Products You May Like

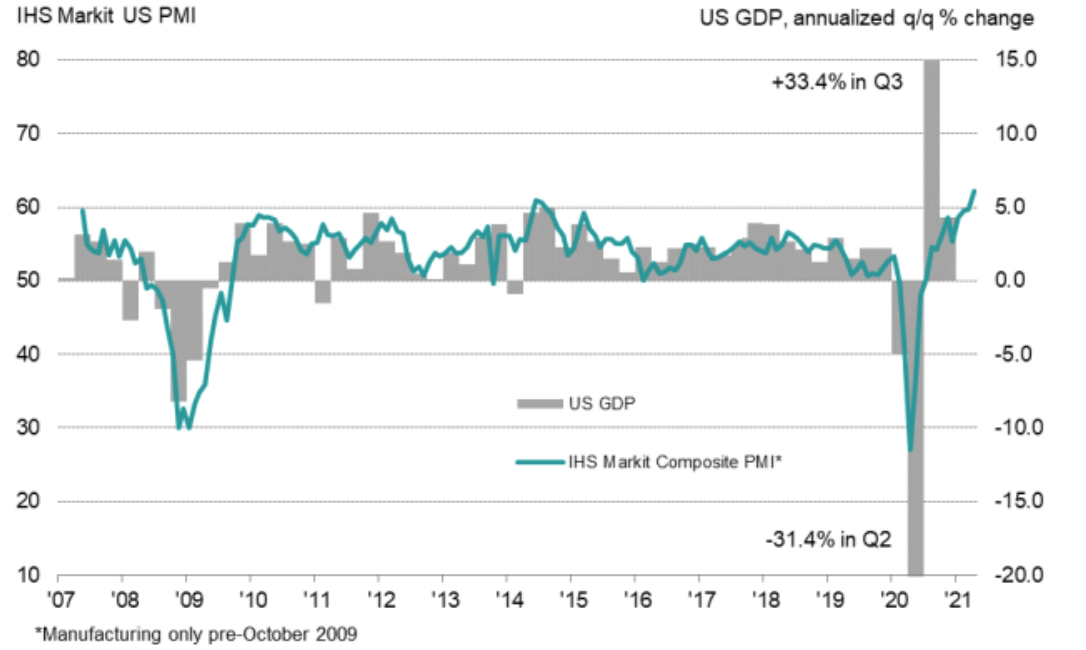

Markit services and manufacturing data for the USA

- Record high for this series

- Prior was 60.4

- Manufacturing PMI 60.6 vs 61.0 expected — record high

- Prior manufacturing 59.1

- Composite PMI 62.2 vs 59.7 prior — record high

- New orders highest on record

- Manufacturing input prices second highest on record (record was last month)

The services, manufacturing and composite indexes are all at record highs. The series started in 2009.

Commenting on the PMI data, Chris Williamson,

Chief Business Economist at IHS Markit, said:

“The US economy is enjoying a strong start to the

second quarter, firing on all cylinders as loosening

virus restrictions, an impressive vaccine roll-out, a

brighter outlook and stimulus measures all helped

boost demand.“The upturn is broad-based: the service sector is

growing at the fastest rate recorded in almost 12

years of survey history, and manufacturers reported

one of the strongest expansions seen over the past

seven years. The latter was all the more impressive,

as factories continued to be throttled by

unprecedented supply chain delays, a consequence

of which was a further steep rise in prices.“The worsening supply situation is a concern for the

outlook, especially in relation to prices. Supply needs

to improve to come into line with demand. But with

record supply chain delays driving a rise in backlogs

of uncompleted work of a magnitude not surpassed

for over seven years, firms appear to be struggling to

boost operating capacity in the near-term.”

This is another impressive report. It’s a matter of ‘when’ the Fed follows the BOC, not ‘if’. I think Wednesday’s FOMC is too soon but I don’t see how Powell avoids taking a more upbeat tone.