Products You May Like

GBPUSD falls after BOE falls short of market expectations

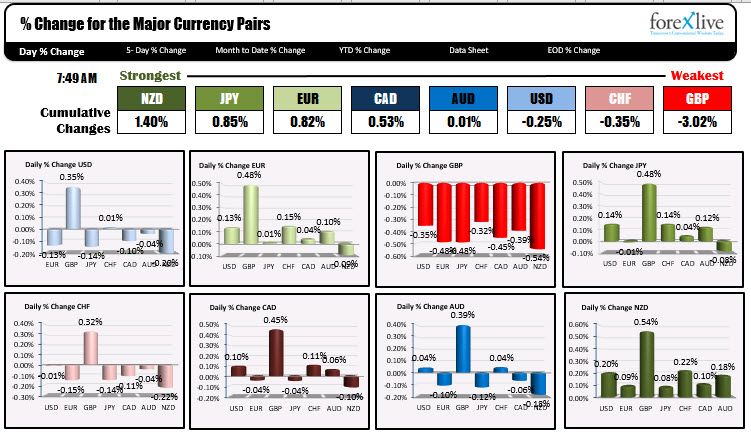

The NZD is the strongest and the GBP is the weakest as the North American session begins. The NZD keeps it’s run higher going (it was the strongest of the major yesterday as well). The GBP took a turn to the downside after the BOE decision fell short of any hawks. The GBPUSD is testing it 100 hour MA at 1.3908 as I type after leaning against its 200 hour MA at 1.3974 just before the decision. US stocks are up in pre-market trading with the Nasdaq on pace to close at a record level for the 3rd day in a row. The S&P is also looking to open at a new record level above 4257.11. US infrastructure deal is hoped for today with reps meeting at the White House with President (at 11:45 PM ET). Lots of data today with durable goods, trade balance, GDP (final for Q1), jobless claims all on the scheduled for release. The treasury will auction off seven year notes at 1 PM . There is Fed speak of course.

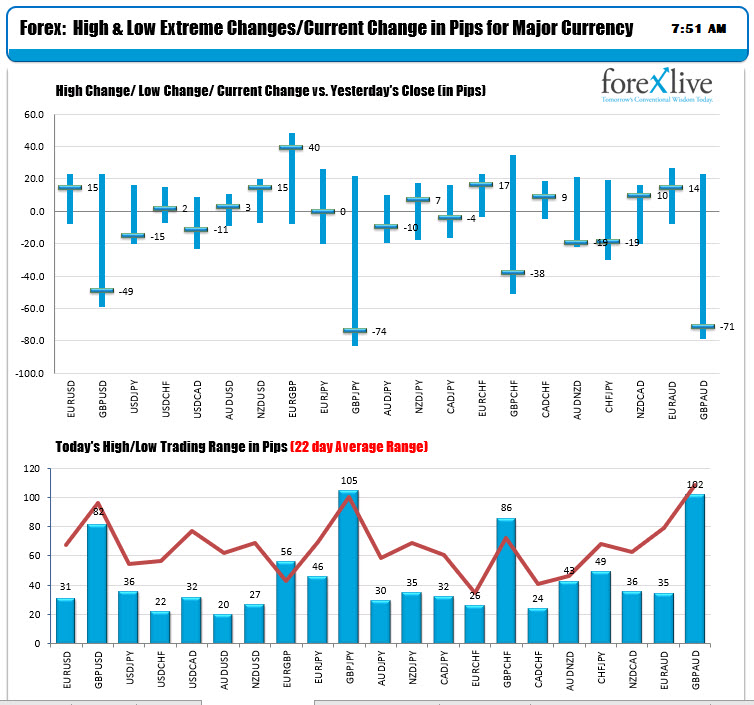

The ranges and changes show the action in the GBP pairs as they trade at extremes (and moving lower) with the GBP under pressure. The other movement in the other currencies versus the US dollar show limited price action with the snapshot showing ranges of 22 pips to 36 pips for the major pairs.

In other markets:

- Spot gold is trading up $7.80 or 0.44% at $1786.35

- Spot silver is up $0.17 or 0.69% at $26.07

- WTI crude oil is trading down $0.40 or -0.55% at $72.68

- Bitcoin is higher by $1062 or 3.23% at $34,124.70

In the premarket for US stocks, the major indices are higher across the board with the S&P and NASDAQ index looking to make all-time highs today. The NASDAQ index has closed at a record level II days in a row

- Dow is up 180 points after yesterday’s -71.34 point decline

- S&P is up up 21 points after yesterday’s -4.6 point decline

- NASDAQ index up up 91 points after yesterday’s 18.46 point rise

In the European equity markets, the major indices are trading higher across the board

- German DAX, +0.7%

- France’s CAC, +1%

- UK’s FTSE 100, +0.6%

- Spain’s Ibex, +1.1%

- Italy’s FTSE MIB +0.8%

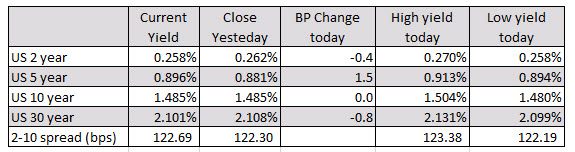

In the US debt market, the yields are modestly changed ahead of the seven year note auction at 1 PM ET. The five year auction was met with average demand yesterday.

In the European debt market, the benchmark 10 year yields are lower across the board UK yields down -3.5 basis points after the Bank of England decision