Products You May Like

A look at seasonal trends in the forex market for June 2021

June will begin after a long weekend in the US as we turn the calendar Tuesday with an OPEC meeting that could set the table for crude and commodity currencies. In the bigger picture, economic data and central banks are growing drivers in the forex market, which is music to a fundamental traders’ ears.

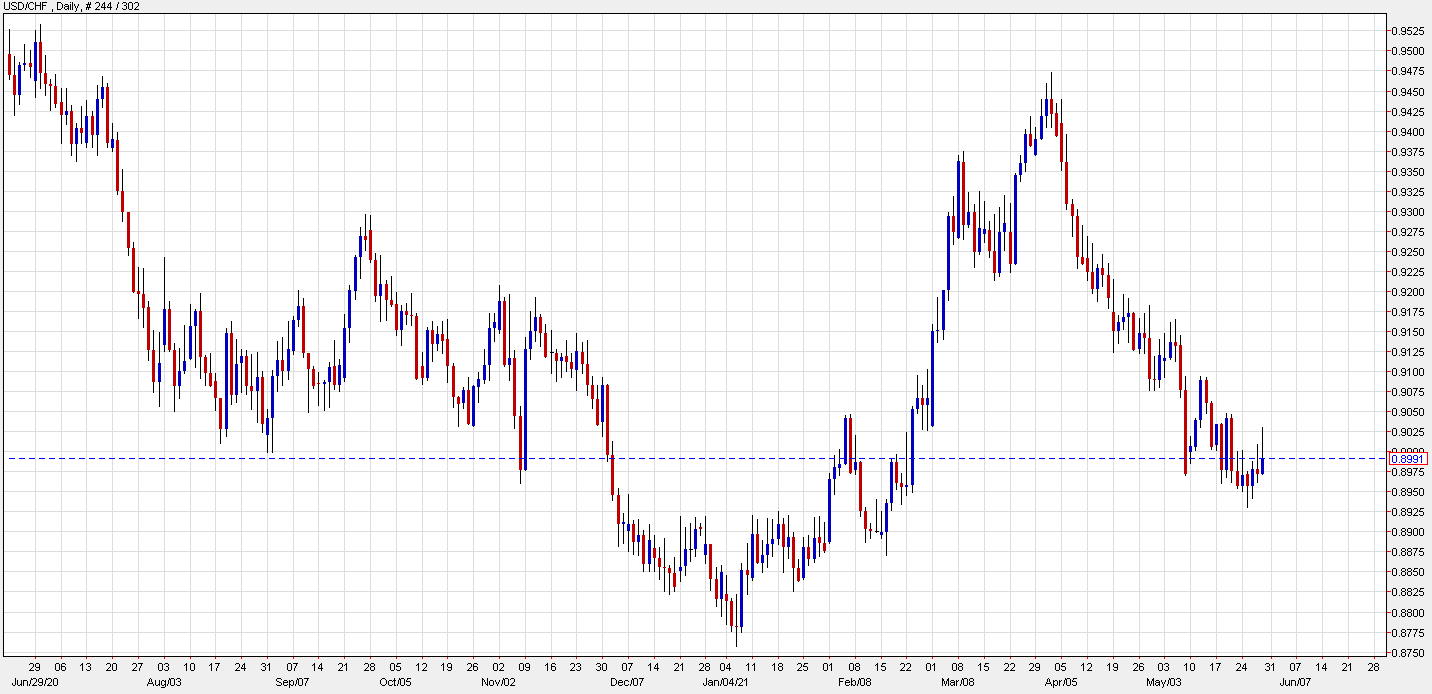

1) USD/CHF on the decline

June is the second-worst month for USD/CHF over the past 20 years and the pair has fallen in 10 of the past 11 years. The average decline over the past two decades is 1.02%. The chart ads to the case for shorts, with little support standing in the way of a fall to 0.8875 or the January low.

2) Cable run to continue

3) The 2nd best month for commodity FX

June is the second-best month for AUD, CAD and NZD. The kiwi is compelling because of the turn at the RBNZ. Now that they’ve broken the dam, policymakers there may find it easier to deliver upbeat comments or flirt with the idea of faster rate hikes. I’m less enthusiastic about AUD because of risks around covid, vaccine hesitancy and China relations. USD/CAD could fall fast if it breaks through 1.20 as it’s also the 3rd best month for oil. Iran and OPEC risks loom in the near term.

4) Divergence in US and Japanese stocks

June is the second-worst month for US stocks over the past 20 years but it’s a solid one for the Japanese Nikkei with a 0.6% average gain over the past two decades. The index has also risen in 4 straight years and 13 of the past 18.

5) No time to give up on the euro

Euro bulls and bears are fiercely entrenched but I’ve been impressed by the resilience of the single currency. It’s risen for two straight months following the March drop and June is the third-best month over the past 20 years. On top of that, EUR/USD has risen in June in 8 of the past 10 years.