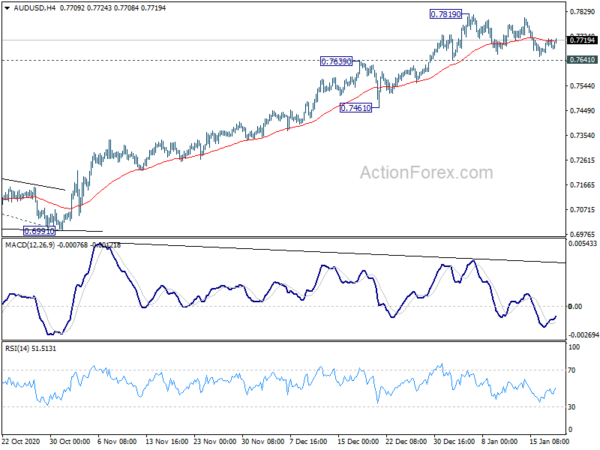

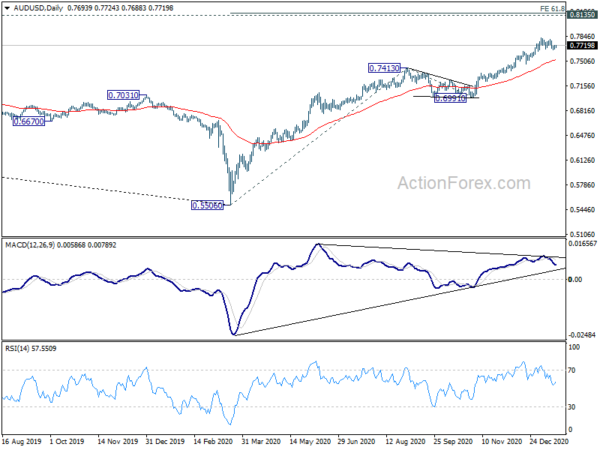

AUD/USD is staying in consolidation from 0.7819 and intraday bias remains neutral for the moment. As long as 0.7641 support holds, further rally is expected. On the upside, break of 0.7819 will resume larger up trend form 0.5506 to 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170. However, break of 0.7641 will indicate short term topping, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned back to the downside for deeper correction to 0.7461 support.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Jan | -4.50% | 4.10% | ||

| 07:00 | EUR | Germany PPI M/M Dec | 0.30% | 0.20% | ||

| 07:00 | EUR | Germany PPI Y/Y Dec | -0.30% | -0.50% | ||

| 07:00 | GBP | CPI M/M Dec | 0.30% | -0.10% | ||

| 07:00 | GBP | CPI Y/Y Dec | 0.50% | 0.30% | ||

| 07:00 | GBP | Core CPI Y/Y Dec | 1.30% | 1.10% | ||

| 07:00 | GBP | RPI M/M Dec | 0.60% | -0.30% | ||

| 07:00 | GBP | RPI Y/Y Dec | 1.10% | 0.90% | ||

| 07:00 | GBP | PPI Input M/M Dec | 0.70% | 0.20% | ||

| 07:00 | GBP | PPI Input Y/Y Dec | 1.00% | -0.50% | ||

| 07:00 | GBP | PPI Output M/M Dec | 0.30% | 0.20% | ||

| 07:00 | GBP | PPI Output Y/Y Dec | -0.60% | -0.80% | ||

| 07:00 | GBP | PPI Core Output M/M Dec | 0.00% | |||

| 07:00 | GBP | PPI Core Output Y/Y Dec | 0.90% | |||

| 09:30 | GBP | DCLG House Price Index Y/Y Nov | 5.80% | 5.40% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | -0.30% | -0.30% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 0.20% | 0.20% | ||

| 13:30 | CAD | CPI M/M Dec | 0.00% | 0.10% | ||

| 13:30 | CAD | CPI Y/Y Dec | 1.00% | 1.00% | ||

| 13:30 | CAD | CPI Common Y/Y Dec | 1.50% | 1.50% | ||

| 13:30 | CAD | CPI Median Y/Y Dec | 1.90% | 1.90% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 1.90% | 1.90% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 86 | 86 | ||

| 15:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 16:15 | CAD | BoC Press Conference |