Products You May Like

J&J pause of vaccine sends stocks lower

The JPY is the strongest and the CAD is the weakest as NA traders enter for the day. The US has called for a pause on the J&P vaccine after clotting cases. That has pushed stocks modestly into the red. Yields are off their highs as well. The reopen trades are leading the way lower including airlines. The USD has moved higher on a modest flight to safety bid (or so it seems).

All eyes will be on the US CPI which will be released at the bottom of the hour. The expectations are for +0.4% for the headline number, with ex food and energy up 0.2%. The year on year levels are expected to rise to 2.5% from 1.7% and 1.5% from 1.3% (for ex food and energy).

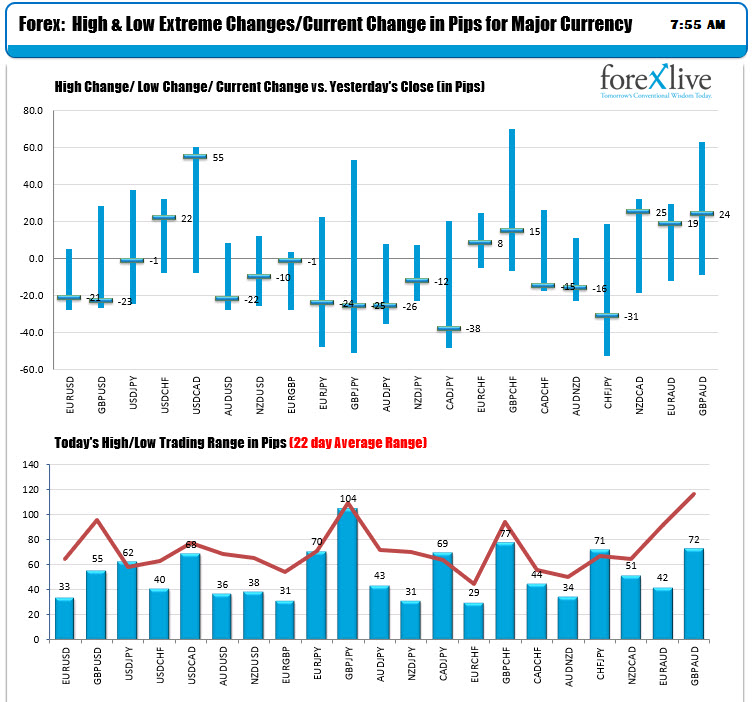

Looking at the ranges and changes, the dollar is working and trading near the highs. The USDJPY is just off of unchanged on the day. The JPY pairs are off the lows but still lower on the day. Low to high trading ranges are mixed.

In other markets:

- Spot gold is down $-3.80 or -0.22% at $1729.

- Spot silver is up $0.13 or 0.56% at $24.95.

- WTI crude oil futures are up $0.40 or 0.67% at $60.10

- Bitcoin as searched nearly $3000 or 5% at $62,961

In the premarket for US stocks:

- Dow -160 points

- S&P down -9 points

- NASDAQ is now trading up 4 points after moving lower and rebounding

In the European equity markets, the major indices are trading mixed:

- German Dax, +0.15%

- France’s CAC +0.15%

- UK’s FTSE 100, -0.17%

- Spain’s Ibex, -0.6%

- Italy’s footsie MIB, +0.2%

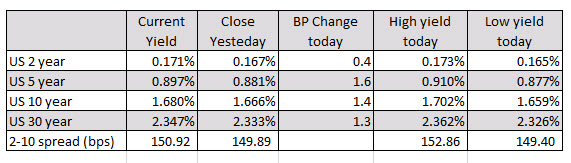

In the US debt market, yields are higher but off their highs levels. The 10 year yield got back up to 1.7015%. It currently trades at 1.68%.

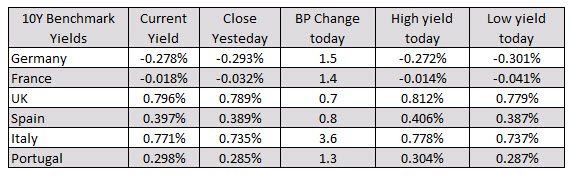

In the European debt market, the benchmark 10 year yields are trading higher with the German Dax up 1.5 basis points. Italy’s 10 year yield is up 3.6 basis points.

In the European debt market, the benchmark 10 year yields are trading higher with the German Dax up 1.5 basis points. Italy’s 10 year yield is up 3.6 basis points.