Products You May Like

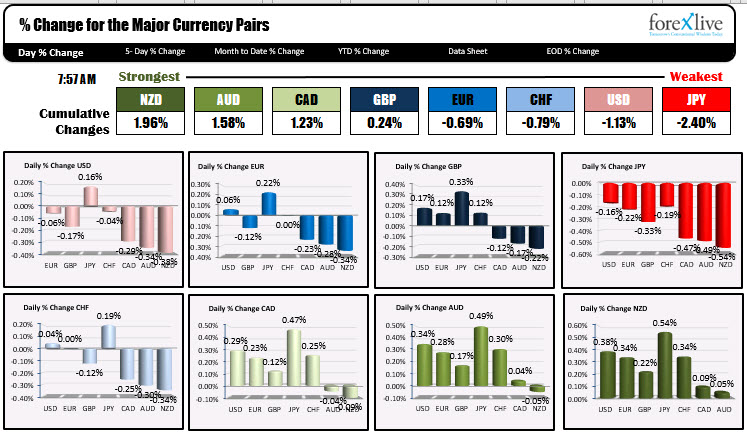

The USD is drifting lower with declines vs all majors with the exception of the JPY

As North American traders enter for the day, the NZD is the strongest (it was also the strongest yesterday and continues that trend today), and the JPY is the weakest (it was the weakest yesterday as well but is off highs today). The USD is mostly weaker a day after Fed’s Powell testimony which stayed the course on easing into tapering and inflation is transitiory. The Nasdaq closed at record levels yesterday. Today shares are modestly higher in pre-market trading. US yields area modestly mixed. Bitcoin is higher. Oil continues it’s move higher.

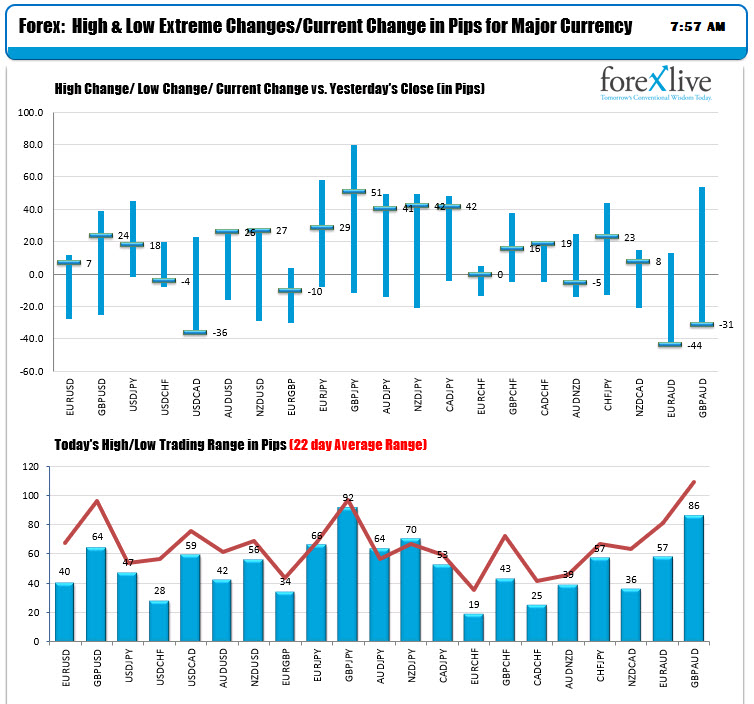

Looking at the ranges and changes, the commodity/risk on currencies are at their highs. The EURUSD has recovered from negative levels earlier in the day and trades modestly higher (the GBPUSD is also positive after an earlier dip) The JPY and JPY crosses area all higher.

In other markets:

- Spot gold is trading up $7.30 or 0.41% at $1786.03

- Spot silver is up $0.22 or 0.87% $26 even

- WTI crude oil is trading up $0.66 or 0.91% at $73.52. That is near its high for the day at $73.58. The low reached $72.82

- Bitcoin is continue to rebound higher and is up around $1000 or 3.15% at $33,956. The low price dipped below $30,000 yesterday before rebounding higher

In the premarket for US stocks, the major indices are marginally higher after moving higher yesterday. The NASDAQ index closed at a record. The S&P index nearly reached an all time intraday high before moving lower into the close

- Dow is up 68 points after yesterday’s 68.61 point rise

- S&P is up 5 points points after yesterday’s 21.61 point rise

- NASDAQ index up 15 points after yesterday’s 111.79 point surge

In the European equity markets, the major indices are trading mixed

- German DAX, -0.36%

- France’s CAC, -0.58%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB -0.5%

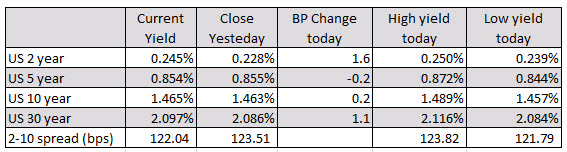

In the US debt market, the yields are mixed with the two year yield higher, the five year lower and the 10 and 30 year also marginally higher.

In the European debt market, the benchmark 10 year yields are lower across the board with Italian yields rallying the most (down -3.9 basis points).