Products You May Like

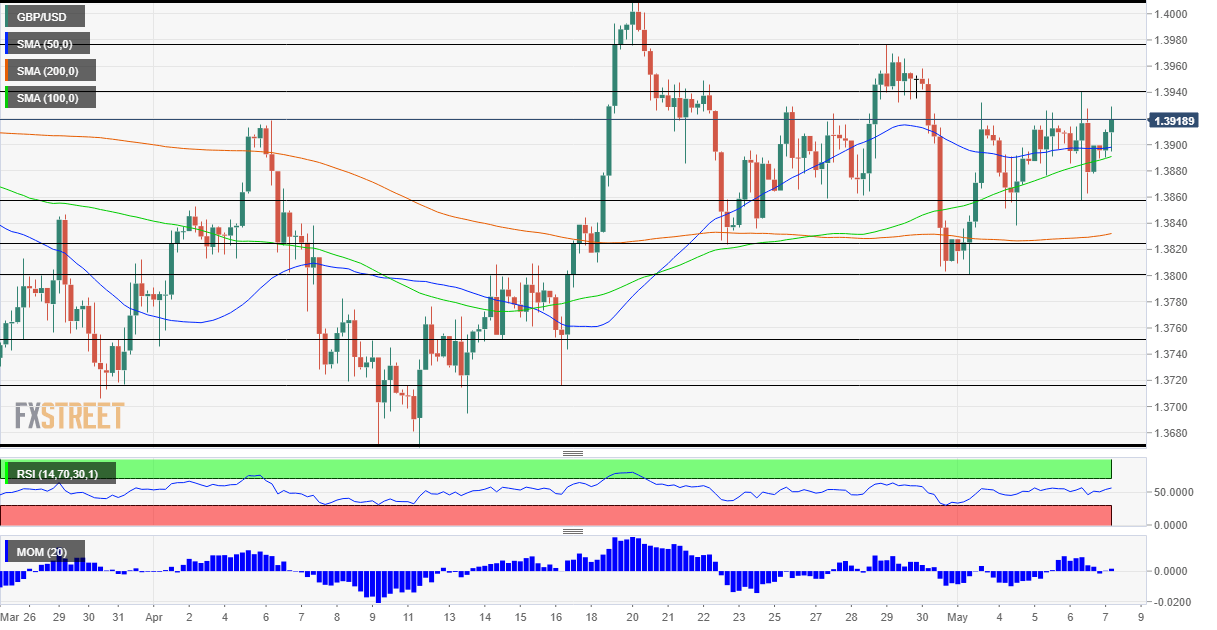

GBP/USD spikes to over one-week tops, around 1.3970 on weaker NFP report

The GBP/USD pair caught some aggressive bets during the early North American session and shot to over one-week tops, around the 1.3970 region in reaction to the dismal US jobs report. The headline NFP showed that the US economy added only 266K new jobs in April as compared to consensus estimates pointing to a reading of nearly one million. Adding to this, the previous month’s reading was also revised down to 770K from 916K reported previously and the unemployment rate unexpectedly edged higher to 6.1% from 6.0% in March. Read more…

GBP/USD Weekly Forecast: Can America’s cooldown send sterling above 1.40? UK GDP, US consumer eyed

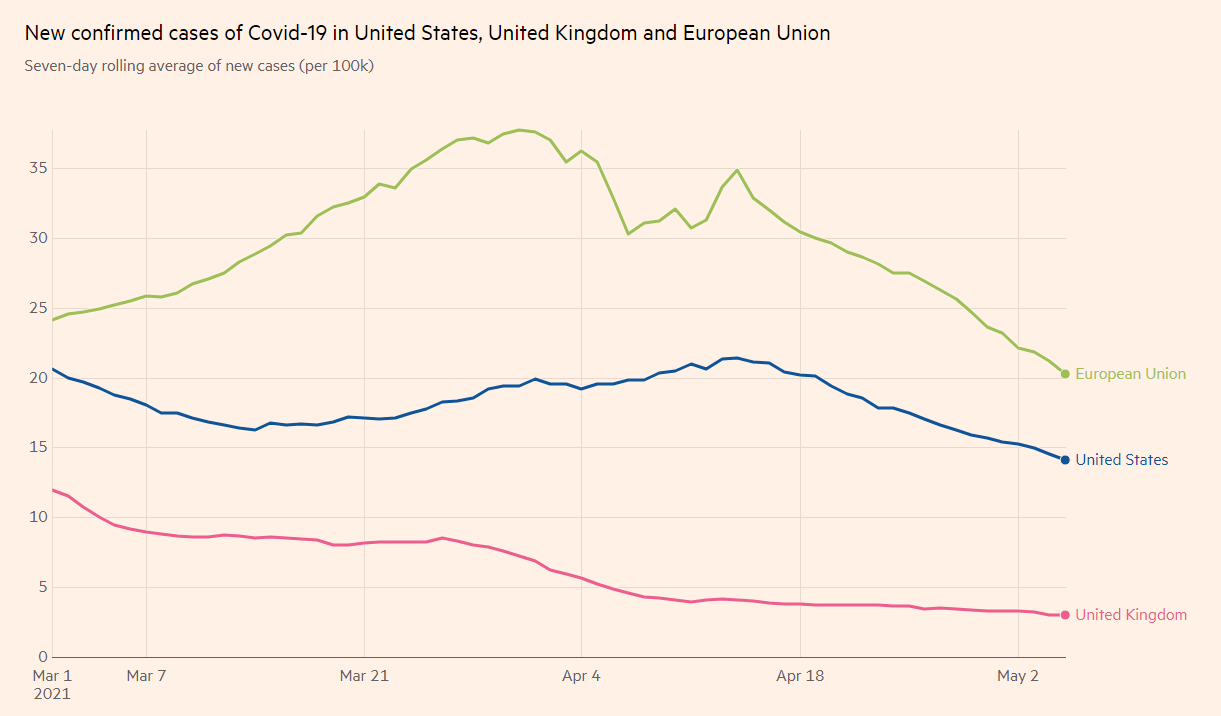

GBP/USD has bounced as the BOE upgraded its outlook and horrible US jobs figures. UK GDP and US consumer figures promise another busy week in cable. Early May’s daily chart shows bears are gaining some ground. Something is more than nothing – the Bank of England monetary policy tweak has pushed up the pound, while concerns about road bumps in the US economy have kept the dollar from storming the board. Can the upswing continue? Economic data has rising prominence as covid concerns fade on both sides of the pond. Read more…

GBP/USD Forecast: UK elections outweigh Nonfarm Payrolls impact and favor the bulls

GBP/USD has been drifting higher as Conservatives have come on top in a by-election. US Nonfarm Payrolls and speculation about the vote in Scotland are set to move the currency pair. Hartlepool – a place where many GBP/USD traders are unable to locate on the map – is breaking the typical pre-Nonfarm Payrolls silence. Prime Minister Boris Johnson’s Conservatives have won a by-election for the Northern seat, defeating the opposition Labour Party in its heartland. Such a victory provides some political calm. Read more…