Products You May Like

As European stocks turned south after initial trading, US futures also also dragged down. Overall market sentiments turned mixed after a bright start in Asia. Dollar is recovering mildly but commodity currencies remain the strongest one so far, as led by New Zealand Dollar. There is apparently some pressure on European majors after German Ifo business climate dropped to 6-month low. The current around of tough restrictions is generally expected to drag European economics to a double dip recession But of course, selloff in stocks and European majors is not deep for now. Vaccine roll-outs are the basis for optimism of a back-to-normal second half.

Technically, most major pairs and crosses are bounded inside Friday’s range, except a few Kiwi pairs. Recovers in EUR/USD, EUR/GBP and EUR/AUD are all losing momentum. We might see retest of 1.0252, 0.8828, and 1.5591 lows respectively, if selloff intensifies.

In Europe, currently, FTSE is down -0.89%. DAX is down -1.22%. CAC is down -1.10%. German 10-year yield is down -0.028 at -0.538. Earlier in Asia, Nikkei rose 0.67%. Hong Kong HSI rose 2.41%. Singapore Strait Times rose 0.48%. Singapore Strait Times dropped -0.60%. Japan 10-year JGB yield dropped -0.0036 to 0.039.

ECB Lagarde and Panetta discussed climate-related monetary policy

ECB President Christine Lagarde said the central bank was creating a team of around 10 staff, reporting directly to her, to set the agenda on climate-related topics. “Climate change can create short-term volatility in output and inflation through extreme weather events, and if left unaddressed can have long-lasting effects on growth and inflation,” Lagarde noted.

Executive Board member Fabio Panetta also said, ECB has already taken steps on contributing to environmental policies in the implementation of monetary policy. For example, “sustainable finance instruments – the sustainability-linked bonds – among the collateral that can be used in refinancing operations” were included.

Additionally, “the ECB has to protect its balance sheet from the financial risks caused by climate change that are not correctly priced by the markets,” Panetta added. “By performing its own analysis of these risks on the basis of rigorous methodologies, the ECB can contribute to the accurate valuation of these climate-related risks and promote awareness among investors, thereby helping to combat climate change. These issues are currently being considered as part of our monetary policy strategy review.

German Ifo business climate dropped to 90.1, second wave brought recovery to a halt

Germany Ifo business climate dropped to 90.1 in January, down from 92.2, below expectation of 92.0. Current assessment index dropped to 89.2, down from 91.3, missed expectation of 90.7. Expectations index dropped to 91.1, down from 93.0, below expectation of 93.2.

Looking at the sectors, manufacturing index dropped from 9.1. to 8.8, first decline after eight straight rises. Services dropped from -0.4 to -4.4. Trade nose-dived sharply from 0.3 to -17.2, steepest fall since April 2020. Construction dropped from -0.8 to -5.1.

Clemens Fuest, President of the ifo Institute: “The second wave of coronavirus has brought the recovery of the German economy to a halt for now.”

BoJ Kuroda: Most important policy now is to avoid unemployment and corporate failures

BoJ Governor Haruhiko Kuroda said at a WEF virtual meeting “the resurgence of COVID-19 and the state of emergency declaration by the government just a few weeks ago would tend to dampen economic recovery” of Japan. “In this kind of situation, the most important policy is to … avoid unemployment and corporate failures and so forth,” he added.

The government has “already implemented huge amount of fiscal support”. At the same time, BoJ provided liquidity to the banking sector and tried to “stabilize the financial markets”. Both policies have been “fairly successful in stabilizing the markets, avoiding corporate failures, maintaining employment”.

But, “we have to overcome, contain this pandemic”, through vaccination and creation of immunity. That is the “challenge still faced by Japan”.

Australia goods exports jumped 16% in Dec, imports dropped -9%

According to preliminary data, Australia’s export of goods rose 16% mom to AUD 34.9B. Imports of goods dropped -9% mom to AUD 26.0B. There was a goods trade surplus of AUD 9.0B.

Exports to China jumped 21% to AUD 2312m, to Japan rose 24% to AUD 864m, to US rose 58% to AUSD 678m, to India rose 35% to AUD 339m, to South Korea dropped -14% to AUD 317m.

Imports from China dropped -7% to AUD 641m, from US dropped -33% to AUD 1274m, from Germany dropped -10% to AUD 127m, from Japan rose 6% to 95m, from Thailand rose 8% to AUD 101m.

“Imports have fallen following a November spike to be more in line with recent history”, said ABS Head of International Statistics, Katie Hutt, “while exports of metalliferous ores and cereals are the strongest in history, resulting in the fourth highest goods trade surplus on record”.

EUR/USD Mid-Day Outlook

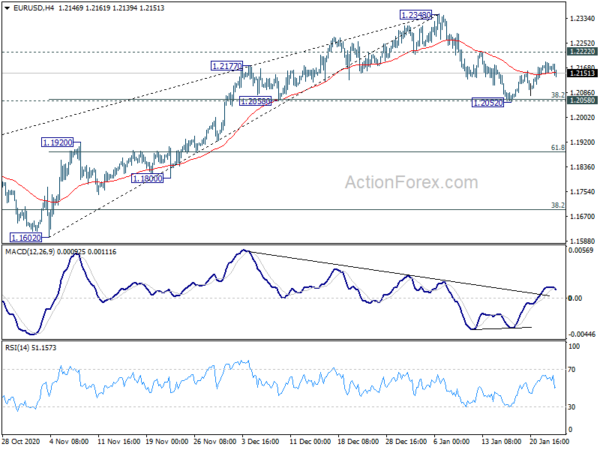

Daily Pivots: (S1) 1.2152; (P) 1.2171; (R1) 1.2190; More…

Intraday bias in EUR/USD is turned neutral with 4 hour MACD crossed below signal line. On the upside, break of 1.2222 minor resistance will extend the rebound form 1.2052 to retest 1.2348 high. On the downside, however, firm break of 1.2052 support will extend the correction from 1.2348. Intraday bias will be turned back to the downside for 61.8% retracement of 1.1602 to 1.2348 at 1.1887.

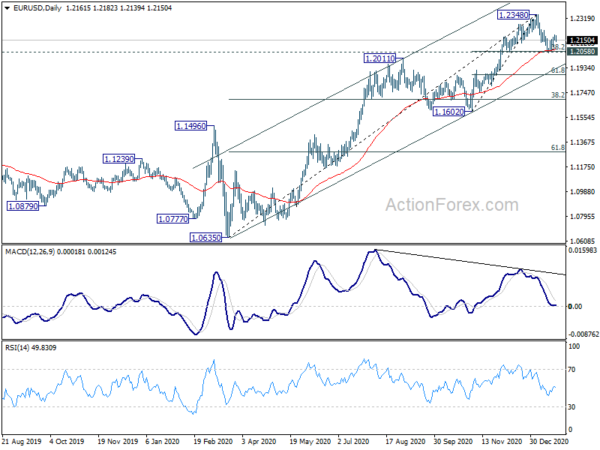

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Germany IFO Business Climate Jan | 90.1 | 92 | 92.1 | 92.2 |

| 09:00 | EUR | Germany IFO Current Assessment Jan | 89.2 | 90.7 | 91.3 | |

| 09:00 | EUR | Germany IFO Expectations Jan | 91.1 | 93.2 | 92.8 | 93 |