Products You May Like

The sell everything mode in the market is dragging gold lower as well

Gold is down 0.7% on the day as price falls below its 30 November low @ $1,764.80, trading to levels last seen since June last year.

With the November low and 50.0 retracement level @ $1,763.51 out of the picture, gold looks primed for a test of $1,700 next with a flush towards $1,670-90 on the cards.

It has been a rough start to the new year for gold with seasonal tailwinds failing to offer much reprieve in January and now this in February trading.

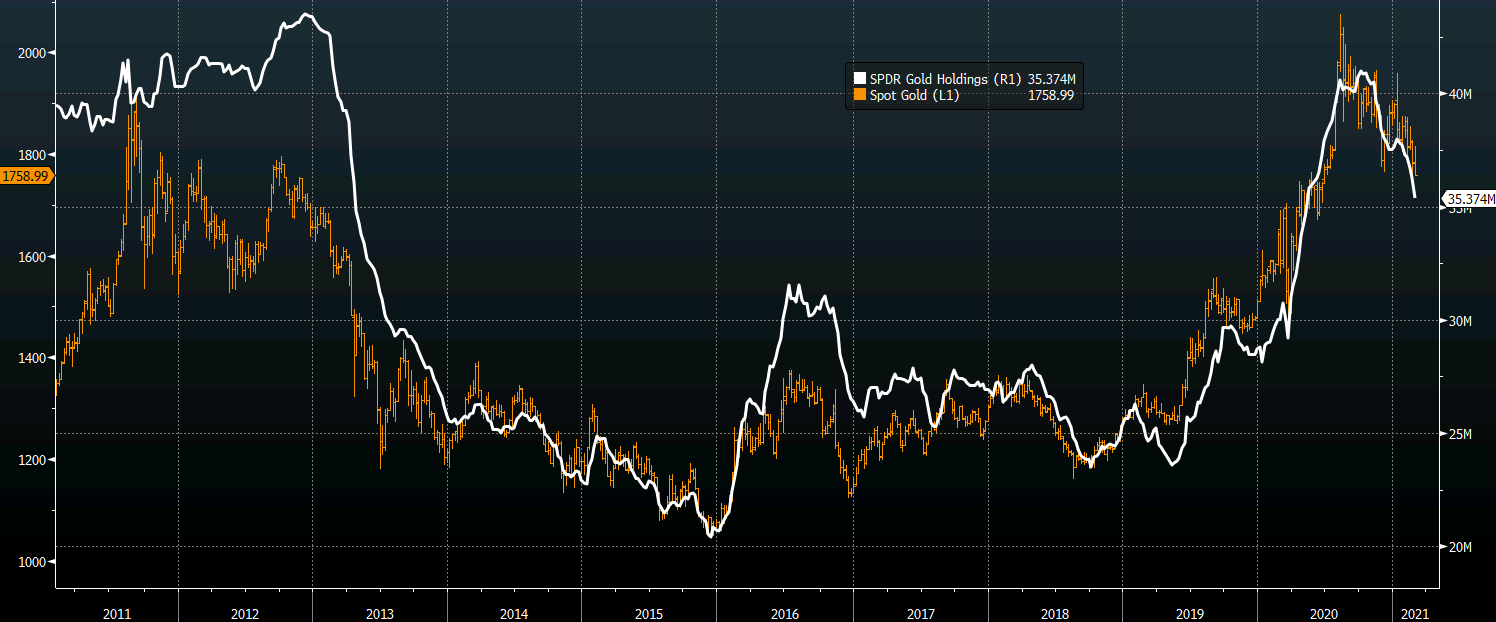

When looking at gold, I continue to look at ETF holdings as the main driver at the moment and the signs are showing that investors are still shedding positions for now:

As long as that continues, the lack of enthusiasm in the yellow metal may see gold tough to find much footing as it is stuck between a rock and a hard place – both from a technical and somewhat fundamental point of view at the moment.

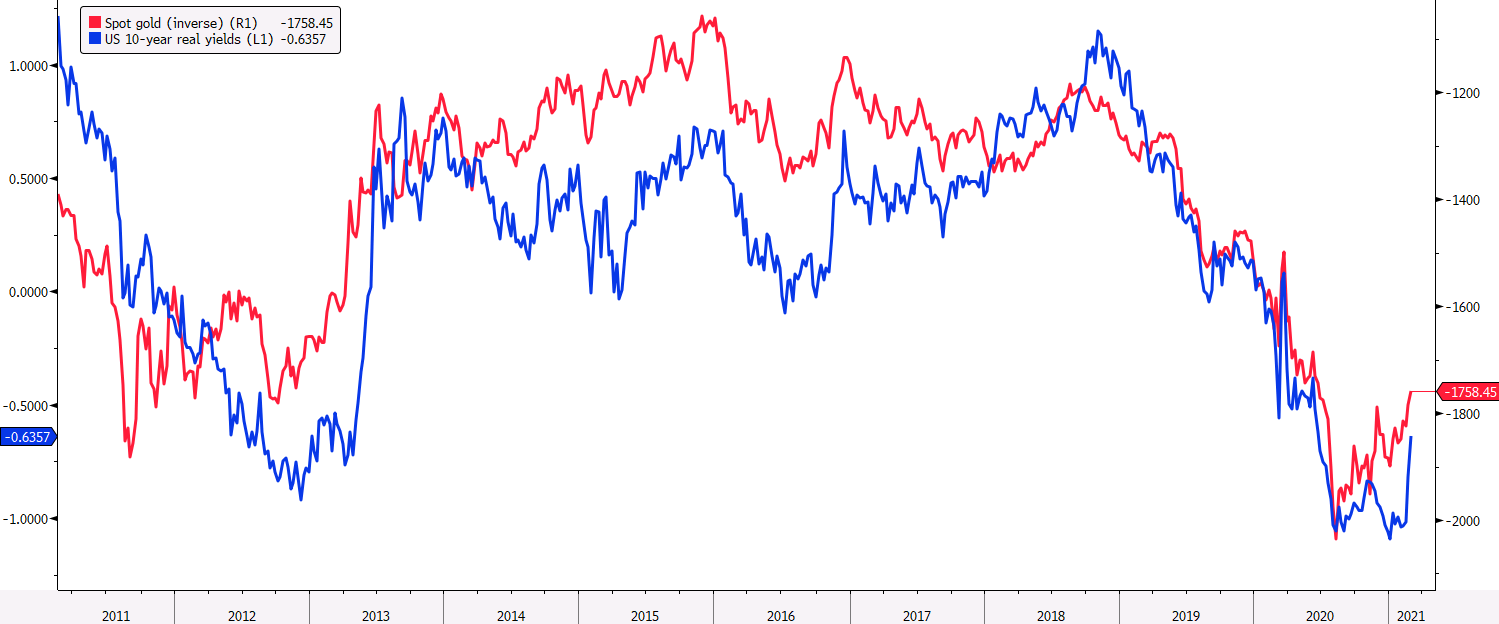

The surge higher in yields this week is another reason that punches gold right in the gut, with real yields in the US having risen by almost 40 bps since the start of the month: