Products You May Like

Forex news for North American trading on April 5, 2021.

With yields lower in the US after the strong employment report last week, the moderate Dems on Capitol Hill shooting down Pres. Biden’s 28% corporate tax hike, and stocks higher with records in the Dow and S&P, the “risk on” flows headed out of the dollar and into global currencies today. That idea may change tomorrow but for today, that was the trend during the North American session.

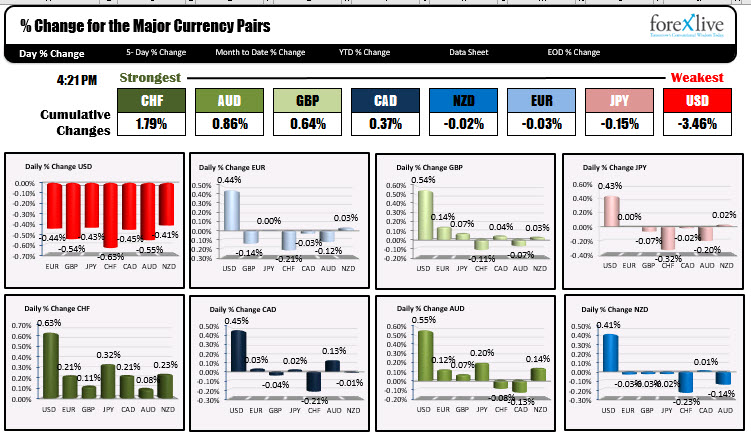

The strongest currency today was the CHF followed by the AUDUSD. Below is the ranking of the strongest to weakest

Looking at some of the currency pairs:

- EURUSD: The EURUSD cracked above its 200 hour moving average around 1.1768 in the early NY trading and the next six trading hours all the price spike up to 1.1819, just ahead of the 50% retracement of the move down from the March 22 high at 1.18249. The price has remained above the 1.1800 level on the modest correction 9th (the low reached 1.1807). Stay above 1.1800 is the best case scenario in the new trading day for the buyers. The percent midpoint 1.18249 will be the next major target.

- GBPUSD : The GBPUSD also extended higher early in the near trading session after the pair traded above the highs from last week between 1.3846 and 1.3851. The NY session low was at 1.38535 – just above those levels. The move to the upside breached the 61.8% of the move down from the March 18 high at 1.38743, and a swing area from March 19 at 1.3885 and 1.3891. Stay above in the new day, keeps the buyers in firm control.

- USDJPY: The USDJPY fell below a swing floor from last week at 110.367 t0 110.42. That turned buyers into sellers and the price did not bottom until reaching the 38.2% and 200 hour MA near 109.98. The price bounced off the dual support level and trades at 110.174. In the new day, stay below 110.36-41 would keep short term sellers in control. A move below the 200 hour MA at 110.027 and the 38.2% at 109.98, would increase the bearish bias.

- USDCHF: The USDCHF fell peaked in the NY session right at the 100 hour MA at 0.9427. Sellers leaned and pushed lower. In the rpicess, the 200 hour MA was broken at 0.9405 and the 38.2% of the move up from the March 17 low at 0.9373 were broken. The low price reached 0.9353 before consolidating near the lows into the close (trading at 0.9362 currently). Stay below the 38.2% at 0.9373 keeps the sellers firmly in control in the new trading day. A move above could see shorts push back toward 0.9397. On the downside, the 50% midpoint at 0.93426 is the next downside target.

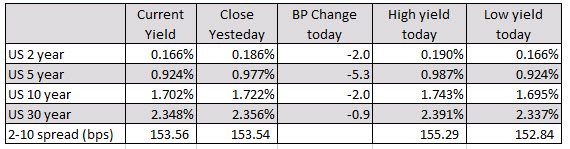

As mentioned, lower yields did help to weaken the dollar today. Looking at the changes along the yield curve, the five year yield moved down the most at -5.3 basis points followed by the 10 year at -2.0 basis points.

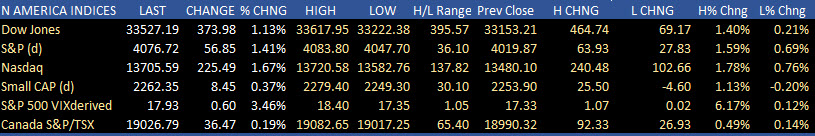

US stocks moved sharply higher with the Dow and S&P both trading to new session highs. The NASDAQ index also advanced strongly but remains over 3% below its all-time high back in February:

In other markets :

- Gold is ending the day near unchanged at $1728.49 (down $-0.38).

- Silver is trading down $0.12 or -0.49% at $24.88.

- The price of bitcoin is trading up $746 or 1.29% of $58,797.70

- Crude oil tumbled -4.56% (was down close to 6% at the lows) estimated remains a concern

Fundamentally, factory orders came in weaker than expected along with durable goods orders, but the declines were the first in eight or so months. So no big deal. The ISM services index for March soared to 63.7 which was the highest on record going back to 2008

Post-links Paragraph Text Here, don’t forget an image.