Products You May Like

Narrow trading range for the week of 128 pips

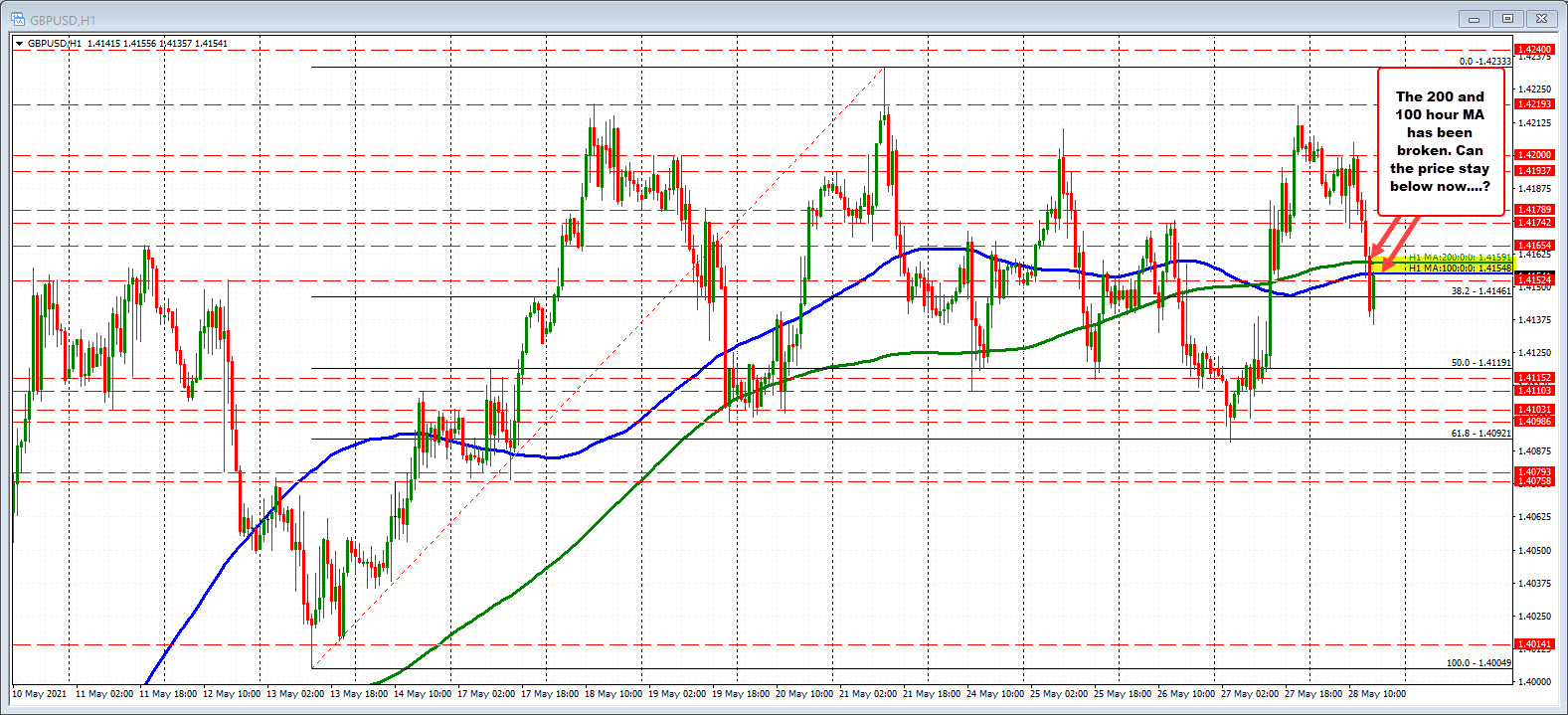

Yesterday at this time the GBPUSD had a 119 pip trading range for the week. The price was trading just above its 100 and 200 hour moving averages near 1.4154. I speculated that the range would be extended before the end of the week.

Well it was, but only by 9 pips. The high by the end of the day reached up to 1.4219 which was just short of the May 18 swing high. The price stalled and has continued lower with the dollar buying today.

With the range now up to 128 pips, it is still near the low of the ranges for the year, but the current price is near the middle of the week’s trading range. That comes in at 1.41547 (PS yesterday’s range was the low and high for the week by the way). Also at that level, is the 100 hour moving average. The 200 hour moving averages just above it at 1.41591. The current price is trading right at the 1.41548 level.

Stay below the 100/200 hour MAs keeps the bias to the downside. If yesterday the range is also the range for the week, that says, maybe the up-and-down volatility can still extend the narrow trading range for the week before the close. It is month end and that can increase volatility due to flows. Maybe…..

The next target comes in at 1.41191. That is the 50% of the range since May 13 (not the range for the week). Below that and traders will be targeting the 1.4100. On Thursday and Friday of last week, the lows bottomed between 1.4098 to 1.4103. The low yesterday dipped below that level but only briefly.

I guess we can say, sellers had their shot yesterday on the break of 1.4100 yesterday, and the buyers had their shot (also yesterday) on the break of the week’s highs. So everything is now possible.

However, sellers currently have the edge on the move below the week’s midpoint and below the 100/200 hour MAs. That might change, but the edge goes to the sellers right now technically.

PS if the range remains the same, that increases the chances for something better next week (I hope).