Products You May Like

Forex news for NY trading on March 19 2021

In other markets:

- Spot gold is trading up $6.87 or +0.39% at $1743.20

- Spot silver is up $0.12 or 0.46% $26.20

- WTI crude oil futures rallied $1.49 or 2.48% $61.49

- The price of bitcoin is trading up $1300 or 2.26% at $58,780

Today was a somewhat different day than has been seen over the last few. The US stocks reversed their recent flow out of tech and into cyclicals stocks. As such, the Dow industrial average was the biggest loser and the Nasdaq was the biggest gainer. Nevertheless the major indices all closed lower for the week.

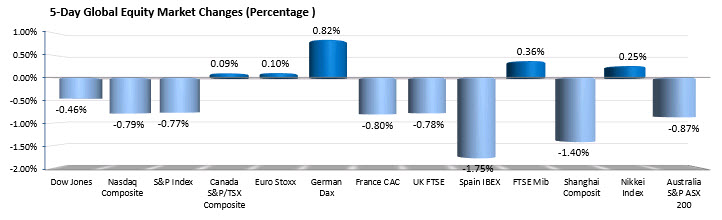

A look at the changes in North America and Europe today showed the NASDAQ index up 0.76% The Russell index was also higher today. IN Europe, all the major indices (sans the Portuguese PSI 20) all fell led by Spain’s Ibex at -1.53%.

For the week, the German DAX was the biggest gainer of the major indices around the world. A gain of 0.82%. Spain’s Ibex was the weakest at -1.75%, followed by the Shanghai composite index at -1.4%. In the US the NASDAQ index was the weakest -0.79% with the S&P at -0.77%.

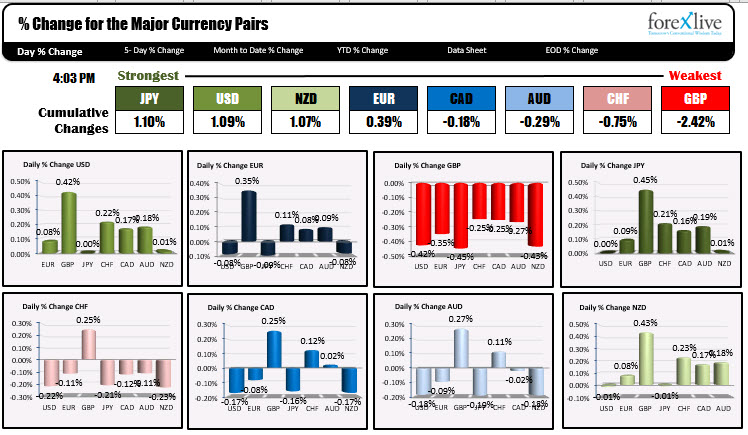

In the forex market today, although the pattern has been that if tech is getting hit, the dollar rises. Today, tech rallied but so did the dollar. The dollar is ending the day just behind the JPY as the strongest of the majors (with the NZD just behind it). The GBP was the more dominant weakest of the majors. Although the greenback rose against the Pavlovian reaction of late, it was still only a marginal gain – with the largest chunk coming against the GBP (+0.42%).

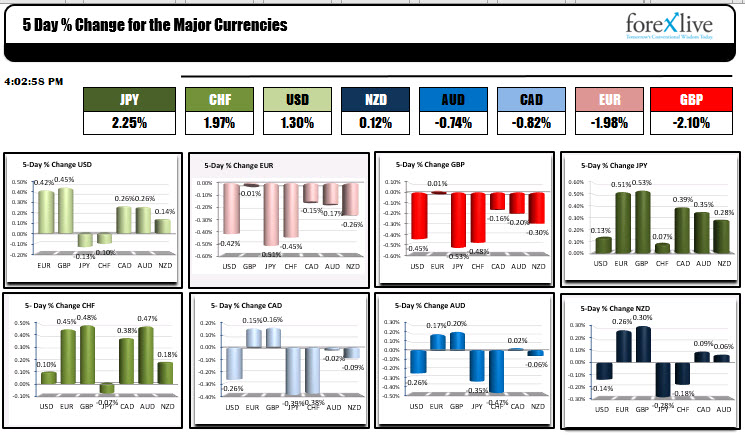

For the week, the JPY was the strongest followed by the CHF and USD. The GBP and the EUR were the weakest (see rankings below).

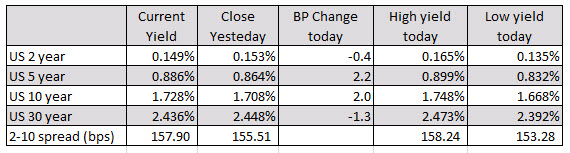

In the US debt market today, the yields are ending mixed with the 2 and 30 year down marginally, while the 5 and 10 year were up but off highs for the day.

The changes in the yields across the yield curve this week (from Friday close) showed:

- 2 year went from 0.147% to a high of 0.162%. The yield is currently at 0.149%

- 5 year went from 0.8401% to a high of 0.8986%. The yield is currently 0.886%

- 10 year went from 1.6247% to a high of 1.7526%. The yield is currently 1.728%

- 30 year went from 2.3776% to a high of 2.5146%. The yield is currently 2.436%

Fundamentally today, the only major economic release today came out of Canada with retail sales. Although lower at -1.1% for January, that was better than the expectations of -3%. Ex auto, the data showed a -1.2% decline vs. -2.7 estimate.

Baker Hughes weekly rig count showed a gain of around 9 rigs (all oil rigs). Although higher, it is still well below the pre-pandemic rig count at 680 or so. This despite the rise in the price of oil this week to the highest level since October 2018. US oil producers are being extra cautious.

Toward the close, Richmond Fed President Barkin speaking on CNBC said that the US economy has some momentum, but added:

“Seeing price pressure over 6 months is not the same as seeing price pressure over next several years.”

He added that the economy was “strong enough to be able to take somewhat higher rates.” .

Wishing you all a good weekend. Thank you for your support.