Products You May Like

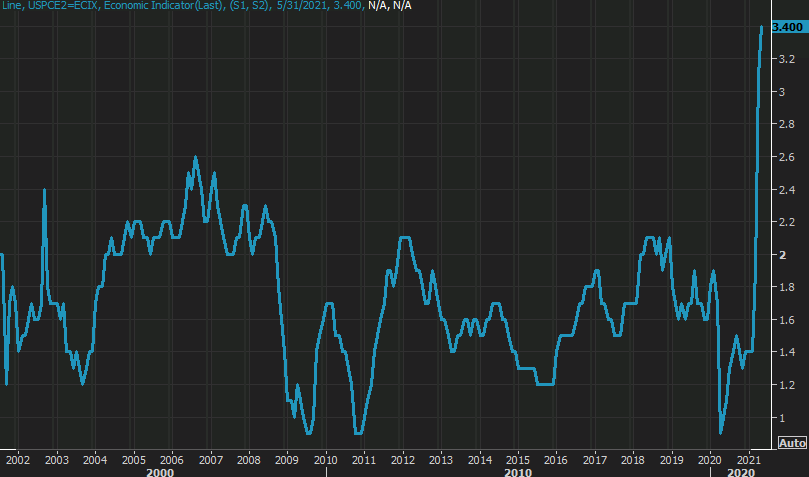

Highlights from the May 2021 personal consumption expenditure report:

- Prior was +1.8%

- PCE core MoM +0.5% vs +0.6% expected

- Prior MoM +0.7%

- Deflator YoY +3.9% vs +3.9% expected

- Prior deflator YoY +3.6%

- Deflator MoM +0.4% vs +0.6% expected

- Prior MoM deflator +0.7%

- Full report

Consumer spending and income for May:

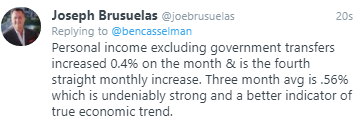

- Personal income -2.0% vs -2.5% expected. Prior month -13.1%

- Personal spending 0.0% vs +0.4% expected. Prior month +0.5% (revised to +0.9%)

- Real personal spending -0.4% vs -0.1% expected. Prior month -0.1% (revised to +0.3%)

Inflation numbers in-line with estimates is a relief for markets and the Fed members who were worried about it running away. The negative surprise in the report is the miss on personal spending, which is continuing to adjust to the run-off of stimulus payments and the wind-down in benefits. How that’s balanced with re-opening spending and a high savings rate during the pandemic is tough to predict.

More details on inflation (y/y):

- Goods +5.4% vs +4.7% prior

- Durable goods +6.7% vs +5.7% prior

- Services +3.1% vs +3.1% prior

- Energy +27.4% vs +24.8% prior

- Food +0.4% vs +0.9% prior

The US dollar is falling on the report as inflation fears ebb.

This article was originally published by Forexlive.com. Read the original article here.