Products You May Like

Trading is generally subdued in the markets today. European indices are stuck in very tight range while US futures point to slightly higher open. Both gold and oil are bounded in consolidative trading. Bitcoin was short to new record high but quickly reversed. In the currency markets, New Zealand and Canadian Dollar are the strongest ones so far, but Aussie is the weakest. Euro and Yen are also next weakest for now. Traders seem to be holding their hands ahead of FOMC rate decision and press conference on Wednesday.

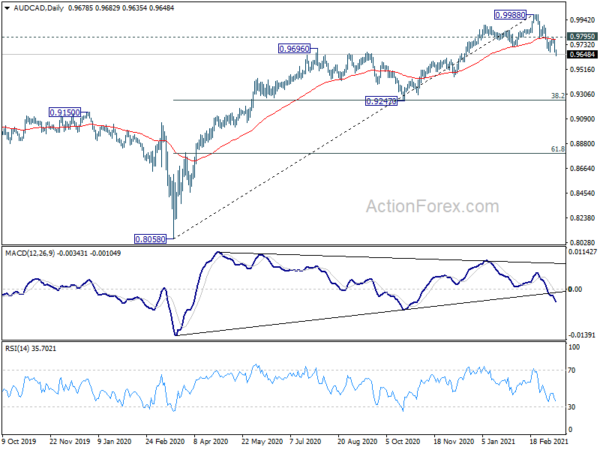

The clearly movements are seen in Canadian crosses for now, with CAD/JPY extending recent rally while EUR/CAD continuing near term fall. On development to note is that the Loonie is clearly outperforming Aussie for now. AUD/CAD’s decline from 0.9988 resumes today. Outlook will stay bearish as long as 0.9795 resistance holds. AUD/CAD should target 38.2% retracement of 0.8058 to 0.9988 at 0.9251, to complete the correction.

In Europe, currently, FTSE is up 0.08%. DAX is up 0.07%. CAC is up 0.16%. Germany 10-year yield is down -0.0033 at -0.305. Earlier in Asia, Nikkei rose 0.17%. Hong Kong HSI rose 0.33%. China Shanghai SSE dropped -0.96%. Singapore Strait Times rose 0.35%. Japan 10-year JGB yield dropped -0.0043 to 0.109.

US Empire State manufacturing rose to 16.1, substantial employment increases expected

US Empire State manufacturing general business conditions rose to 17.4 in March, up from 12.1, above expectation of 14.5. Expectations for six months ahead rose 1.5, from 34.9 to 36.4.

More importantly, number of employees for six months ahead jumped from 14.8 to 16.6. Average employment work week for six months ahead rose from 14.3 to 201.

New York Fed said, “The index for future employment rose to its highest level in over ten years, suggesting that firms widely expect to increase employment in the months ahead.”

From Canada, manufacturing sales rose 3.1% mom in January versus expectation of 2.8% mom. Housing starts dropped to 246k in February, slightly above expectation of 245k.

BoE Bailey: Rise in rates consistent with change in economic outlook

BoE Governor Andrew Bailey told BBC radio, “we watch rates in financial markets very closely.” “We have seen some increase in rates over the last month or so as have other countries,” he said. “My view is that is consistent with the change in the economic outlook.”

“Our current view of inflation is that it will get back towards our 2% target,” he added. “It will get back towards that level in the next two or three months. The important question here is: will that be sustained?”

“I’m saying we will need to see evidence that the trend in the economy and therefore the trend in inflation is sustainable simply because of the uncertainty and the huge effect of the Covid shock.”

“This Covid effect on the economy is huge so what we are saying on the recovery is the economy will get back by the end of this year to where it was at the end of 2019. That’s good news but let’s be realistic: it’s no more than getting back to where we were pre-Covid.”

China industrial production surged 35.1% yoy, retail sales rose 33.8% yoy

January-February data from China showed strong rebound from the pandemic hit period of last year. Both manufacturing and consumption started the year on a strong footing. Industrial production rose 35.1% yoy , above expectation of 30.0% yoy. Retail sales rose 33.8% yoy, above expectation of 32.0% yoy. Fixed asset investment rose 35.0% yoy, below expectation of 40.0% yoy.

The National Bureau of Statistics said that economy could show a sharp rebound in Q1 from a year earlier. But there are still imbalances in the recovery and support for consumption is needed. Also, time is needed to see recovery in manufacturing investment. Small firms are facing many difficulties.

Suggested readings on China: China Economic Activities Expanded Significantly, Mainly Due to Low Base Effect

RBA Lowe: Business investment yet to click into gear

RBA Governor Philip Lowe reiterated in a speech that economic recovery was “quicker and stronger” than expected. But “we still have a long way to go”, with unemployment rate at 6.4% and economy operating “well short of its capacity”. Inflation and wages growth were also lower than RBA would like. It’s “going to take some time” before we reach our goals.

“one piece of the recovery that is yet to click into gear is business investment”. There was a pick-up late last year, but it’s “still a long way to go” to get back to pre-pandemic level, which was “low by historical standards” already. It’s important to continue and broaden business investment recovery to have a “strong and durable recovery”.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.63; (P) 108.90; (R1) 109.31; More..

USD/JPY’s break of 109.22 temporary top suggests resumption of rally from 102.58. Intraday bias is back on the upside. Current rise should target long term channel resistance at 110.02 next. Decisive break there will carry larger implications. On the downside, though, break of 108.33 support will now indicate short term topping, and bring deeper correction.

In the bigger picture, focus is now back on long term channel resistance (now at 110.02). Sustained break there will indicate that the down trend from 118.65 (Dec 2016) has completed. Further break of 112.22 resistance will confirm this bullish case and target 118.65 next. However, rejection by the channel resistance will keep medium term outlook bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Jan | -4.50% | -5.50% | 5.20% | |

| 00:01 | GBP | Rightmove House Price Index M/M Mar | 0.80% | 0.50% | ||

| 02:00 | CNY | Industrial Production Y/Y Jan | 35.10% | 30.00% | 7.30% | |

| 02:00 | CNY | Retail Sales Y/Y Jan | 33.80% | 32.00% | 4.60% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jan | 35.00% | 40.00% | 2.90% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jan | -1.70% | -0.40% | -0.40% | -0.30% |

| 12:15 | CAD | Housing Starts Feb | 246K | 245K | 282K | 284K |

| 12:30 | CAD | Manufacturing Sales M/M Jan | 3.10% | 2.80% | 0.90% | |

| 12:30 | USD | Empire State Manufacturing Index Mar | 17.4 | 14.5 | 12.1 |