Products You May Like

Commodity currencies and Sterling recover broadly as sentiments in Asian markets stabilized, after mixed economic data. In particular, Nikkei is trading up over 2% at the time of writing, with help from strong PMI manufacturing. On the other hand, Yen turn softer together with Swiss Franc, Dollar and Euro. But majority of major pairs and crosses are bounded inside Friday’s range, suggesting movements are relatively limited.

Technically, commodity Yen crosses will be worth a watch this week. In similar outlook to stock indices, despite deep pull back in AUD/JPY and NZD/JPY last week, there is no clear indication of trend reversal yet. As long as 80.91 support in AUD/JPY and 75.56 support in NZD/JPY holds, we’d still expect the near term up trend to resume sooner rather than later. However, firm break of these levels, in tandem with deeper decline in stocks, could confirm the start of a medium scale correction in risk sentiments.

In Asia, currently, Nikkei is up 2.09%. Hong Kong HSI is up 1.20%. China Shanghai SSE is up 0.52%. Singapore Strait Times is up 0.88%. Japan 10-year JGB yield is down -0.0002 at 0.157.

China Caixin PMI manufacturing dropped to 50.9, inflationary pressure continued to grow

China Caixin PMI Manufacturing dropped to 50.9 in February down from 51.5, missed expectation of 51.5. That’s also the worst reading since last May. Output expanded modestly amid notably softer rise in new work. Pandemic weighed on exports sales and supplier performance. Though, business confidence improved on hopes of global economic recovery in months ahead.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the momentum of the manufacturing recovery further weakened as the supply and demand both rose at a slower clip, adding pressure on employment. The prices of raw materials continued to increase and inflationary pressure continued to grow. Despite the headwinds mentioned above, manufacturers became more optimistic about the outlook for their businesses.”

Released over the weekend, official NBS PMI Manufacturing dropped to 50.6 in February, down from 51.3, below expectation of 51.1. NBS PMI Non-Manufacturing dropped to 51.4, down from 52.4, below expectation of 52.1.

Japan PMI manufacturing finalized at 51.4. Feb, sharp rises in raw materials prices

Japan PMI Manufacturing rose to 51.4 in February, up from 49.8. That’s the strongest reading since December 2018, as manufacturers gradually recovered from the impact of the pandemic. Markit also noted that output and new orders expanded modestly. Input prices rose at fastest pace for two years. Positive sentiments reached strongest since July 2017.

Usamah Bhatti, Economist at IHS Markit, said: “Concern has been building throughout the Japanese manufacturing sector regarding ongoing supply chain disruption, which has induced sharp rises in the prices of raw materials. Cost burdens faced by firms rose at the sharpest pace in two years… Japanese manufacturers continued to report a positive outlook beyond the immediate future… in line with the IHS Markit forecast for industrial production to grow 7.4% in 2021, although this is from a low base.”

Australia AiG manufacturing rose to 58.8 in Feb, input prices surged

Australia AiG Performance of Manufacturing Index rose to 58.8 in February, up from 55.3, hitting the strongest level since March 2018. Input prices jumped above its long-run average (67.4 pts), by 9.7 pts to 74.1, highest since October 2019. Selling prices only rose slightly by 0.4 pts to 51.2.

Looking at other details, production rose 8.9 pts to 65.8. New orders rose 5.3 pts to 59.9. Employment rose 2.7 pts to 57.8. Average wages rose 1.8 to 58.2. But supplier deliveries dropped -2.6 to 53.2. Exports also dropped -7.3 to 54.1.

Ai Group Chief Executive Innes Willox said: “Australia’s manufacturers lifted production and employment in February as sales recovered a large share of the ground lost in 2020. Growth was distributed broadly across manufacturing… Manufacturers are generally positive about the outlook for the next few months with new orders coming in at a greater pace as restrictions on activity and cross-border travel are hopefully wound back.

Also from Australia, TD securities inflation rose 0.1% mom in February. Company gross operating profits dropped -6.6% qoq in Q4.

Employment and prices related data to be the focus

Some activity indicators would catch much attention this week, including US ISMs, China PMIs, Canada PMIs and Australia AiG indices. In particular, both employment and inflation related components of those data will be scrutinized. Fed’s Beige Book will also be watched for the two issues. Additionally, US will release non-farm payrolls and Eurozone will release CPI flash.

RBA rate decision could be a non-event as the central bank will stand pat, and deliver a similar statement to February’s. Australia will also feature GDP and retail sales.

Here are some highlights for the week:

- Monday: Australia AiG manufacturing; Japan PMI manufacturing final; China Caixin PMI manufacturing; Germany CPI; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final, M4 money supply, mortgage approvals; Canada current account; Canada PMI manufacturing; US PMI manufacturing final, ISM manufacturing, construction spending.

- Tuesday; RBA rate decision, Australia building approvals, current account; New Zealand terms of trade index; Japan monetary base, capital spending; Germany retail sales, unemployment; Eurozone CPI flash; Canada GDP.

- Wednesday: Australia GDP, AiG construction; New Zealand building permits; China Caixin PMI services; Swiss CPI; Eurozone PMI services final, PPI; UK PMI services final; US ADP employment, PMI services final, ISM services, Fed’s Beige Book; Canada building permits.

- Thursday: Australia retail sales, trade balance; Japan consumer confidence; ECB monthly bulletin, retail sales, unemployment rate; UK construction PMI; Canada labor productivity; US non-farm productivity, jobless claims, factory orders.

- Friday: Australia AiG services; Germany factory orders, France trade balance; Swiss foreign currency reserves; Canada trade balance, Ivey PMI; US non-farm payrolls, trade balance.

EUR/AUD Daily Outlook

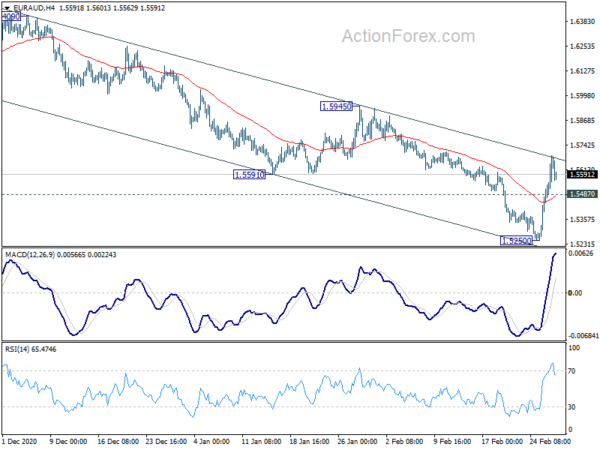

Daily Pivots: (S1) 1.5514; (P) 1.5603; (R1) 1.5760; More…

EUR/AUD’s recovery from 1.5250 short term bottom could extend higher. But still, outlook stays bearish as long as 1.5945 resistance holds. Break of 1.5487 minor support will bring retest of 1.5250 low. However, firm break of 1.5945 will suggest that fall from 1.6827 has completed. Stronger rise would then be seen back to 1.6033 resistance turned support and above.

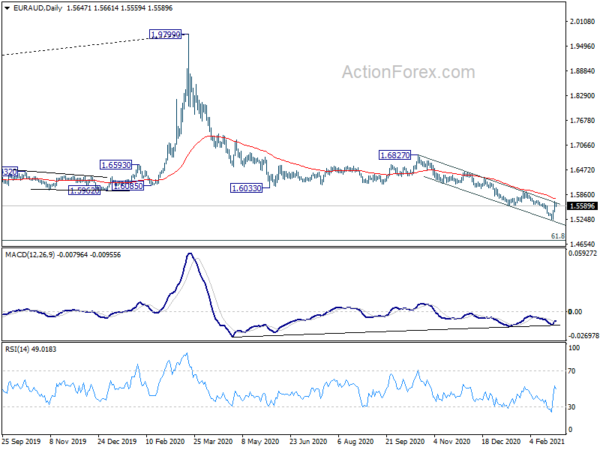

In the bigger picture, price actions from 1.9799 are developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6033 support turned resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | CNY | Non-Manufacturing PMI Feb | 51.4 | 52.1 | 52.4 | |

| 1:00 | CNY | NBS Manufacturing PMI Feb | 50.6 | 51.1 | 51.3 | |

| 21:30 | AUD | AiG Performance of Manufacturing Feb | 58.8 | 55.3 | ||

| 0:00 | AUD | TD Securities Inflation M/M Feb | 0.10% | 0.20% | ||

| 0:30 | AUD | Company Gross Operating Profits Q/Q Q4 | -6.60% | 2.10% | 3.20% | |

| 0:30 | JPY | Jibun Bank Manufacturing PMI Feb F | 51.4 | 49.9 | 49.8 | |

| 1:45 | CNY | Caixin Manufacturing PMI Feb | 50.9 | 51.5 | 51.5 | |

| 7:30 | CHF | Real Retail Sales Y/Y Jan | 4.50% | 4.70% | ||

| 8:30 | CHF | SVME PMI Feb | 60 | 59.4 | ||

| 8:45 | EUR | Italy Manufacturing PMI Feb | 56.5 | 55.1 | ||

| 8:50 | EUR | France Manufacturing PMI Feb F | 55 | 55 | ||

| 8:55 | EUR | Germany Manufacturing PMI Feb F | 60.6 | 60.6 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Feb F | 54.7 | 57.7 | ||

| 9:30 | GBP | Manufacturing PMI Feb F | 54.9 | 54.9 | ||

| 9:30 | GBP | Mortgage Approvals Jan | 100K | 103K | ||

| 9:30 | GBP | M4 Money Supply M/M Jan | 0.70% | |||

| 13:00 | EUR | Germany CPI M/M Feb P | 0.50% | 0.80% | ||

| 13:00 | EUR | Germany CPI Y/Y Feb P | 1.20% | 1.00% | ||

| 13:30 | CAD | Current Account (CAD) Q4 | -7.0B | -7.5B | ||

| 14:30 | CAD | Manufacturing PMI Feb | 54.4 | |||

| 14:45 | USD | Manufacturing PMI Feb F | 58.5 | 58.5 | ||

| 15:00 | USD | ISM Manufacturing PMI Feb | 58.9 | 58.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Feb | 80 | 82.1 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Feb | 52.6 | |||

| 15:00 | USD | Construction Spending M/M Jan | 0.70% | 1.00% |