Products You May Like

Dollar is under selling pressure against after rather poor retail sales data. US futures also pare back some earlier gains and look vulnerable. Yen is currently following the greenback as the second weakest, while commodity currencies are the strongest, together with Euro. The question now is, whether Dollar’s decline could gather enough momentum for new lows before weekly close.

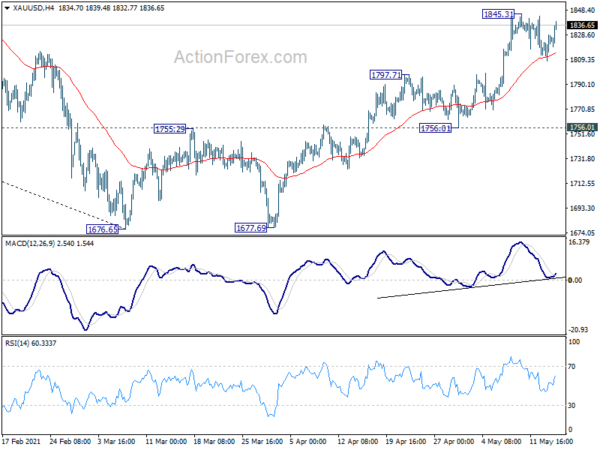

Technically, focuses will now be on 1.2181 temporary top in EUR/USD and 0.8984 temporary low in USD/CHF. Additionally, Gold’s retreat could have completed after drawing support from 4 hour 55 EMA. Eyes are back on 1845.31 resistance and break will resume larger rebound from 1676.65.

In Europe, at the time of writing, FTSE is up 0.69%. DAX is up 0.64%. CAC is up 0.95%. Germany 10-year yield is down -0.010 at -0.129. Earlier in Asia, Nikkei rose 2.32%. Hong Kong HSI rose 1.11%. China Shanghai SSE rose 1.77%. Singapore Strait Times dropped -2.18%. Japan 10-year JGB yield dropped -0.0108 to 0.085.

US retail sales flat in April, ex-auto sales dropped -0.8% mom

US retail sales was flat at USD 619.9B in April, well below expectation of 0.5% mom rise. Ex-auto sales dropped -0.8% mom, missed expectation of 0.9% mom rise. Ex-gasoline sales rose 0.1% mom. Ex-auto, ex-gasoline sales dropped -0.8% mom.

From Canada, manufacturing sales rose 3.5% mom in March, matched expectations. Wholesale sales rose 2.8% mom, versus expectation of 1.0% mom.

ECB: Future pace of PEPP purchases data-dependent, and based on assessment of financing conditions and inflation outlook

In the accounts of April 21-22 meeting, ECB said that risk-free interest rates and sovereign bond yields had “largely moved sideways” since March and “decoupled from developments in US markets” since late February. Broader lending conditions have “remained favorable”.

“This was widely seen as validating the Governing Council’s March decision to significantly increase the pace of net asset purchases under the PEPP, effectively insulating euro area financing conditions from global spillovers and preventing a premature tightening,” the accounts added.

Looking ahead, June meeting would “provide the next opportunity to conduct a thorough assessment of financing conditions and the inflation outlook”. Also, “future pace of purchases under the PEPP was data-dependent and would continue to be based on the joint assessment of financing conditions and the inflation outlook.

New Zealand BusinessNZ PMI dropped to 58.3

New Zealand BusinessNZ PMI dropped to 58.3 in April, down from 63.6. Looking at some details, production dropped form 66.5 to 64.5. Employment dropped from 53.6 to 52.7. New orders dropped from 72.3 to 60.9. Finished stocks dropped from 55.4 to 55.2. Deliveries also dropped from 63.0 to 52.4.

BNZ Senior Economist, Craig Ebert stated that “firms’ commentary to April’s PMI noted improving conditions internationally, in addition to many global PMIs clearly pointing to economic activity expanding strongly in significant portions of the world right now”.

GBP/USD Mid-Day Outlook

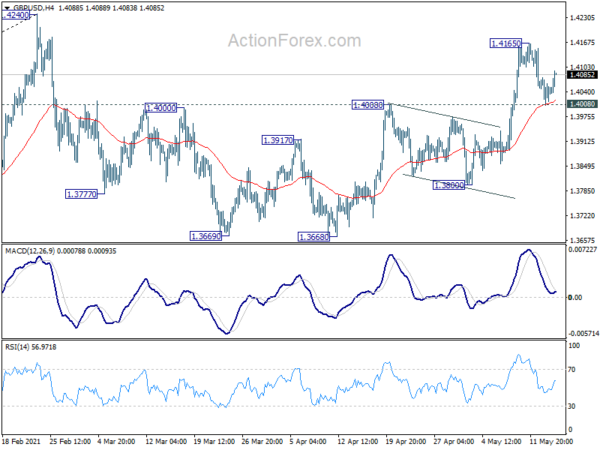

Daily Pivots: (S1) 1.4011; (P) 1.4045; (R1) 1.4083; More…

GBP/USD recovers today but stays below 1.4165 resistance. Intraday bias remains neutral first. But further rise is expected with 1.4008 resistance turned support intact. On the upside, break of 1.4165 will resume the rally from 1.3668 to retest 1.4240 high. Firm break there will resume larger up trend from 1.1409 low for 1.4376 long term resistance next. However, firm break of 1.4008 will delay the bullish case and extend the corrective pattern from 1.4240 with another falling leg.

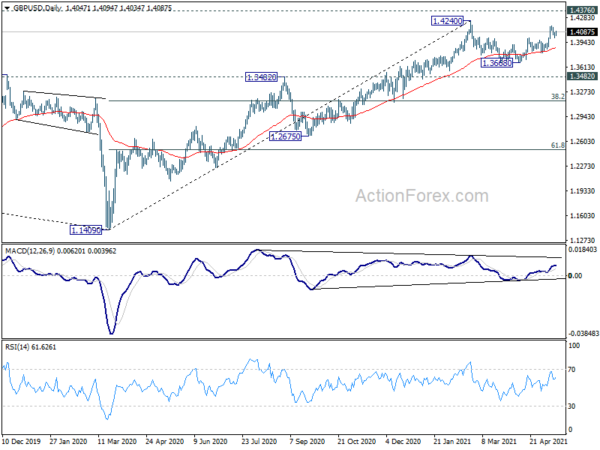

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Apr | 58.4 | 63.6 | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 9.20% | 9.40% | 9.50% | 9.40% |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | CAD | Manufacturing Sales M/M Mar | 3.50% | 3.50% | -1.60% | |

| 12:30 | CAD | Wholesale Sales M/M Mar | 2.80% | 1.00% | -0.70% | |

| 12:30 | USD | Retail Sales M/M Apr | 0.00% | 0.50% | 9.70% | 9.80% |

| 12:30 | USD | Retail Sales ex Autos M/M Apr | -0.80% | 0.90% | 8.40% | 9.00% |

| 12:30 | USD | Import Price Index M/M Apr | 0.70% | 0.60% | 1.20% | |

| 13:15 | USD | Industrial Production M/M Apr | 0.90% | 1.40% | ||

| 13:15 | USD | Capacity Utilization Apr | 75.20% | 74.40% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 89.5 | 88.3 | ||

| 14:00 | USD | Business Inventories Mar | 0.30% | 0.50% |