Products You May Like

Silver down over 1% to the lows of $25.63 on the day

The drag in gold is also inadvertently having a negative pull on the likes of silver and platinum lately and we are seeing more of that today as well with silver having fallen to its lowest levels since 28 January below $26.

The drop pushes silver towards a test of key trendline support @ $25.65 and also brings into focus the 100-day moving average (red line) @ $25.43.

Those will be key lines in the sand for silver buyers to hang on to in order to keep the upside momentum running, after having seen year-to-date gains erased this week after having jumped to $30 at the start of February.

The dollar’s resilience so far today is also part of the story but precious metals haven’t really been getting much love – especially gold – as of late.

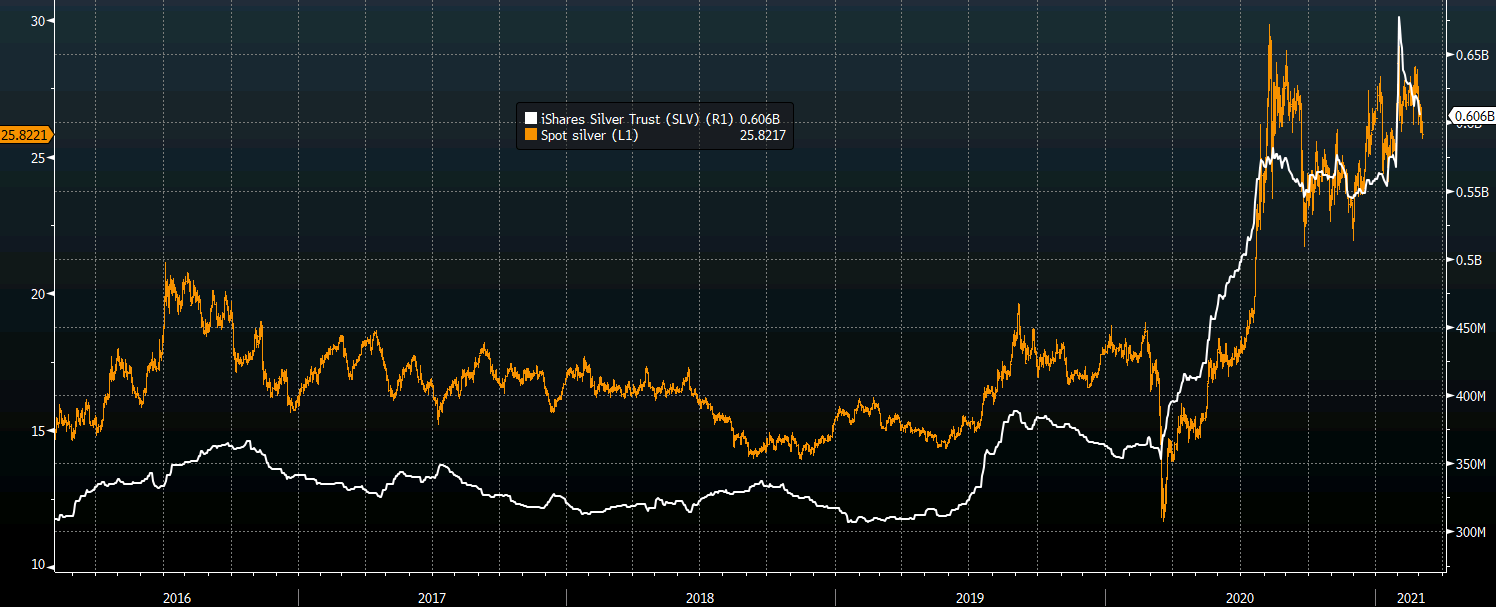

Silver ETFs may not have declined as drastically as gold but they have eased off since peaking in early February amid the surge in demand and retail trading frenzy at the time.

For trading this week, a lot is riding on Fed chair Powell’s speech later today and the spillover impact from the bond market is the key thing to watch out here.

The mood in precious metals will depend a lot on dollar and risk sentiment and higher yields could easily send precious metals even lower ahead of the weekend.

With key technical levels starting to come into play, I’m still a fan of silver but I fear that the market may be asking too much of Powell this week.