Products You May Like

German DAX falls slightly breaking the 4 day win streak. Italy and Spain have risen for 5 consecutive days

The European shares are ending the session with mixed results. Italy and Spain led the way today and in this week. Each of their indices increased every day this week.

A look at the provisional closes shows:

- German DAX, -0.06%. That’s the 1st decline this week

- France’s CAC, +0.82%

- UK’s FTSE 100, -0.12%

- Spain’s Ibex, +1.0%

- Italy’s FTSE MIB, +0.7%

For the week provisional closes shows:

- German DAX, +4.6%

- France’s CAC, +4.6%

- UK’s FTSE 100, +1.4%

- Spain’s Ibex, +5.7%

- Italy’s FTSE MIB, +7%

In other markets as European traders prepare to exit for the weekend shows:

- spot gold is rebounding today at up $16.14 or 0.90% to $1810.24. The contract is just off the high price of $1811.38. The low price extended to $1792.19.

- Spot silver is trading up $0.53 or 2.0% at $26.88. It’s high price reached $26.93. It’s low price extended to $26.20

- WTI crude oil futures are trading up $0.66 or 1.17% $56.90. The high price has reached $57.29. The low price has extended to $56.43

- Bitcoin is trading up $220 or 0.58% at $37892

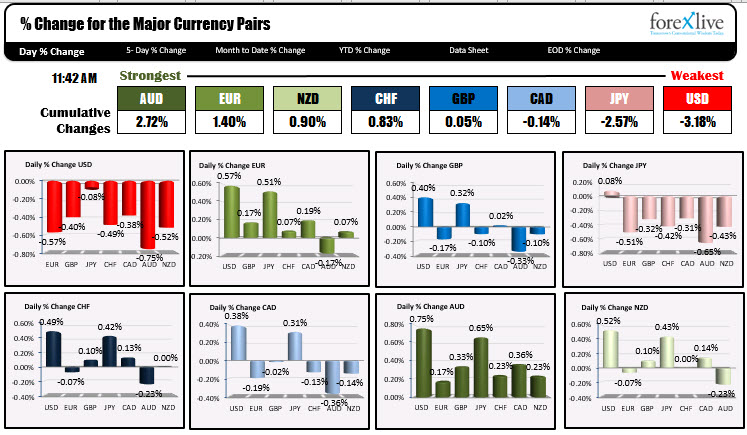

In the forex, the AUD remains the strongest of the major currencies, while the USD has taken over as the weakest of the majors. At the start of the New York session the US dollar was mixed to modestly lower with gains vs. the JPY and the NZD. That trend has reversed on the back of the weaker employment report.

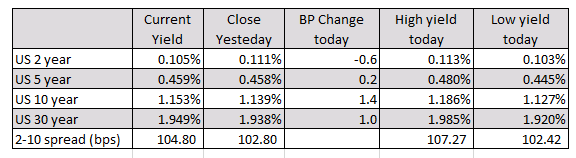

In the US debt market, yields are off the days highest levels, but still higher in the 10 and 30 year sector:

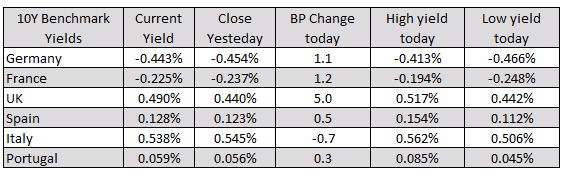

The benchmark 10 year European yields are mostly higher with the UK leading the way at +5.0 basis points. German and French yields remain comfortably below 0.0% which should keep upside in the EURUSD limited (all things being equal). Today’s employment report however as push the EURUSD higher after it dipped below its 100 day moving average for the first time since early November in the Asian session.