Products You May Like

Gold has been quite a show on Monday falling from a high of $1,878.08 to a low of $1,844.63, or by 1.8%, or by over 33 dollars.

Relatively speaking, the greenback has hardly moved. As measured by the DXY, the index is flat and has stuck to a 90.4120 and 90.6010 range.

The dollar is in consolidation following Friday’s move that was showing its strongest weekly gain since early May as investors likely positioned for the Federal Reserve meeting this week.

Investors have been covering short positions and searching for carry in a low volatility forex environment.

All eyes on the Fed

The Federal Reserve’s assertion that high inflation would be temporary has been weighing on the greenback for many weeks as US stocks reached record highs and US yields chugged along the bottom of their sideways range since April.

The Fed meets for its 2-day June meeting tomorrow, with the policy decision and updated projections due on Wednesday.

The markets are on the lookout for the Fed to eventually announce a strategy for reducing its massive bond-buying program.

In turn, this has been supporting the greenback to some extent.

However, while the magnitude of price rises in both April and May has been unsettling, caution should prevail this week because there is little chance of there being new taper hints so soon.

The members at the Fed believe that the current inflation reflects the historically exceptional circumstances only.

With that being said, the risk on Wednesday is if inflation expectations are higher, ultimately feeding through to a more sustained rise in inflation over the medium term.

This would be more hawkish than what the markets are priced for and would most probably be marginally positive for the US dollar.

”We expect that this week’s FOMC meeting is likely to bring upward revisions for PCE inflation in 2021,” analysts at Rabobank said.

”As long as further out inflation forecasts remain anchored the market should absorb this well.”

On the other hand, ABN Amro wrote in a note, ”the most likely course is that inflation decelerates over the coming months, settling back at more normal levels later this year. It is even possible we could get one or two weak readings in the months ahead, as some price rises look unsustainable and vulnerable to payback (particularly in used cars, a category driving 1/3 of the overshoot in April/May).”

”As such, although we expect a significant upward revision to the Fed’s current 2.4% forecast for PCE inflation in 2021 – perhaps a rise of more than a percentage point – we expect the FOMC statement to continue to describe the current inflation overshoot as transitory, and Chair Powell is likely to mount a vigorous defence of this thinking in the press conference.”

Bill Diviney at ABN Amro further explained, ”at the same time, while Chair Powell might acknowledge that the Committee is now ‘talking about talking about’ a tapering of its asset purchases, we do not expect any concrete hints on this at the press conference. We continue to think a formal taper announcement could come by the September meeting – perhaps telegraphed at the Jackson Hole Symposium. This would pave the way for tapering to start in Q4.”

Implications for gold

Meanwhile, analysts at TD Securities explained that considering that gold was set-up for a pullback like a speed bump on the racetrack, they see risks for further weakness in prices as the talk of taper talk saps interest in the yellow metal at a time when flows are not particularly supportive.

”Golds failure to break $1900/oz despite the surprise non-farm payrolls and CPI inflation prints highlights a lack of speculative interest for the yellow metal, at a time when the technical break in inflation breakevens signals slowing inflation-hedging appetite.”

Gold technical analysis

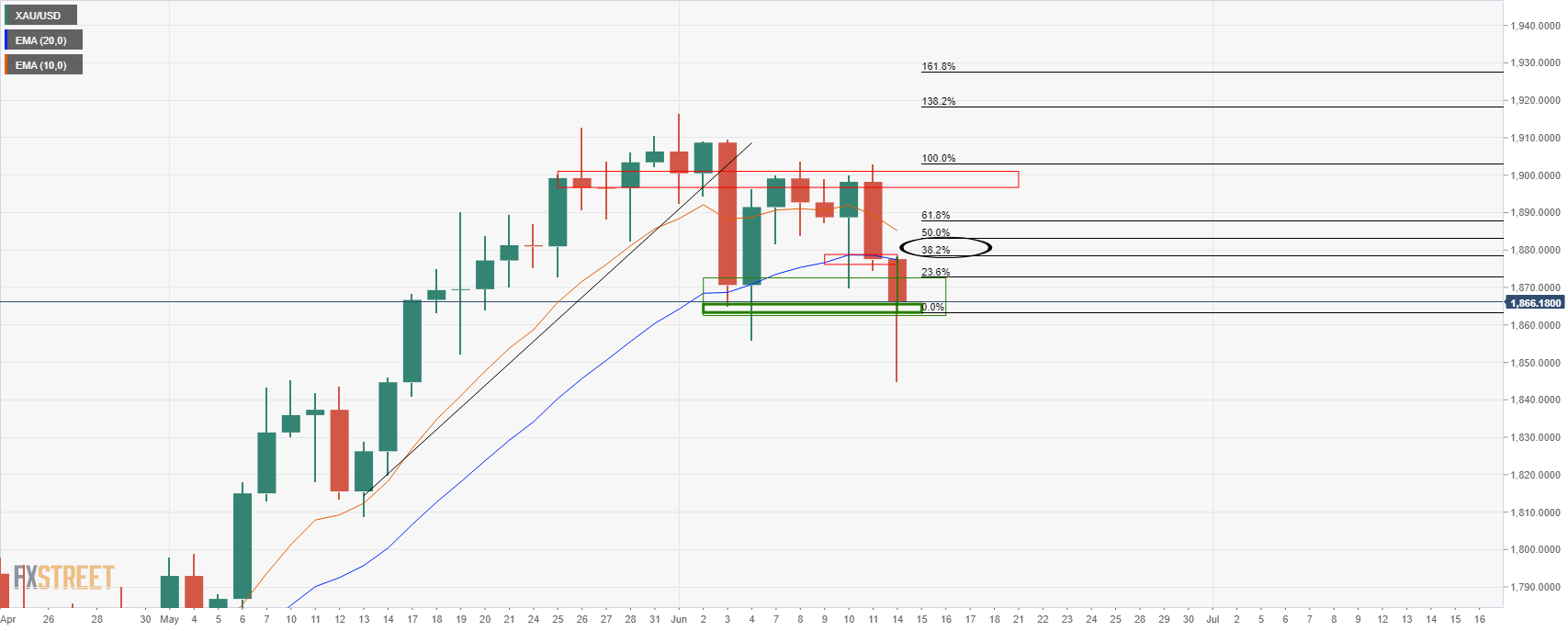

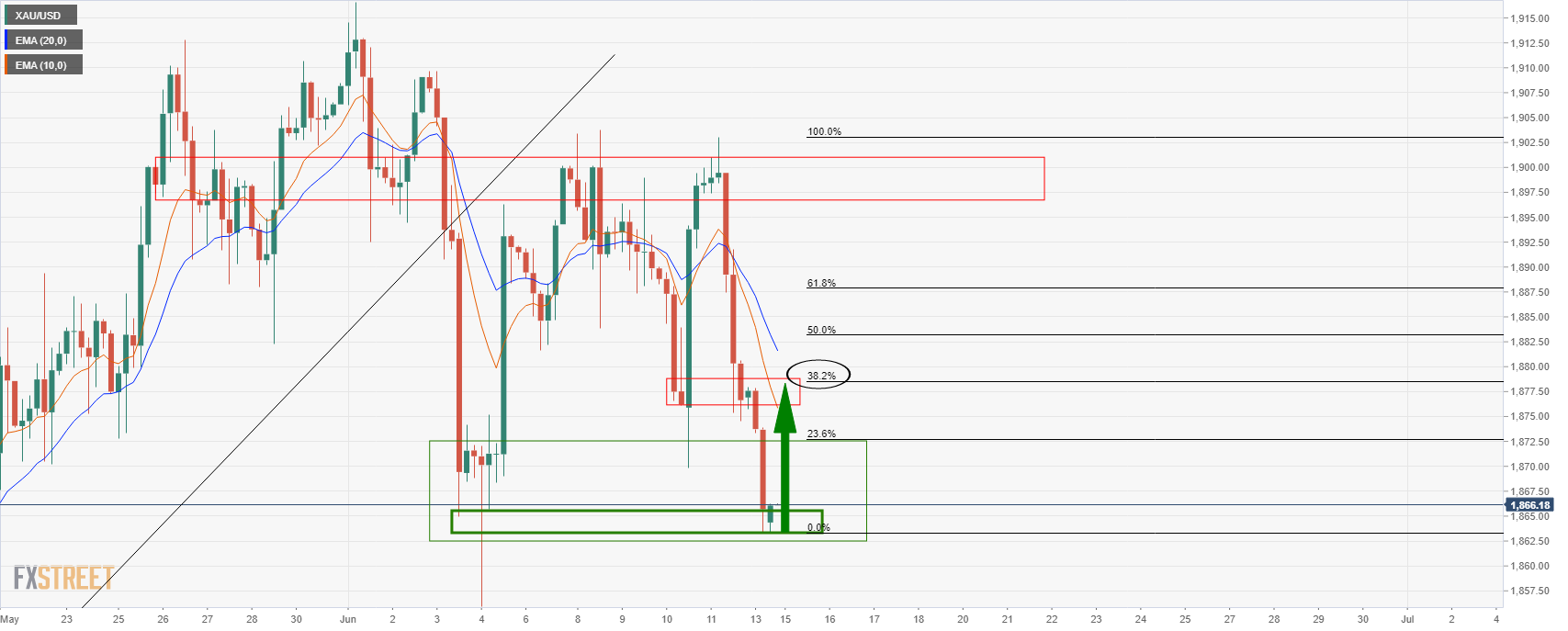

The daily chart has completed an M formation and a retest of the old lows would be expected at this juncture.

A 38.2% Fibonacci has a confluence with 4-hour structure as follows:

-637592968570039753.jpeg)

-637592971032099015.png)