Products You May Like

Australian Dollar leads other commodity currencies higher today on improved market sentiments. Asian stocks are trading generally higher, following the record close in DOW overnight. Investors found some comfort from the soft yet acceptable 10-year auctions. Dollar, Yen and Swiss Franc turn softer as a result. Now, focus will turn to ECB rate decision, economic projections, and more importantly, comments on recent surge in long term yields.

Technically, on focus today is on the extend of Dollar’s pull back. Break of 1.1951 resistance in EUR/USD, would argue that the pair has bottomed in the near term. Similarly, break of 1740.32 resistance gold will also indicate short term bottoming, adding to pressure on Dollar in general. Another focus would be on commodity Yen crosses. For example, AUD/JPY could have a test on 84.93 resistance today if the improvement in sentiments continue. Break there will resume whole up trend form 59.89.

In Asia, Nikkei closed up 0.60%. Hong Kong HSI is up 1.21%. China Shanghai SSE is up 2.13%. Singapore Strait Times is up 0.91%. Japan 10-year JGB yield is down -0.0248 at 0.101, back at around 0.1 handle. Overnight, DOW rose 1.46%. S&P 500 rose 0.60%. NASDAQ dropped -0.04%. 10-year yield dropped -0.026 to 1.520.

US 10-year yield to settle in 1.4/1.6 range as bond auction cleared investor fears

The closely watched US treasury bond auction overnight was soft, but enough to temporarily ease investors’ worry of an avalanche collapse in demand. USD 38B in 10 year treasuries were sold, with bid-to-cover ratio of 2.38, just slightly below one-year average of 2.42. Focus will now turn to 30-year auction today.

10-year yield closed down -0.026 at 1.520, after hitting as low at 1.506. TNX would likely settle in range of 1.4/1.6, with S&P dividend at around 1.5 in the middle. Such developments should provide a floor for overall market sentiments.

DOW hit record as Congress passed stimulus package, targets 33k

DOW hit near record high overnight, with help from retreat in bond yields, as well as passage of the USD 1.9T economic stimulus package. The bill was parted in the House by 220 to 221, after going through the Senate with 50.49 on Saturday. The bill will now head to the White House for signature of President Joe Biden.

DOW closed up 1.46% or 464.28 pts at 32297.02. The bullish outlook was retained after drawing support form 55 day EMA earlier. It’s also staying well inside near term rising channel. The up trend is on course to 61.8% projection of 18213.65 to 29199.35 from 26143.77 at 32932.93.

As there is no clear sign of upside acceleration for now, we’d be cautious from strong resistance from this projection level. But still, break of 30547.53 support is needed to indicate topping. Or outlook will remain bullish.

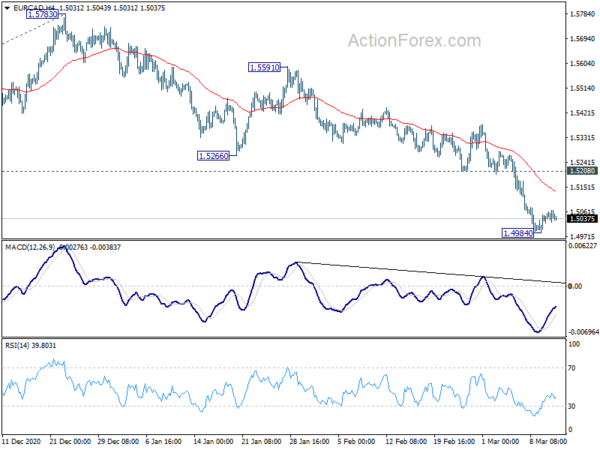

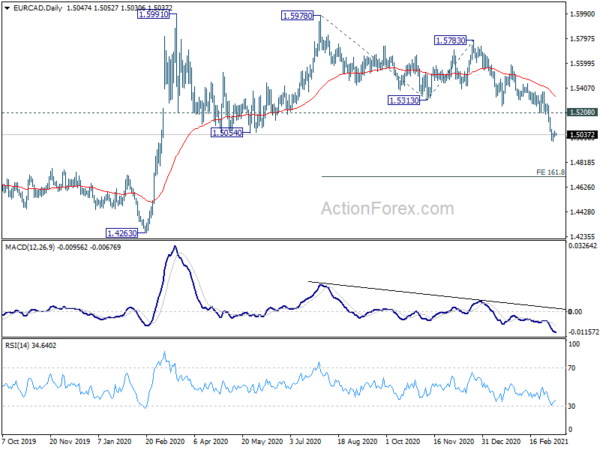

EUR/CAD weak in tight range after BoC, down trend intact

Canadian Dollar stays firm in general after BoC left monetary policy unchanged yesterday, and delivered and slightly more upbeat outlook. While interest rate will remain on hold until into 2023, the central bank is ready to taper asset purchases if board members “gain confidence in the strength of the recovery”.

Suggested readings on BoC:

EUR/CAD turned into consolidation after hitting as low as 1.4984 earlier this week. Some sideway trading could be seen but upside of recovery should be limited below 1.5208 support turned resistance to bring down trend resumption. Current down trend should target 161.8% projection of 1.5978 to 1.5313 from 1.5783 at 1.4707 on next fall.

EUR/GBP vulnerable ahead of ECB, comments on yields eyed

ECB is a major focus for today and no change in monetary policy is expected. In the updated economic projections, growth forecast will likely be revised lower, reflecting weaker than expected Q1 activities due to lock downs. On the other hand, inflation forecasts could be revised up to reflect recent rise in inflation expectations, commodity and energy prices.

Reflation trades have sent global yields since February. While this phenomenon is more remarkable in US Treasury, European yields have also increased a lot. The development prompted some cautious comments from officials. But there appears no consensus on the way to handle the issue yet. The markets would be eager to see President Christine Lagarde shedding some likes on whether ECB would recalibrate the instruments again, in response to surge in yields.

Here are some suggested previews:

EUR/GBP would be one to watch in reaction to the event. Recovery from 0.8537 was limited well below the falling 55 day EMA, keeping near term outlook bearish. Break of 0.8537 will extend the whole pattern from 0.9499 towards 0.8276 key long term support level.

On the data front

Japan PPI dropped -0.7% yoy in February, matched expectations. Australia consumer inflation expectations rose to 4.1% in March, UK RICS house price balance rose to 52 in February. US will release jobless claims later today.

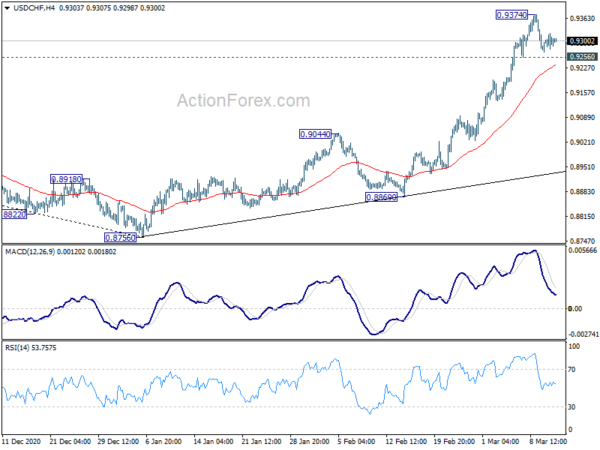

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9276; (P) 0.9299; (R1) 0.9323; More….

Intraday bias in USD/CHF remains neutral for the moment. Consolidations from 0.9374 should be relatively brief with 0.9256 minor support intact. On the upside, break of 0.9374 will resume recent rise to 61.8% retracement of 0.9901 to 0.8756 at 0.9464. On the downside, break of 0.9256 will bring deeper pull back. But overall, further rally is expected as long as 0.9044 resistance turned support holds.

In the bigger picture, current development argues that fall from 1.0237 has completed at 0.8756, on bullish condition in daily and weekly MACD. Current rally from 0.8756 should target 0.9901 resistance first. Break there will target 1.0237/0342 resistance zone in the medium term. This will now remain the favored case as long as 0.9044 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | -0.70% | -0.70% | -1.60% | -1.50% |

| 0:00 | AUD | Consumer Inflation Expectations Mar | 4.10% | 3.70% | ||

| 0:01 | GBP | RICS Housing Price Balance Feb | 52% | 46% | 50% | 49% |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | Initial Jobless Claims (Mar 5) | 725K | 745K | ||

| 15:30 | USD | Natural Gas Storage | -98B |