Products You May Like

- Equity markets shrug off a shocking jobs report to rally anyway.

- No news is good news, bad news is good news as the dip dominates.

- Bears have been hibernating and face possible extinction.

Well after a fairly sluggish start to the week things certainly sprang to life on Friday as a brutal employment report was a catalyst for a strong rally! Go figure. Well, the logic is actually not as stupid as it first appears. Equity markets have been fretting over inflation and overheating for the best part of 2021. The US 10-year Treasury yield has had its attempts at nearing two percent and the long duration Nasdaq stocks have had the interest rate sweats. Duration is the sensitivity of an asset, stocks in this case, to interest rates. The majority of tech stocks are high growth, high price/earnings (PE) stocks. That means they are predicted to generate significant cash flows in the future. Analysts discount these predicted future cash flows to present value using the prevailing interest rate. However, if the prevailing interest rate rises, these future cash flows get more and more discounted.

Alright, my brain hurts. Let’s get back to something more straightforward here. So basically Friday’s brutal employment report has a silver lining. Long-duration growth stocks will not have their cash flows discounted at zero rates for much longer as the Fed has stated employment is its main goal. So tapering or interest rate rises have been pushed further out the calendar after the employment number. So bad news is good news. The Nasdaq was well aware of this. While Dax, Dow, and Eurostoxx futures dumped right after the release of the employment figures, the Nasdaq immediately began rallying and was up 1% a few minutes after the release. The rest of the market soon copped on and followed suit.

Stay up to speed with hot stocks’ news!

For the week, the Dow rose 2.65%, the S&P 500 rose 1.23% and the Nasdaq dropped 1.5%. The Dow and S&P closed yet again at record levels.

Now where to from here? Well, that is where it gets interesting. The main fundamentals have not changed. In fact, this last week has further established the record-breaking run of earnings with a huge week of releases. As of Friday, earnings season is nearly done and dusted. 439 companies from the S&P 500 have reported and 87.2% of them have beaten analysts’ expectations. A lot have hammered analyst expectations. Earnings growth is 50% higher year over year for this quarter. The interesting aspect to note is that earnings are 50% ahead but revenue is only 13% ahead. Makes one wonder, is cost-cutting, debts, and restructuring due to free Fed money, or are earnings artificially inflated? Whoa let me calm down for a second, that’s another argument entirely.

More importantly, the wall of money supporting equities is now more likely to stay in equities as interest rates remain lower for longer. The latest Equity Exchange Traded Funds (ETF) data from Refinitiv shows net equity inflows for the thirteenth consecutive week. Equity ETFs attracted $10.7 billion inflows for the week to May 5th. Expect the Nasdaq (Nasdaq, QQQ) to see some inflows next week after Friday’s jobs report as it was one of the few ETFs to see outflows.

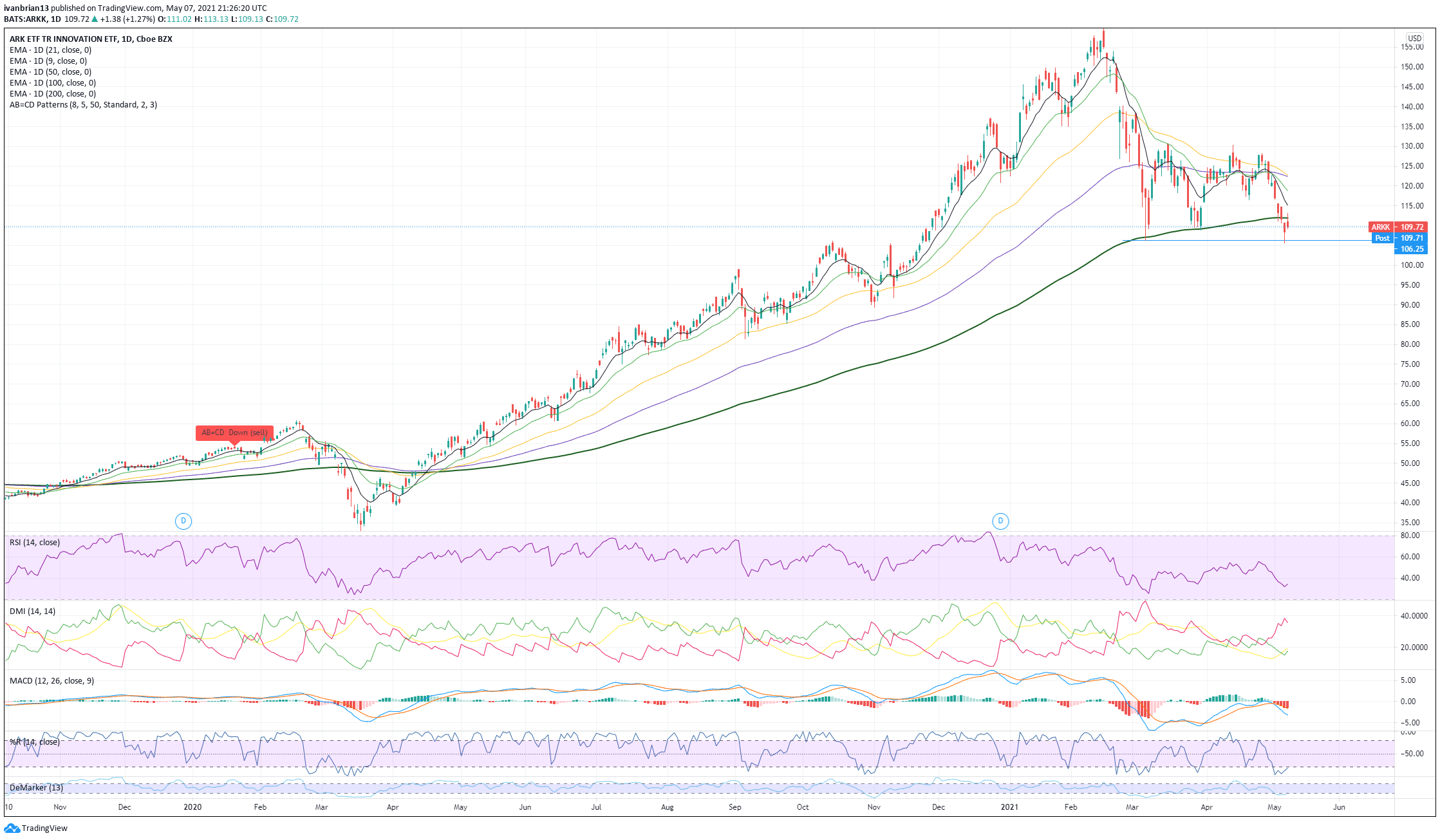

Another interesting development is the outflows from the Cathie Woods ARKK ETF. Cathie Wood has built up a stellar reputation and a large following but the ARKK fund has been dumping hard as it is heavy in the retail meme stocks which are suffering. Top holdings include COIN, PLTR, SKLZ.

ARKK has broken the significant 200-day moving average support and is close to breaking through the 106 support which it had a look at yesterday. Friday has seen some respite for the fund as everything rallies. Given the widespread following that ARK and Cathie Wood attract, fund redemptions will lead to holding liquidations putting a self-fulfilling spin on any potential sell-off. The fund is not leveraged and as significant as Archegos but would have more reputational damage among ordinary investors.

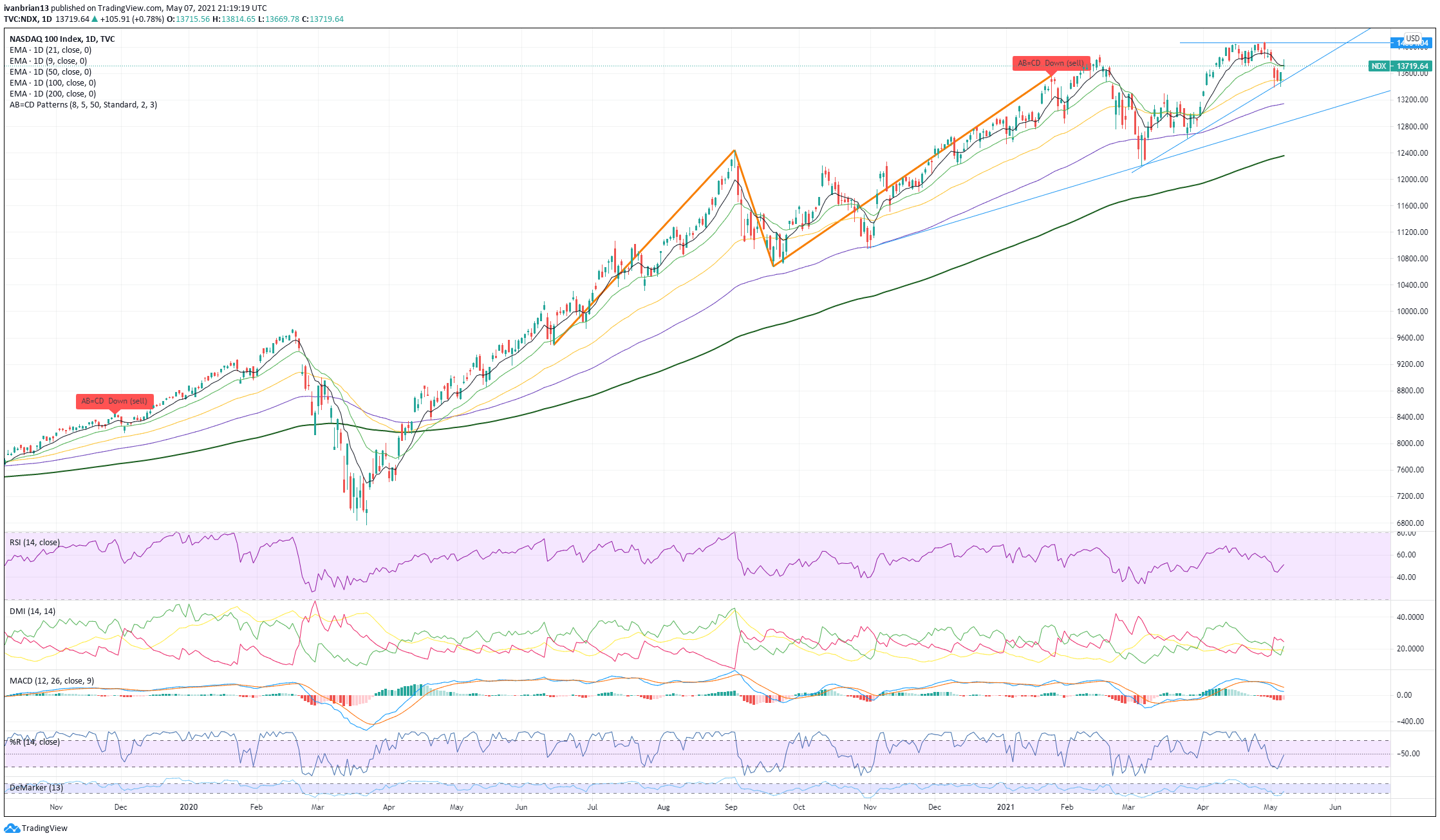

Nasdaq (QQQ) technical chart

The Nasdaq (NDX QQQ) proved the buy the dip strategy is still the one to follow as long as the fed has your back! Nice test on Thursday of trendline support and a stall at the 50-day moving average. Friday brings the bounce and a test of the convergence resistance from 9 and 21-day moving averages. The Nasdaq just closed on the level and so should see a retest of the resistance area 14060-14070 next week and then further record highs.

A failure sees a retracement back to trendline support at 13500 and 50 day MA 13510 before a test of 12627 low from March 25. A break of this ends the series of lower highs.

Wall Street Week Ahead

Earnings season is more or less done but a few laggards report next week, the highlights being Disney and Alibaba.

2021-05-10 After Market Close Wynn Resorts

2021-05-10 Before Market Open Energizer Holdings

2021-05-10 After Market Close Occidental Petroleum

2021-05-10 After Market Close AECOM

2021-05-10 Before Market Open Party City Holdco

2021-05-10 Before Market Open Weibo

2021-05-10 Before Market Open Duke Energy

2021-05-10 Before Market Open Marriott International

2021-05-10 After Market Close Intl Flavors & Fragrances

2021-05-10 Before Market Open Tyson Foods

2021-05-11 Before Market Open Perrigo Co

2021-05-11 Before Market Open Aramark

2021-05-11 After Market Close Electronic Arts

2021-05-11 After Market Close FuboTV

2021-05-11 Before Market Open Hanesbrands

2021-05-12 After Market Close A-Mark Precious Metals

2021-05-12 Before Market Open Wendy’s

2021-05-13 Before Market Open Alibaba Group Holding

2021-05-13 After Market Close Walt Disney

2021-05-13 Before Market Open Bilibili

2021-05-13 After Market Close DoorDash

Economic releases

Monday is quiet with nothing exciting except a few short-term T-Bill auctions late in the day.

Tuesday has the Redbook Index and a speech from NY Fed John Williams.

FuboTV reports earnings on Tuesday after the close, a retail favourite. EPS expected $-0.44 and revenue of $103.79m.

Wednesday will liven things up with the release of Consumer Price Index data. The core number is expected to see a rise of 0.3% in April and 3.6% yearly. Fed Vice Chair Richard speaks after the CPI data so it may provide something to bears!

Thursday brings the turn us Producer Price Index with the core number here expected to register a rise of 0.2% for April, 3.1% for the year. Jobless claims are expected to spike a bit more than the usual interest given Friday’s poor jobs report.

Friday brings Retail Sales expected to show a 1% rise for April and University of Michigan Sentiment Index for May expecting 89.5.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author is short SPY. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.