Products You May Like

Global macro outshines domestic macro

The top two items on the Canadian dollar agenda this week were the retail sales report and the Bank of Canada.

The retail sales numbers today were up 1.3%, crushing the flat estimate. Ex-autos were +2.1% versus the +0.3% consensus. December advance numbers took the shine off but that’s a great report.

Leading into the Bank of Canada decision there was (misguided) talk of a micro rate cut but the BOC wasn’t dovish in any way. Instead Macklem boosted growth forecasts and even talked about tapering.

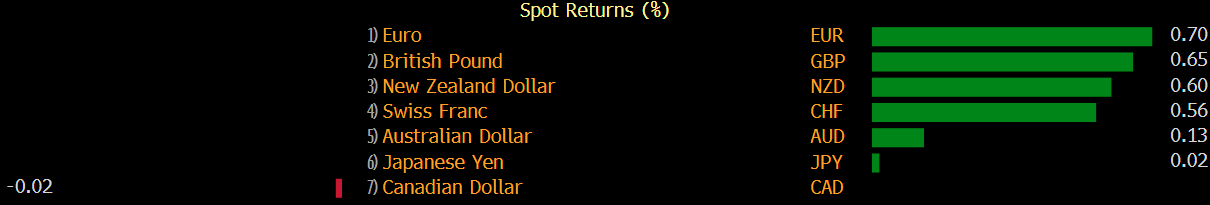

The BOC initially gave the loonie a big boost and it kicked a bit higher on retail sales as well but the overall performance of CAD this week puts it at the bottom of the G10 pile, narrowly behind USD.

To be fair, all those moves are small but it’s a reminder that domestic fundamentals are often trumped by global macro and the broader mood in the market.

Also dragging was the announcement about the Keystone XL pipeline. I don’t see how anyone could have been surprised by that and shares of TC Energy (the pipeline owner) are up on the week so that says it all. Still, it’s not a great sign that Biden values his relationships with Canada.

In the bigger picture, this week is a blip. There’s a solid downtrend in the pair and oil is the thing to watch. We also get into a heavier earnings schedule next week and equities will be a factor.