Products You May Like

UK’s FTSE 100 flat

The major indices are ending the session mostly lower. The provisional closes are showing:

- German DAX -0.9%

- France’s CAC, -0.8%

- UK’s FTSE 100, unchanged

- Spain’s Ibex, -0.8%

- Italy’s FTSE MIB, -0.7%

In the European debt market, the benchmark 10 year yields are mostly lower with the exception being the UK 10 year up 0.4 basis points. The yields are off their lowest levels of the day however.

Looking at other markets as London/European traders look to exit:

- Spot gold is up $8.50 or 0.48% $1787.30.

- Spot silver is up $0.38 or 1.49% at $26.16

- WTI crude oil futures are up $0.73 or 1.0% at $73.58. The high price extended to a new cycle high of $74.25 before rotating back to the downside. Crude oil inventory data showed a bigger than expected drawdown of 7.6 million barrels versus -3.5 million barrels estimate. Last week there was a drawdown of 7.3 million barrels as the economy reopens and people hit the road.

- The price of bitcoin is up $744 or 2.26% at $33,651. That is off the intraday high of $34,881.

In the US stock market, the markets are mixed:

- The NASDAQ index made a new all-time high today of 14317.66. The currently trades at 14281.13, up 28 points or 0.20%

- S&P index reached a high of 4256.60. That was just below the all-time high of 4257.11. It currently trades at 4248.69, up 2.28 points or 0.05%

- Dow industrial average is down around 20 points or -0.06% at 33925.30.

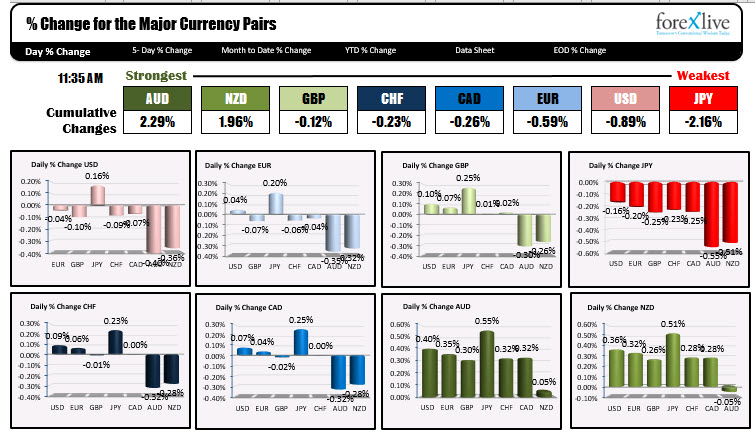

In the forex market, the snapshot shows the AUD is now the strongest of the majors (it was the NZD at the start of the New York session). The JPY remains the weakest. The USD is mostly lower but has given up some of the earlier declines over the last few hours (the USD is now marginally higher in the NY session).