Products You May Like

6 straight day of gains in jeopardy

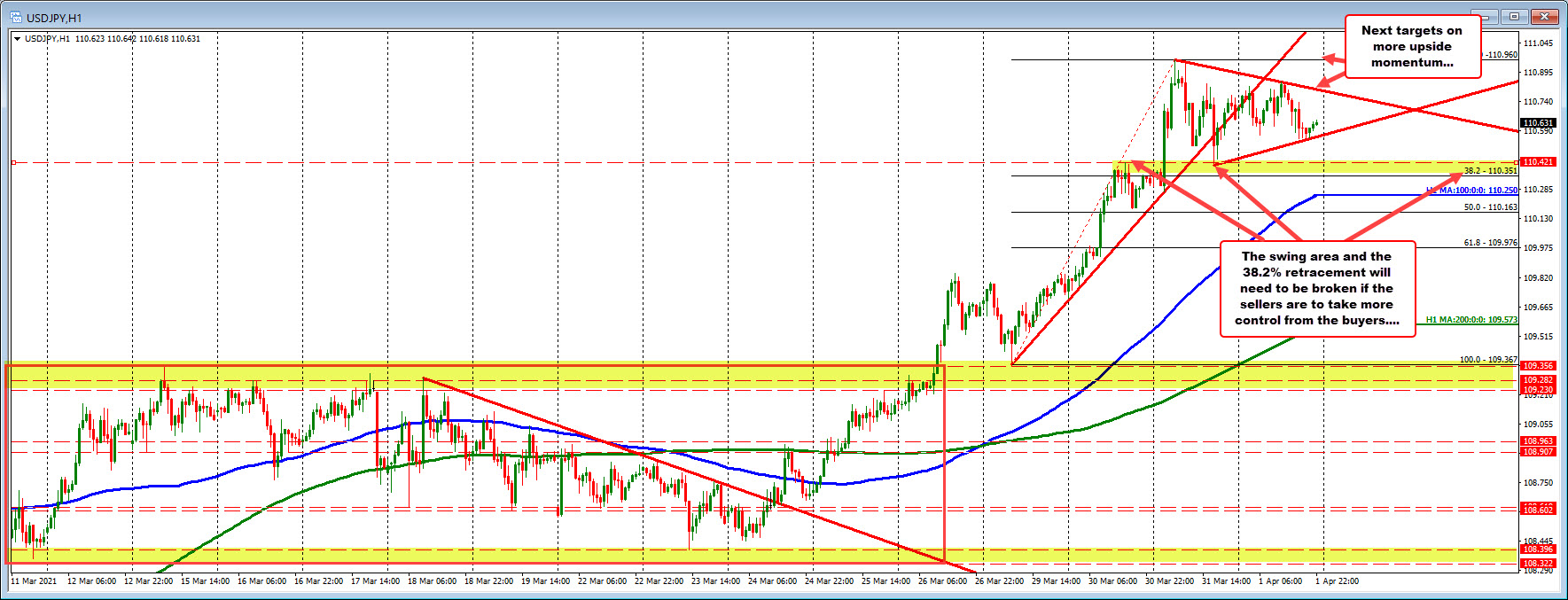

The USDJPY has moved higher for 6 consecutive days. On the 3rd day higher, the price moved outside a narrow trading range of 103 pips that was in effect for 14 days. Since then, the price has moved 160 pips higher (yesterday was the high). The price broke at 109.356 and after a retest of the break on March 29, the price trended higher.

Today, the price has traded in a much narrow trading range of 30 pips. The average over the last 22 days is 60 pips. Clearly, buyers and sellers are battling it out at the higher level and consolidating the gains.

The close was yesterday at 110.65. The price high today reached 110.843. The low for the day reached 110.545 – above and below the close. The current price is at 110.61 – just below the close.

What should traders look for now?

The low yesterday reached 110.41. That was just below the swing high from March 30 at 110.421. The 38.2% of the move up from March 29 swing low comes in at 110.351.

If the sellers are to take more control, getting below the 110.35 to 110.41 area would give sellers more confidence of further downside probing.

On the topside, there is a topside trend line at 110.81 followed by the high at 110.96.

Of course forex markets are open but other global markets will be mostly closed in observance of Good Friday. The caveat is that the US jobs report will be released at 8:30 AM ET tomorrow, but I would expect limited price action (that is just a guess). Nevertheless, the levels should give clues for bias tomorrow and going forward. I would not necessarily be overly anxious to trade actively.